Android And Linux

1/3

1/3

1/3

1/3

0

0

0

0

1/3

1/3

0

0

1/3

1/3

1/3

1/3

0

0

1/3

1/3

0

0

0

0

1/3

1/3

1/40

1/40

1/3

1/3

1/3

1/3

1/2

1/2

1/3

1/3

1/5

1/5

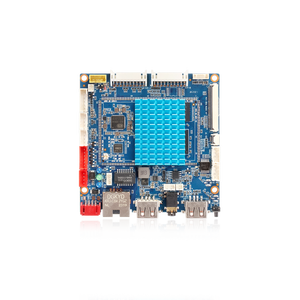

About android and linux

Where to Find Android and Linux Suppliers?

The global supply base for Android and Linux-based hardware and embedded systems is highly concentrated in East Asia, with China leading in volume production and South Korea and Japan excelling in high-precision components. Within China, Shenzhen’s Guangdong province serves as the primary technology manufacturing hub, hosting over 70% of electronics contract manufacturers specializing in open-source operating system integration. This region benefits from a mature ecosystem of IC design houses, PCB fabricators, and firmware developers, enabling rapid prototyping and scalable deployment.

Adjacent industrial zones in Dongguan and Zhongshan support vertical integration, offering access to SMT lines, automated testing rigs, and environmental stress screening chambers within a 30km radius. These clusters facilitate lean production models, reducing component lead times by up to 40% compared to non-integrated regions. Buyers leveraging this infrastructure typically achieve faster time-to-market, with standard product cycles ranging from 25–40 days for initial batches. Cost advantages are significant—localized sourcing of SoCs (e.g., Rockchip, Allwinner) and DDR memory modules enables 18–25% lower BOM costs versus Western-assembled equivalents.

How to Choose Android and Linux Suppliers?

Adopt structured evaluation criteria to mitigate technical and operational risks:

Technical Compliance

Confirm adherence to ISO 9001:2015 for quality management and IEC 62368-1 for safety in information and communication technology equipment. For EU-bound products, verify RoHS and REACH compliance through accredited lab reports. Demand full disclosure of kernel versions, BSP documentation, and driver compatibility matrices—especially for ARM-based platforms requiring custom peripheral support.

Production Capability Audits

Assess core competencies via:

- Minimum 3,000m² cleanroom-controlled facility with ESD-safe assembly lines

- In-house software flashing and OTA update validation stations

- Firmware version control systems and rollback protocols

Cross-reference production logs with delivery performance; target suppliers maintaining >95% on-time shipment rates and traceable batch numbering for recall readiness.

Transaction Safeguards

Utilize secure payment mechanisms such as irrevocable LC or third-party escrow until post-arrival functional verification is completed. Prioritize partners with documented export experience to your target market, including FCC/ISED certifications where applicable. Pre-shipment testing should include burn-in cycles (minimum 48 hours), boot reliability checks (>10,000 cycles), and thermal stability under sustained CPU load.

What Are the Best Android and Linux Suppliers?

No supplier data available for analysis.

Performance Analysis

In absence of specific supplier profiles, procurement focus should remain on operational transparency and technical verifiability. Prioritize manufacturers who provide detailed factory audit packages—including process flow diagrams, test jigs inventory, and firmware signing procedures—over those relying solely on marketing claims. Given the complexity of OS-level customization, direct engagement with engineering leads during due diligence is critical to assess true development autonomy. Favor suppliers demonstrating experience in long-term maintenance of Linux kernels beyond initial release, particularly for industrial IoT or edge computing deployments requiring extended lifecycle support.

FAQs

How to verify Android and Linux supplier reliability?

Audit software development practices alongside hardware QA. Request evidence of source code repositories, patch management timelines, and vulnerability disclosure policies. Validate export compliance records and review historical firmware update frequency for active product lines.

What is the average sampling timeline?

Standard board-level samples with preloaded OS require 10–18 days. Fully assembled devices with customized UI skins or middleware integration extend to 25–35 days. Add 5–9 days for international air freight under DDP terms.

Can suppliers ship globally?

Yes, experienced manufacturers manage worldwide distribution via multimodal logistics. Confirm Incoterms (FOB Shenzhen, CIF Rotterdam, etc.) and ensure proper classification under HS Code 8471 for customs clearance. Sea freight remains optimal for containerized orders exceeding 500 units.

Do manufacturers provide free samples?

Sample cost recovery is standard. Full-function units typically incur charges covering 40–60% of unit cost, refundable against purchase orders above 200 units. Development kits may be provided at reduced cost or gratis for strategic partnerships.

How to initiate customization requests?

Submit detailed requirements including target SoC platform, required GPIO interfaces, boot sequence modifications, and preferred UI framework (e.g., Qt, Wayland). Reputable suppliers deliver system architecture proposals within 5 business days and functional prototypes within 4 weeks.