Assembly Line Vehicles

CN

CN

CN

CN

CN

CN

CN

CN

CN

CN

CN

CN

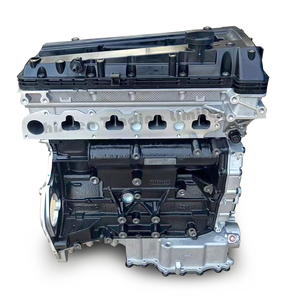

About assembly line vehicles

Where to Find Assembly Line Vehicles Suppliers?

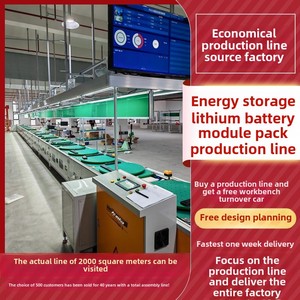

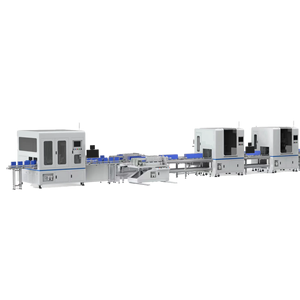

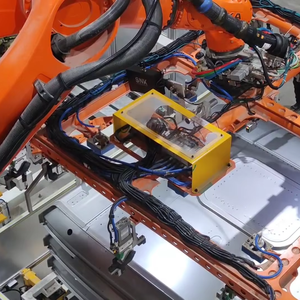

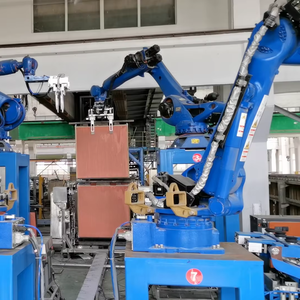

China remains the global hub for assembly line vehicle manufacturing, with key production clusters concentrated in Guangdong, Shanghai, and Henan provinces. These regions host vertically integrated industrial ecosystems that combine automation engineering, material handling systems, and advanced manufacturing R&D. Guangdong’s Pearl River Delta region leads in intelligent transport solutions, offering modular AGV (Automated Guided Vehicle) platforms and smart conveyor integration. Shanghai and Xinxiang specialize in heavy-load electric carts and battery-powered assembly carriers, leveraging proximity to automotive OEMs and Tier-1 suppliers.

The clustering enables rapid prototyping and scalable production, supported by localized access to CNC machining, steel fabrication, and control system components within 50km supply radii. Buyers benefit from reduced lead times—typically 30–60 days depending on customization level—and cost advantages stemming from mature logistics networks and in-house design-to-production workflows. Average unit costs range from $1,000 for basic configurations to over $99,000 for fully automated SKD (Semi-Knocked Down) car assembly lines.

How to Choose Assembly Line Vehicles Suppliers?

Selecting reliable partners requires structured evaluation across technical, operational, and transactional dimensions:

Technical Capability Verification

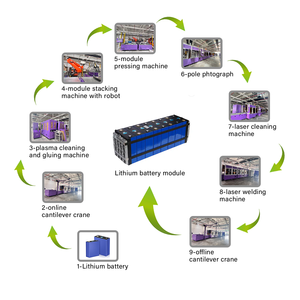

Confirm suppliers possess in-house engineering teams capable of designing load-specific transport vehicles (e.g., flatbed AGVs, V-block transfer carts, final assembly carriers). Prioritize those demonstrating CE certification for electrical safety and motion control compliance. Validate motor specifications, battery voltage (24V–80V common), and maximum load capacity (ranging from 2.5T to 30T) against application requirements.

Production Infrastructure Assessment

Evaluate facility maturity through objective metrics:

- Minimum factory area exceeding 3,000m² for dedicated production zones

- In-house capabilities in welding, CNC cutting, and PLC programming

- Demonstrated experience in turnkey assembly line integration

Cross-reference online revenue data and on-time delivery rates (target ≥90%) as indicators of operational stability and order fulfillment consistency.

Customization & Transaction Security

Assess flexibility for color, size, branding, and functional modifications. Require clear documentation of warranty terms and after-sales support. Utilize secure payment mechanisms such as escrow services for initial orders. Request product videos or virtual factory tours to verify claims before procurement. Sampling is recommended for high-volume deployments—expect sample lead times between 15–35 days depending on complexity.

What Are the Best Assembly Line Vehicles Suppliers?

| Company Name | Location | Verification Type | Main Products | On-Time Delivery | Avg. Response | Online Revenue | Reorder Rate | Min. Order Value |

|---|---|---|---|---|---|---|---|---|

| Guangdong Huazhe Intelligent Manufacturing Co., Ltd. | Guangdong, CN | Custom Manufacturer | Intelligent car assembly lines, flexible part conveyors | 33% | ≤2h | US $20,000+ | <15% | $1,000/set |

| Xinxiang Hundred Percent Electrical And Mechanical Co., Ltd. | Xinxiang, CN | - | Electric automated carts, AGVs, steel transfer trolleys | 100% | ≤5h | US $2,000+ | - | $2,900/set |

| Shanghai Hoton Auto Equipment Co., Ltd. | Shanghai, CN | - | SKD car assembly plants, single-line systems | 71% | ≤12h | US $10,000+ | 16% | $99,000/set |

| Tianjin Juren Intelligent Technology Co., Ltd. | Tianjin, CN | Multispecialty Supplier | Remote-control flatbed transporters, multi-functional carriers | 100% | ≤5h | US $700+ | <15% | $3,550/piece |

| Guangdong Weitaopu Automation Equipment Co., Ltd. | Guangdong, CN | - | New energy vehicle assembly modules, lithium-core transporters | 100% | ≤4h | - | - | $199.98/piece |

Performance Analysis

Suppliers like Xinxiang Hundred Percent and Tianjin Juren demonstrate strong reliability with 100% on-time delivery records and sub-5-hour response times, making them suitable for time-sensitive deployments. Guangdong-based manufacturers offer broader customization but vary in reorder performance. Shanghai Hoton targets large-scale SKD plant integrations at premium price points ($99k+), indicating specialization in full-line automotive assembly setups. Guangdong Weitaopu stands out for component-level modularity, supporting low-cost entry into EV core assembly with units starting under $200. For mission-critical applications, prioritize suppliers with documented CE compliance, proven export history, and transparent communication patterns.

FAQs

How to verify assembly line vehicle supplier reliability?

Cross-check certifications (CE, ISO) with official registries. Request evidence of past projects, including site photos or client references. Analyze response consistency and technical depth in communications. Use platform-verified transaction histories to assess fulfillment reliability.

What is the typical lead time for custom assembly line vehicles?

Standard models ship in 20–35 days. Custom configurations involving PLC integration, non-standard load frames, or specialized drive systems require 45–70 days. Add 7–14 days for international air freight or 25–40 days for sea shipping.

Do suppliers support OEM branding and design changes?

Yes, most suppliers listed offer customization for color, logo, labeling, and structural dimensions. Full OEM rebranding and graphical interface modification are available upon request, typically without additional fees for bulk orders.

What are common minimum order quantities (MOQ)?

MOQs generally start at 1 set or piece, enabling pilot testing and small-scale deployment. Volume discounts apply from 5 units onward, particularly for standardized AGV and cart models.

Can assembly line vehicles be integrated into existing production systems?

Yes, reputable suppliers provide compatibility assessments and interface protocols (e.g., Modbus, PROFIBUS) for seamless integration with MES and SCADA systems. Pre-deployment simulations and commissioning support are often included in turnkey contracts.