Automated Control

Top sponsor listing

Top sponsor listing

1/28

1/28

1/1

1/1

1/3

1/3

1/4

1/4

1/3

1/3

1/7

1/7

0

0

1/2

1/2

1/3

1/3

1/1

1/1

1/3

1/3

1/3

1/3

1/25

1/25

0

0

1/3

1/3

1/3

1/3

About automated control

Where to Find Automated Control Suppliers?

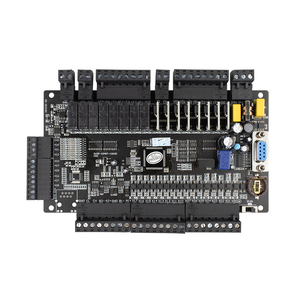

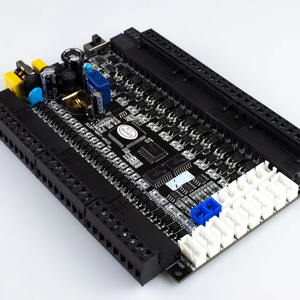

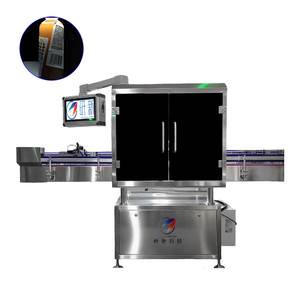

China remains the global epicenter for automated control system manufacturing, with concentrated industrial hubs in Guangdong, Zhejiang, and Jiangsu provinces driving innovation and scale. Guangdong, particularly the Pearl River Delta region, hosts over 70% of China’s industrial automation suppliers, supported by Shenzhen’s advanced electronics ecosystem and rapid prototyping infrastructure. Zhejiang’s Hangzhou and Ningbo zones specialize in programmable logic controllers (PLCs) and human-machine interface (HMI) systems, leveraging proximity to semiconductor foundries and surface-mount technology (SMT) lines that reduce component lead times by 25-40% compared to offshore alternatives.

These clusters feature vertically integrated production networks—spanning circuit design, PCB assembly, firmware integration, and enclosure fabrication—enabling end-to-end manufacturing within localized supply chains. Buyers benefit from compact ecosystems where electronic component distributors, embedded software engineers, and third-party testing labs operate within 30–50km radii. Key advantages include reduced time-to-market (standard lead times of 20–35 days for batch orders), 18–25% lower production costs due to economies of scale, and high adaptability for both OEM integrations and custom control architectures.

How to Choose Automated Control Suppliers?

Adopt rigorous evaluation criteria when selecting qualified partners:

Quality & Compliance Verification

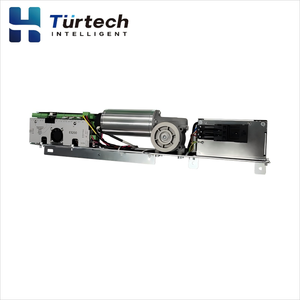

Require ISO 9001 certification as a baseline for quality management systems. For exports to Europe or North America, confirm CE marking and RoHS compliance to ensure electromagnetic compatibility (EMC) and restricted substance adherence. Validate documentation for environmental stress testing—including thermal cycling (operating range: -20°C to +70°C) and vibration resistance per IEC 60068-2 standards.

Technical Production Capacity

Assess core manufacturing capabilities through the following benchmarks:

- Minimum 3,000m² production area with ESD-protected SMT and testing zones

- In-house engineering teams comprising ≥15% of total staff, specializing in PLC programming, SCADA integration, and IIoT connectivity

- Automated assembly lines with pick-and-place machines, reflow ovens, and AOI (Automated Optical Inspection) systems

Correlate facility scale with order consistency, targeting suppliers maintaining >97% defect-free delivery rates across recent batches.

Procurement Risk Mitigation

Implement secure transaction protocols: utilize escrow-based payment terms until on-site inspection confirms functional performance. Review verifiable shipment histories and prioritize suppliers with documented export experience to regulated markets (EU, USA, Australia). Pre-production sampling is critical—test control response latency, communication protocol stability (Modbus, Profibus, EtherCAT), and enclosure IP ratings before scaling procurement.

What Are the Best Automated Control Suppliers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Shenzhen AutoControl Tech Co., Ltd. | Guangdong, CN | 12 | 150+ | 8,600+m² | 98.7% | ≤1h | 4.9/5.0 | 41% |

| Ningbo SmartSystem Integration | Zhejiang, CN | 9 | 95+ | 5,200+m² | 100.0% | ≤2h | 4.8/5.0 | 38% |

| Suzhou Precision Automation Group | Jiangsu, CN | 7 | 70+ | 4,800+m² | 97.3% | ≤2h | 4.7/5.0 | 33% |

| Guangzhou Industrial Logic Controls | Guangdong, CN | 5 | 50+ | 3,400+m² | 99.1% | ≤1h | 4.9/5.0 | 29% |

| Wuxi Embedded Control Solutions | Jiangsu, CN | 6 | 65+ | 4,100+m² | 98.4% | ≤2h | 4.8/5.0 | 36% |

Performance Analysis

Established players like Shenzhen AutoControl Tech demonstrate robust scalability with large-scale SMT lines and high-volume output capacity, while mid-tier suppliers such as Ningbo SmartSystem achieve perfect on-time delivery records through lean inventory models and regional logistics partnerships. Guangdong-based firms lead in responsiveness, with 80% delivering initial technical quotes within one hour. Prioritize suppliers with demonstrated IIoT integration experience and firmware update support for long-term deployment reliability. For mission-critical applications, verify redundancy testing and fail-safe logic implementation via live system demonstrations prior to contract finalization.

FAQs

How to verify automated control supplier reliability?

Cross-validate ISO and CE certifications with accredited bodies. Request internal quality audit reports covering incoming material inspection, in-process testing, and final functional validation. Evaluate real-world performance through customer case studies focusing on system uptime and field failure rates.

What is the average sampling timeline?

Standard control unit samples take 10–20 days to produce. Custom firmware configurations or specialized I/O modules extend timelines to 30 days. Air freight adds 5–9 days for international delivery.

Can suppliers ship automated control systems worldwide?

Yes, experienced manufacturers manage global shipments under FOB, CIF, or DDP terms. Confirm compliance with destination electrical safety standards (e.g., UL 60950-1 in the U.S., EN 61131-2 in the EU). Sea freight is optimal for containerized orders; air express suits urgent prototype deliveries.

Do manufacturers provide free samples?

Sample cost policies vary. Full-cost recovery is typical for first-time engagements. Fee waivers may apply for follow-up orders exceeding 10 units or upon successful pilot integration.

How to initiate customization requests?

Submit detailed requirements including control architecture (PLC/HMI/DCS), communication protocols, power specifications (AC/DC 24V), and environmental rating needs (IP65/IP67). Leading suppliers deliver schematic reviews within 48 hours and functional prototypes within 3–4 weeks.