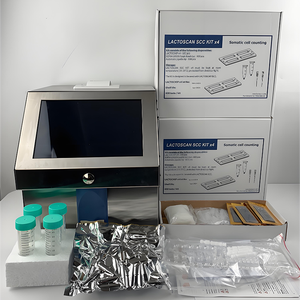

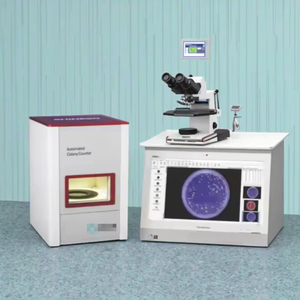

Automated Cell Counter Distributor

1/24

1/24

0

0

0

0

1/3

1/3

CN

CN

1/37

1/37

0

0

CN

CN

1/27

1/27

0

0

1/3

1/3

1/3

1/3

CN

CN

1/21

1/21

1/30

1/30

0

0

0

0

HK

HK

1/30

1/30

1/1

1/1

0

0

1/1

1/1

About automated cell counter distributor

Where to Find Automated Cell Counter Distributors?

China remains the central hub for life science equipment manufacturing, with specialized industrial clusters in Jiangsu and Guangdong provinces leading production of automated cell counters. Jiangsu’s Suzhou Science and Technology City hosts over 40% of China’s biomedical instrumentation suppliers, supported by proximity to Tier-1 research institutions and semiconductor component manufacturers. Guangdong’s Shenzhen and Dongguan zones leverage advanced electronics integration capabilities, enabling high-precision optical and microfluidic subsystems essential for accurate cell enumeration.

These regions benefit from vertically integrated supply chains—spanning PCB fabrication, sensor assembly, and software calibration—reducing component procurement lead times by up to 35%. The concentration of contract manufacturers, firmware developers, and regulatory consultants within 30km radii allows distributors to offer scalable fulfillment models. Key advantages include MOQ flexibility (as low as 1 unit for validated prototypes), lead times averaging 25–40 days for standard units, and cost efficiencies of 20–30% compared to EU- or US-based OEMs due to localized sourcing and labor optimization.

How to Choose Automated Cell Counter Distributors?

Implement rigorous evaluation criteria when assessing potential partners:

Regulatory and Quality Compliance

Confirm ISO 13485 certification as a prerequisite for medical device distribution. For export to regulated markets (EU, USA, Japan), verify CE marking under MDR 2017/745 or FDA 510(k) clearance documentation. Request test reports for critical performance metrics: accuracy (±3%), repeatability (CV < 5%), and contamination rate (< 0.1%). RoHS and REACH compliance is mandatory for material safety in laboratory environments.

Technical and Operational Capacity

Assess core competencies through infrastructure benchmarks:

- Minimum 2,000m² cleanroom-equipped facility for assembly and calibration

- Dedicated R&D team comprising ≥15% of technical staff with expertise in image processing and fluid dynamics

- In-house optical module testing and software validation protocols

Correlate facility scale with order consistency—target distributors maintaining >97% on-time delivery rates across 12-month transaction histories.

Procurement and Transaction Security

Utilize secure payment structures such as third-party escrow or irrevocable LC terms until post-delivery verification. Review traceability records for firmware version control and hardware serial tracking. Conduct sample benchmarking against NIST-traceable cell standards before volume deployment. Prioritize distributors offering API integration support for LIMS compatibility in automated workflows.

What Are the Best Automated Cell Counter Distributors?

No supplier data available for automated cell counter distributors at this time.

Performance Analysis

In the absence of verified supplier profiles, procurement teams should prioritize engagement with distributors demonstrating documented experience in Class I/II medical device logistics. Emphasis should be placed on audit readiness, including access to design history files (DHF), risk analysis reports (ISO 14971), and post-market surveillance records. For custom configurations—such as dual-channel fluorescence detection or disposable-free operation—require proof of prior project execution via reference installations or case studies.

FAQs

How to verify automated cell counter distributor reliability?

Cross-validate certifications with notified bodies and request recent audit summaries from independent quality assessors. Evaluate technical responsiveness by submitting detailed RFQs covering calibration procedures, consumable compatibility, and error logging functionality. Analyze customer testimonials focusing on after-sales service response times and mean time between failures (MTBF).

What is the average sampling timeline?

Standard model samples are typically produced within 10–20 days. Custom variants requiring modified optics or software interfaces may require 30–45 days for prototyping. Air freight adds 5–8 days for international delivery. Sample costs generally range from 100–150% of unit price, partially refundable upon order confirmation.

Can distributors ship globally?

Yes, experienced distributors manage international shipments under EXW, FOB, or DDP terms. Confirm compliance with destination-specific import classifications for diagnostic instruments (e.g., HS Code 9027.50). Sea freight is recommended for bulk orders (>10 units) to reduce logistics costs by 40–60% versus air transport.

Do distributors provide free samples?

Free samples are uncommon due to high unit value and regulatory handling requirements. Some distributors waive fees for qualified institutions placing anticipated orders exceeding five units. Educational and government labs may qualify for evaluation loaners subject to deposit and return agreements.

How to initiate customization requests?

Submit detailed specifications including required throughput (cells/minute), cell type (mammalian, yeast, bacteria), detection method (brightfield, fluorescence), and data output format (CSV, JSON, LIMS API). Leading partners provide feasibility assessments within 5 business days and deliver functional prototypes within 4–6 weeks for approved designs.