Automated Atm Solutions

Top sponsor listing

Top sponsor listing

CN

CN

About automated atm solutions

Where to Find Automated ATM Solutions Suppliers?

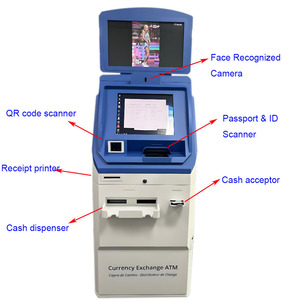

China remains the central hub for automated ATM solutions manufacturing, with key production clusters in Shenzhen and Zhejiang provinces driving innovation and export capacity. Shenzhen’s tech ecosystem supports advanced R&D in self-service kiosks and integrated banking systems, leveraging proximity to semiconductor and display component suppliers. This region specializes in high-speed cash handling, multi-currency exchange, and touchscreen interface technologies, enabling rapid prototyping and customization.

Zhejiang's industrial base emphasizes scalable production of commercial-grade ATMs, particularly for overseas financial institutions and retail networks. Integrated sheet metal fabrication and electronics assembly lines allow manufacturers to maintain tight tolerances and consistent quality across large orders. These clusters offer buyers reduced lead times (typically 25–40 days), access to vertically aligned supply chains, and competitive pricing due to localized sourcing of core components such as bill validators, card readers, and secure enclosures.

How to Choose Automated ATM Solutions Suppliers?

Effective supplier selection requires a structured evaluation of technical, operational, and transactional capabilities:

Technical Compliance & Certification

Verify adherence to international safety and performance standards, including CE marking for European markets and PCI PTS certification for secure transaction environments. Demand documentation on electromagnetic compatibility (EMC), environmental durability (IP rating), and software security protocols. For foreign currency ATMs, confirm integration with real-time exchange rate APIs and compliance with local financial regulations.

Production Capability Assessment

Evaluate infrastructure indicators that signal scalability and reliability:

- Facility size exceeding 3,000m² indicating dedicated production zones

- In-house engineering teams supporting OEM/ODM configurations

- On-site testing for cash module reliability, touchscreen responsiveness, and network connectivity

Cross-reference on-time delivery rates above 90% and response times under 3 hours as proxies for operational efficiency.

Customization & Transaction Safeguards

Confirm available customization options—including color schemes, branding elements, language localization, and hardware specifications (RAM, storage, reader types). Prioritize suppliers offering third-party transaction protection and post-delivery technical support. Request sample units to validate build quality, user interface design, and functional accuracy before scaling procurement.

What Are the Best Automated ATM Solutions Suppliers?

| Company Name | Location | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Customization Options | Min. Order Quantity |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Rong Mei Guang Science And Technology Co., Ltd. | Shenzhen, CN | ATMs, Service Equipment | US $250,000+ | 93% | ≤3h | 41% | Color, label, cassette capacity, card reader, material, size, logo, model, compatibility, graphic, lead time, RAM | 1 unit |

| Shenzhen Diversity Kiosk Technology Co., Ltd. | Shenzhen, CN | ATMs, Kiosks | US $140,000+ | 87% | ≤1h | 20% | Color, material, size, logo, packaging, label, graphic | 1 unit |

| Shenzhen Hunghui It Co., Ltd. | Shenzhen, CN | Payment Kiosks, ATMs, Smart Displays | US $170,000+ | 100% | ≤2h | <15% | Multi-touch interface, foreign currency support, payment integration | 1 piece |

| Zhejiang Jieyang Intelligent Equipment Co., Ltd. | Zhejiang, CN | ATMs, Payment Kiosks, Vending Systems | US $9,000+ | 100% | ≤2h | <15% | Software localization (e.g., Russian), touchscreen OS, custom design | 1–10 sets |

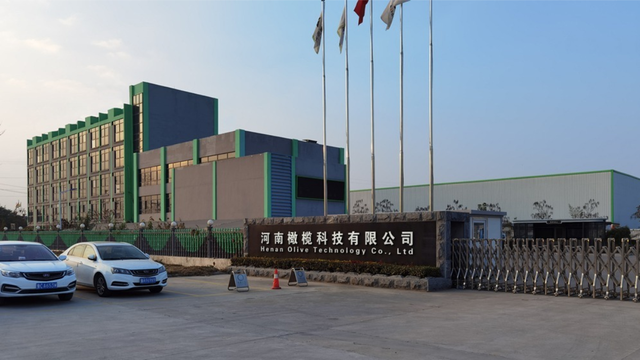

| HENAN OLIVE TECHNOLOGY CO LTD | Henan, CN | Vending Machines, Coin/Card Systems | Not specified | Not available | ≤2h | Not available | Limited to coin/card-operated models | 1 set |

Performance Analysis

Shenzhen-based suppliers dominate in responsiveness and customization breadth, with Shenzhen Rong Mei Guang achieving a 41% reorder rate—indicating strong customer retention—despite longer response times. Shenzhen Hunghui and Zhejiang Jieyang both report 100% on-time delivery, suggesting robust production planning and logistics execution. While Hunghui focuses on high-end interactive ATMs for banks and malls, Jieyang offers niche capabilities in multilingual software deployment and heavy-duty enclosures. Buyers seeking cost-effective entry-level ATMs may consider HENAN OLIVE, though limited transaction data warrants additional due diligence. For mission-critical deployments, prioritize suppliers with proven experience in secure financial hardware and documented quality management systems.

FAQs

How to verify automated ATM supplier reliability?

Review verifiable performance metrics such as on-time delivery rate, response time, and reorder rate. Request evidence of compliance with financial equipment standards (e.g., CE, PCI PTS) and conduct virtual audits of production facilities. Analyze customer feedback focusing on after-sales service, software stability, and field failure rates.

What is the typical lead time for ATM orders?

Standard units require 25–35 days for production and testing. Customized models with unique software or hardware integrations may extend to 45 days. Air freight adds 5–10 days; sea freight takes 20–35 days depending on destination.

Do suppliers support global shipping and installation?

Most established manufacturers offer FOB and CIF shipping terms with coordination for customs clearance. On-site installation support varies—confirm availability and associated costs during negotiation. Remote configuration and troubleshooting are commonly provided.

Are samples available for automated ATM machines?

Yes, functional samples are typically offered at full or partial cost, depending on order volume commitments. Sample pricing usually reflects 60–80% of unit cost, with credit applied upon bulk order placement.

What customization options are available?

Suppliers support hardware modifications (size, material, reader type), software localization (language, UI), branding (logo, color), and integration with backend banking systems. High-end providers offer 3D renderings within 72 hours and prototype development within 3–4 weeks.