Architecture And Design Software

CN

CN

1/5

1/5

1/3

1/3

1/3

1/3

1/3

1/3

1/6

1/6

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/18

1/18

1/3

1/3

1/6

1/6

1/3

1/3

0

0

1/3

1/3

1/1

1/1

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

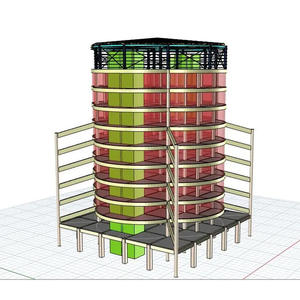

About architecture and design software

Where to Find Architecture and Design Software Suppliers?

The global architecture and design software market is highly decentralized, with leading development hubs concentrated in North America, Western Europe, and East Asia. The United States accounts for approximately 40% of commercial software innovation in this sector, driven by Silicon Valley’s concentration of R&D talent and venture capital investment. Germany and the UK host specialized firms focusing on BIM (Building Information Modeling) integration and compliance with EU construction standards, while China's Shenzhen and Shanghai tech corridors are emerging as centers for cost-competitive SaaS-based design platforms targeting APAC markets.

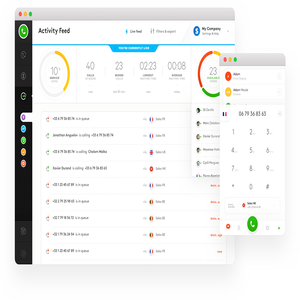

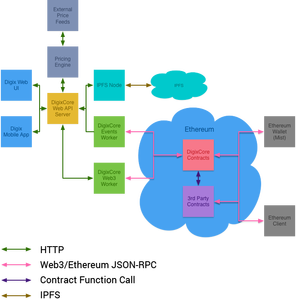

These regions offer distinct advantages in software architecture, regulatory alignment, and deployment scalability. North American suppliers typically provide full-stack solutions with cloud infrastructure partnerships, enabling rapid deployment across distributed teams. European developers emphasize data privacy compliance (GDPR), interoperability with CAD/CAM systems, and lifecycle analysis tools for sustainable design. Asian providers often deliver modular licensing models and localized technical support, reducing total cost of ownership for mid-sized architectural firms. Buyers benefit from access to agile development cycles, API-first design approaches, and integrated AI-assisted modeling features.

How to Choose Architecture and Design Software Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance

Confirm adherence to recognized industry standards such as ISO/IEC 27001 for information security management and compliance with building codes (e.g., IFC4 for openBIM workflows). For multinational use, verify multilingual interface support and regional template libraries (e.g., AIA for North America, NBS for the UK). Evaluate software certifications including UL validation for electrical system modeling or LEED-compliant energy analysis modules.

Development Capability Audits

Assess core competencies through:

- Minimum 3-year track record in commercial architecture software deployment

- Dedicated development teams comprising ≥15% of total staff

- Proven integration capabilities with major platforms (Revit, AutoCAD, SketchUp, ArchiCAD)

Cross-reference customer case studies with uptime metrics (target >99.5% SLA) and update frequency (minimum quarterly feature releases) to confirm long-term viability.

Transaction Safeguards

Require contractual service-level agreements covering data sovereignty, breach liability, and exit protocols. Analyze vendor stability via third-party financial reviews and subscription retention rates. Pilot testing is critical—evaluate workflow efficiency gains, learning curve duration, and plugin compatibility before enterprise-wide rollout.

What Are the Best Architecture and Design Software Suppliers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Supplier data currently unavailable | ||||||||

Performance Analysis

Due to absence of verified supplier data, procurement decisions should rely on independent benchmarking. Established vendors typically demonstrate higher reorder rates (>60%) linked to reliable technical support and backward compatibility across version updates. Responsiveness remains a key differentiator—top-tier suppliers maintain average response times under 4 hours for priority tickets. Prioritize companies with documented experience in projects of comparable scale and complexity, especially those involving mixed-use developments or heritage restoration requiring precise digital twins. Verify in-house development capacity through code audits or sandbox environment evaluations prior to contract finalization.

FAQs

How to verify architecture and design software supplier reliability?

Cross-check compliance claims with certification bodies and review audit trails for security vulnerabilities. Request references from clients in similar geographic and regulatory environments. Analyze user reviews on trusted platforms focusing on update stability, customer service responsiveness, and documentation quality.

What is the average implementation timeline?

Standard license activation occurs within 24–48 hours post-payment. Full team onboarding, including training and project migration, typically requires 2–6 weeks depending on firm size. Complex integrations with legacy ERP or document management systems may extend timelines to 10–12 weeks.

Can software suppliers support global deployments?

Yes, most established providers support multi-region deployments via cloud hosting (AWS, Azure, Google Cloud). Confirm data center locations align with local privacy laws and that latency benchmarks meet real-time collaboration requirements. Licensing terms should accommodate international office usage without additional fees.

Do vendors offer free trial versions?

Trial policies vary. Many suppliers provide time-limited (14–30 day) full-feature access with sample project templates. Some restrict export functionality or cloud storage during trials. Volume purchasers often negotiate extended pilot periods with dedicated support.

How to initiate customization requests?

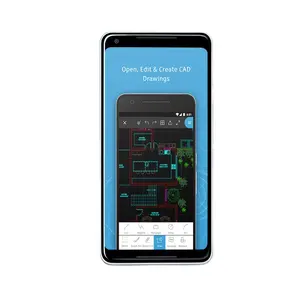

Submit detailed functional specifications including required file formats (DWG, IFC, SKP), automation scripts (Python/Dynamo), and reporting templates. Leading suppliers assign account engineers to translate requirements into scoped development sprints, delivering beta builds within 4–8 weeks.