Cnc Prototype China

Top sponsor listing

Top sponsor listing

1/30

1/30

1/29

1/29

0

0

0

0

1/3

1/3

1/1

1/1

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/2

1/2

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/28

1/28

1/3

1/3

About cnc prototype china

Where to Find CNC Prototype Suppliers in China?

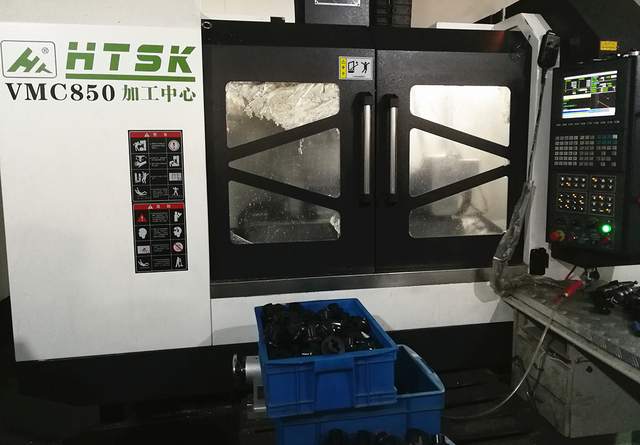

China remains the global epicenter for precision CNC prototyping, with key manufacturing clusters concentrated in Shenzhen, Dongguan, and Xiamen. These regions host vertically integrated facilities specializing in rapid prototyping and low-volume production, leveraging advanced 5-axis CNC machining, turning, milling, and CMM inspection systems. Shenzhen alone accounts for over 40% of China’s high-precision prototype output, supported by a dense network of material suppliers, tooling workshops, and logistics providers within 30km radii.

The ecosystem enables accelerated development cycles—typical lead times range from 5–12 days for machined prototypes—with seamless transitions from design validation to small-batch manufacturing. Localized supply chains reduce component sourcing delays by up to 60%, while proximity to Hong Kong and Shenzhen Port ensures efficient global shipping. Buyers benefit from scalable solutions, with capabilities spanning one-off samples to runs exceeding 5,000 units, all at cost advantages of 25–40% compared to Western-based shops.

How to Choose CNC Prototype Suppliers in China?

Effective supplier selection requires structured evaluation across technical, operational, and transactional dimensions:

Technical Capability Verification

Confirm access to multi-axis CNC lathes and mills (minimum 3-axis, preferred 5-axis) for complex geometries. Demand evidence of in-house quality control tools such as Coordinate Measuring Machines (CMM), surface roughness testers, and first-article inspection reports. For critical applications, verify compliance with ISO 9001 or IATF 16949 standards, particularly when producing automotive or medical prototypes.

Production Readiness Assessment

Evaluate core indicators of operational maturity:

- On-time delivery rate exceeding 95%

- Average response time under 4 hours

- Demonstrated customization capacity (material, color, finish, labeling)

- Reorder rate above 25% indicating customer retention

Cross-reference online revenue metrics and listing volume to assess scale. High-performing suppliers typically maintain active portfolios across machining services, sheet metal fabrication, and casting, indicating diversified capability and process redundancy.

Procurement Risk Mitigation

Utilize secure payment mechanisms tied to milestone verification. Prioritize partners offering detailed work-in-progress updates and final inspection documentation. Request physical or digital samples prior to full commitment—especially for tight-tolerance components—to validate dimensional accuracy and surface quality. Confirm packaging and labeling specifications align with downstream integration requirements.

What Are the Top CNC Prototype Suppliers in China?

| Company Name | Main Products (Listings) | On-Time Delivery | Response Time | Reorder Rate | Online Revenue | Customization Options |

|---|---|---|---|---|---|---|

| Shenzhen Xie Lifeng Technology Co., Ltd. | Machining Services (1,134) | 98% | ≤4h | 35% | US $920,000+ | Color, material, size, logo, packaging, label, graphic |

| Dongguan Formal Precision Metal Parts Co., Ltd. | Customized CNC Machining Metal Parts | 82% | ≤5h | 30% | US $110,000+ | Color, shape, precision, packaging, label, 5-axis milling, material, size, CMM inspection, forging, logo, graphic, heat transfer, dimensions |

| Shenzhen Smart Mold Technology Limited | High-Precision CNC Machining | 96% | ≤2h | 25% | US $880,000+ | Color, material, size, logo, packaging, label, graphic |

| Taizhou Xue Chen Auto Parts Co., Ltd. | Other Fabrication Services (128) | 100% | ≤1h | 24% | US $270,000+ | Limited customization data available |

| Xiamen Jimei Soulide Department Firm | Machining Services (304) | 100% | ≤2h | 32% | US $110,000+ | Material, precision, packaging, labeling, 5-axis CNC |

Performance Analysis

Shenzhen Xie Lifeng leads in service breadth and customer retention (35% reorder rate), backed by extensive machining listings and strong delivery performance. Dongguan Formal Precision stands out for technical customization depth, including CMM inspection and 5-axis milling, despite a lower on-time delivery rate. Taizhou Xue Chen and Xiamen Jimei Soulide achieve perfect 100% on-time delivery, with sub-2-hour response times enhancing communication efficiency. Shenzhen Smart Mold combines high responsiveness with robust output volume, serving clients requiring rapid iteration and mid-volume scaling. Buyers seeking automotive-grade prototypes should prioritize suppliers with documented inspection protocols and material traceability.

FAQs

What is the typical MOQ for CNC prototypes in China?

Most suppliers offer a minimum order quantity of 1 piece, enabling cost-effective sampling and design validation. Bulk pricing applies at volumes above 100–500 units, depending on part complexity and material usage.

How long does CNC prototyping take?

Standard lead time ranges from 5 to 12 business days, inclusive of programming, machining, finishing, and inspection. Expedited services (3–5 days) are available for simple geometries, often at a premium. Complex multi-feature parts or those requiring secondary operations may extend timelines by 3–5 days.

What materials are commonly used in CNC prototyping?

Aluminum alloys (6061, 7075), stainless steel (303, 304, 316), brass, and engineering plastics (ABS, POM, PC, Nylon) are standard. Material selection depends on mechanical requirements, corrosion resistance, and machinability. Suppliers typically provide material certification upon request.

Can Chinese CNC shops handle tight tolerances?

Yes, leading facilities maintain tolerances down to ±0.005mm using calibrated 5-axis machines and environmental controls. Capabilities are validated through CMM reports, which reputable suppliers include with shipment documentation.

Do suppliers support file formats for CNC prototyping?

Commonly accepted formats include STEP (.stp), IGES (.igs), SolidWorks (.sldprt), and DWG/DXF. STL files are used primarily for hybrid workflows involving 3D printing. Ensure models include geometric dimensioning and tolerancing (GD&T) annotations for precision-critical features.