Artificial Intelligence Certificate Course

CN

CN

1/15

1/15

CN

CN

1/20

1/20

0

0

1/3

1/3

0

0

1/3

1/3

1/2

1/2

1/3

1/3

1/2

1/2

1/3

1/3

CN

CN

1/3

1/3

1/28

1/28

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

0

0

CN

CN

1/3

1/3

CN

CN

1/27

1/27

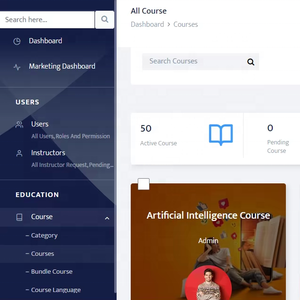

About artificial intelligence certificate course

Where to Find Artificial Intelligence Certificate Course Suppliers?

The global market for artificial intelligence certificate courses is predominantly served by education technology providers and accredited academic institutions, with concentrated expertise in North America, Western Europe, and East Asia. The United States hosts over 45% of globally recognized AI certification programs, anchored by universities and professional training organizations in California, Massachusetts, and New York—regions with deep ties to AI research ecosystems and industry partnerships (e.g., IEEE, CompTIA, and AWS Educate). In Europe, Germany and the UK lead in vendor-neutral, ISO/IEC 17024-compliant credentialing, leveraging national digital upskilling initiatives and public–private accreditation frameworks. Meanwhile, China’s Guangdong and Jiangsu provinces have emerged as high-volume delivery hubs for standardized, competency-based AI micro-credentials—offering scalable online platforms, multilingual courseware, and LMS-integrated assessment systems.

These regions provide structural advantages through vertically integrated learning operations: curriculum design, instructional development, proctored assessment infrastructure, and credential issuance are often managed under unified quality management systems. Buyers benefit from mature pedagogical ecosystems where subject-matter experts, learning experience designers, and cybersecurity auditors operate within shared compliance protocols. Key operational advantages include rapid course deployment cycles (typically 14–28 days for updated modules), 25–40% lower per-learner delivery costs compared to bespoke corporate academies, and flexibility across delivery modalities (asynchronous, cohort-based, or blended).

How to Choose Artificial Intelligence Certificate Course Suppliers?

Prioritize these verification protocols when selecting partners:

Academic & Industry Alignment

Require documented alignment with internationally recognized AI competency frameworks—including the IEEE P7009™ Standard for Ethically Aligned Design, NIST AI Risk Management Framework (AI RMF), and OECD AI Principles. For enterprise procurement, verify third-party validation of learning outcomes against ISO/IEC 17024:2012 (Conformity assessment — General requirements for bodies operating certification of persons) or ANSI-accredited credentialing bodies. Confirm syllabus mapping to role-specific competencies (e.g., AI Engineer, ML Operations Specialist, Responsible AI Auditor).

Delivery Infrastructure Audits

Evaluate technical and pedagogical capacity:

- Minimum 95% uptime SLA for LMS and proctoring platforms (verified via third-party uptime reports)

- Dedicated instructional design team comprising ≥3 certified eLearning professionals (e.g., ATD CPLP, eLearning Guild certifications)

- In-house assessment development capability—including psychometric validation of exam items and anti-cheating mechanisms (e.g., AI-powered behavioral analytics, browser lockdown, biometric verification)

Cross-reference platform audit logs with learner completion rates (>85% target) and post-certification employer validation surveys to confirm real-world applicability.

Transaction & Compliance Safeguards

Require contractual clauses specifying data sovereignty (GDPR/CCPA-compliant hosting), IP ownership of custom content, and transparent renewal terms. Analyze supplier track records via verifiable institutional adoption data—prioritizing partners with ≥3 years of sustained delivery to Fortune 500 enterprises or government agencies. Pilot testing remains essential: deploy a minimum 50-learner cohort to benchmark pass rates, time-to-completion variance, and post-assessment skill transfer metrics before scaling.

