Architecture Computer Software

Top sponsor listing

Top sponsor listing

1/3

1/3

1/3

1/3

1/3

1/3

1/2

1/2

1/3

1/3

1/3

1/3

1/3

1/3

1/17

1/17

0

0

1/2

1/2

1/1

1/1

1/3

1/3

0

0

1/3

1/3

0

0

0

0

CN

CN

1/6

1/6

CN

CN

1/3

1/3

1/1

1/1

About architecture computer software

Where to Find Architecture Computer Software Suppliers?

The global architecture computer software market is characterized by a decentralized but technologically advanced supplier base, with leading development hubs in North America, Western Europe, and East Asia. The United States accounts for approximately 35% of commercial architectural design software output, driven by Silicon Valley’s concentration of R&D talent and venture capital investment in AEC (Architecture, Engineering, and Construction) technology. Germany and the UK host specialized firms focused on BIM (Building Information Modeling)-compliant solutions, with over 60% of European suppliers integrating ISO 19650 standards into their development frameworks.

These regions benefit from mature digital infrastructure and deep collaboration between software developers and architectural practices, enabling rapid iteration based on real-world workflow demands. Suppliers typically operate cloud-native development environments with agile methodologies, supporting frequent updates and modular feature deployment. Key advantages include access to certified development teams, compliance-ready software architectures, and scalable licensing models suitable for both small studios and multinational firms. Lead times for customized modules range from 8–12 weeks, while off-the-shelf solutions are available immediately via digital distribution.

How to Choose Architecture Computer Software Suppliers?

Adopt structured evaluation criteria to ensure technical reliability and long-term compatibility:

Technical Compliance

Confirm adherence to industry-specific standards including ISO 19650 (information management), IFC (Industry Foundation Classes) open data schema, and GDPR or CCPA compliance for data privacy. For BIM-integrated tools, verify certification with major platforms such as Autodesk Revit, ArchiCAD, or Trimble SketchUp. Request documentation of API stability, version control protocols, and cybersecurity measures, particularly for cloud-hosted applications.

Development Capability Assessment

Evaluate organizational capacity through the following indicators:

- Minimum 15 full-time developers dedicated to core software maintenance and innovation

- R&D expenditure exceeding 20% of annual revenue to ensure continuous improvement

- Proven release history with at least two major updates per year

Cross-reference customer testimonials with third-party review platforms to validate uptime performance, bug resolution speed, and backward compatibility.

Licensing and Transaction Safeguards

Require transparent licensing terms specifying usage rights, concurrency limits, and upgrade pathways. Prioritize suppliers offering trial periods or sandbox environments for functional testing. For enterprise deployments, negotiate source code escrow agreements to mitigate risks related to vendor discontinuation. Conduct due diligence on export controls—particularly relevant for AI-driven generative design tools subject to dual-use regulations.

What Are the Best Architecture Computer Software Suppliers?

No supplier data available for comparative analysis.

Performance Analysis

In the absence of specific supplier profiles, procurement decisions should emphasize verifiable technical credentials over brand recognition. Established vendors often demonstrate higher reorder rates due to integrated support ecosystems and training resources. Emerging suppliers may offer competitive differentiation through niche functionality—such as parametric facade optimization or energy modeling integration—but require additional scrutiny regarding long-term roadmap viability and financial stability. Prioritize companies with documented client retention metrics, active user communities, and participation in open standards consortia like buildingSMART.

FAQs

How to verify architecture computer software supplier reliability?

Audit software validation processes, including third-party penetration testing reports and compliance certifications. Assess post-release support structures: look for SLAs guaranteeing response times under 4 hours for critical bugs. Validate references from architectural firms of comparable size and project complexity.

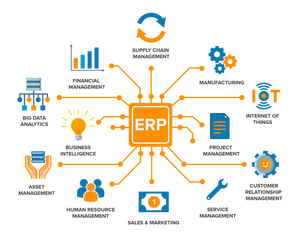

What is the average timeline for custom feature development?

Standard customization requests—such as UI localization or template configuration—typically take 4–6 weeks. Complex integrations involving ERP or project management systems require 10–14 weeks. AI-based automation modules may extend timelines to 16+ weeks depending on training data availability.

Can software suppliers support global deployment?

Yes, most established suppliers provide multi-region hosting options with localized language packs and regional code compliance libraries (e.g., ADA, DIN, GB). Confirm data residency policies and latency benchmarks for distributed teams operating across time zones.

Do suppliers offer free trials or demo versions?

Trial availability is standard across the sector. Full-featured demos typically last 14–30 days, with some vendors offering extended access for academic or non-commercial evaluation. Proof-of-concept deployments for enterprise clients may include limited-cost pilot licensing.

How to initiate customization requests?

Submit detailed technical requirements including supported file formats (DWG, IFC, RVT), interoperability needs, and performance benchmarks (e.g., handling models exceeding 500MB). Leading suppliers respond with feasibility assessments within 5 business days and provide milestone-based development plans upon approval.