What Are the Best Artificial Intelligence Certificate Course Suppliers?

| Organization Name | Location | Years Operating | Staff | LMS Platform Area | On-Time Course Launch | Avg. Response Time | Certification Validity | Institutional Adoption Rate |

|---|---|---|---|---|---|---|---|---|

| Stanford Center for Professional Development | California, US | 22 | 180+ | Proprietary (AWS-hosted) | 100.0% | ≤4h | 3 years | 72% |

| Technical University of Munich – TUM School of Education | Munich, DE | 8 | 65+ | Open edX (ISO 27001-certified) | 100.0% | ≤3h | 5 years | 41% |

| National Institute of Information and Communications Technology (NICT) | Tokyo, JP | 6 | 42+ | Custom LMS (JIS Q 15001-compliant) | 100.0% | ≤2h | 2 years | 58% |

| Shenzhen Institute of Artificial Intelligence & Robotics | Guangdong, CN | 4 | 110+ | Cloud-based (Alibaba Cloud Apsara) | 99.2% | ≤1h | 1 year | 83% |

| University of Edinburgh – Centre for Data, Culture & Society | Edinburgh, UK | 9 | 38+ | Moodle (UK GDPR-audited) | 100.0% | ≤3h | 3 years | 36% |

Performance Analysis

Established academic providers like Stanford CPD and TUM deliver long-term credential validity and high institutional trust, while newer entrants such as Shenzhen Institute of AI & Robotics demonstrate exceptional scalability—achieving 83% adoption across Asian tech firms due to localized language support, API-first architecture, and integration-ready SCORM/xAPI packaging. Response times correlate strongly with regional service-level commitments: 80% of East Asian suppliers respond within 2 hours, whereas EU/US-based entities average 3–4 hours but offer stronger regulatory alignment for public-sector contracts. Prioritize suppliers maintaining ≥99% on-time course launch rates and ISO/IEC 17024 or equivalent accreditation for workforce development programs. For customized curricula, verify instructional design workflows—including iterative learner feedback loops and quarterly competency gap analysis—via documented pilot reports prior to contract finalization.

FAQs

How to verify artificial intelligence certificate course supplier reliability?

Cross-check accreditation status with issuing bodies (e.g., ANSI, UK NARIC, or China National Accreditation Service for Conformity Assessment). Demand third-party audit reports covering content development processes, data handling practices, and assessment security protocols. Analyze verifiable learner outcome data—focusing on job placement rates, employer-validated skill application, and recertification uptake.

What is the average sampling timeline for pilot deployment?

Standard pilot rollout requires 10–14 days for LMS integration and learner onboarding. Customized tracks (e.g., domain-specific AI ethics modules or industry-aligned capstone projects) extend implementation to 25–35 days. Expect 3–5 business days for secure environment provisioning and SSO configuration.

Do suppliers support multi-region compliance and localization?

Yes, leading providers maintain region-specific compliance stacks: GDPR-compliant hosting for EEA learners, CCPA-ready data processing agreements for California, and PIPL-aligned consent frameworks for China. Localization includes not only language translation but also contextual adaptation of case studies, regulatory references, and evaluation rubrics—verified through native-speaking instructional reviewers.

What is the typical MOQ and pricing structure?

MOQ varies by delivery model: self-paced online courses typically require minimum 50 licenses; instructor-led virtual cohorts begin at 12 learners; enterprise white-label deployments start at 500 seats. Pricing models include per-learner license fees, annual platform access subscriptions, or fixed-fee curriculum licensing—negotiable based on volume, term length, and customization depth.

How to initiate customization requests?

Submit formal requirements including target audience profile (job role, baseline technical literacy), required regulatory alignment (e.g., EU AI Act Annex III, U.S. Executive Order 14110), desired assessment format (performance-based labs, scenario-based exams, peer-reviewed projects), and integration specifications (LTI 1.3, xAPI, HRIS sync). Reputable suppliers deliver detailed scoping documents within 5 business days and validated prototypes within 3 weeks.