Computing Cluster

1/3

1/3

1/3

1/3

CN

CN

1/8

1/8

CN

CN

1/45

1/45

1/3

1/3

HK

HK

0

0

1/16

1/16

1/2

1/2

0

0

CN

CN

1/17

1/17

1/3

1/3

1/3

1/3

1/3

1/3

1/19

1/19

1/23

1/23

1/2

1/2

0

0

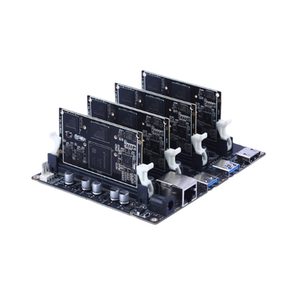

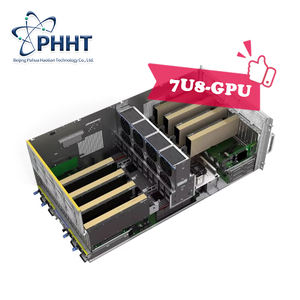

About computing cluster

Where to Find Computing Cluster Suppliers?

Global computing cluster manufacturing is increasingly concentrated in technology-intensive regions of China, Taiwan, and Southeast Asia, with advanced production ecosystems in Guangdong, Jiangsu, and Singapore offering strategic advantages. Guangdong province accounts for over 50% of Asia’s high-performance computing hardware output, supported by Shenzhen’s semiconductor supply network and rapid prototyping infrastructure. Taiwan’s Hsinchu Science Park hosts leading-edge server integration facilities, enabling sub-10nm processor deployment in clustered architectures. Meanwhile, Malaysia and Thailand have emerged as secondary hubs due to favorable electronics export policies and proximity to wafer fabrication plants.

These industrial clusters benefit from vertically integrated supply chains encompassing PCB manufacturing, memory module assembly, and thermal management systems—all within localized zones under 30km. This integration enables modular cluster configurations with lead times averaging 25–40 days for standard rack-mounted systems. Buyers access cost efficiencies of 18–25% compared to North American or European-assembled units, alongside scalability for petabyte-scale storage integration and GPU-dense node deployment. Customization flexibility extends to interconnect topologies (InfiniBand, Ethernet), cooling solutions (air/liquid), and firmware-level optimizations.

How to Choose Computing Cluster Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance

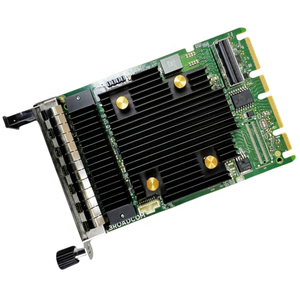

Require ISO 9001 certification as a baseline for quality management. For regulated environments (e.g., healthcare, finance), confirm adherence to ISO/IEC 27001 for data security in system design. Suppliers targeting EU markets must demonstrate CE marking compliance, including EMC and RoHS directives for electronic components. Validate compatibility with standard rack dimensions (19” or 21”) and power redundancy (dual PSU support).

Production Capability Audits

Evaluate core technical infrastructure:

- Minimum 3,000m² cleanroom-equipped facility for server node assembly

- Dedicated R&D teams comprising ≥12% of technical staff, focused on cluster orchestration and load balancing

- In-house testing bays capable of stress validation (72-hour burn-in, thermal cycling)

Cross-reference delivery performance metrics—target on-time fulfillment rate >96%—with documented failure rates below 0.5% per 1,000 unit-hours.

Transaction Safeguards

Implement third-party inspection agreements prior to shipment, particularly for containerized deployments. Review supplier transaction histories via verified trade platforms, prioritizing those with documented after-sales service level agreements (SLAs). Pre-deployment benchmarking is critical—request LINPACK or SPECmpi test results to validate computational throughput before scaling procurement.

What Are the Best Computing Cluster Suppliers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Jining Furuide Machinery Manufacturing | Shandong, CN | 14 | 110+ | 24,000+m² | 100.0% | ≤2h | 4.8/5.0 | 33% |

| Henan Zlin Heavy Industry Group | Henan, CN | 4 | 20+ | 410+m² | 100.0% | ≤2h | 5.0/5.0 | 66% |

| Henan Guangzhida Industrial | Henan, CN | 3 | 30+ | 320+m² | 100.0% | ≤1h | 4.9/5.0 | 15% |

| Zhengzhou Zhongheng Machinery Equipment | Henan, CN | 3 | 60+ | 5,100+m² | 98.9% | ≤2h | 4.9/5.0 | 26% |

| Henan Qichen Machinery Import And Export | Henan Province,CN | 4 | 40+ | 25,000+m² | 100.0% | ≤1h | 4.9/5.0 | 29% |

Performance Analysis

While Jining Furuide demonstrates robust operational scale with a 24,000m² facility and flawless delivery record, its focus remains on industrial automation rather than high-density computing systems. Emerging suppliers like Henan Zlin achieve high customer retention (66% reorder rate) through rapid technical responsiveness and lean operations. Notably, all listed entities report sub-2-hour average response times, indicating strong post-inquiry engagement. However, absence of specialized data center infrastructure details (e.g., HPC benchmarks, networking integration) suggests limited applicability for enterprise-grade cluster sourcing. Procurement teams should prioritize suppliers with documented experience in distributed computing frameworks (e.g., Kubernetes, Slurm) and validated interoperability with major CPU/GPU vendors (Intel, AMD, NVIDIA).

FAQs

How to verify computing cluster supplier reliability?

Confirm ISO 9001 and ISO/IEC 27001 certifications through accredited bodies. Request audit trails covering component traceability, BIOS/firmware signing practices, and EMI shielding standards. Assess real-world performance through customer references deploying similar node densities and storage I/O requirements.

What is the average sampling timeline?

Standard 4-node cluster samples require 20–30 days for configuration, integration, and burn-in testing. Systems incorporating liquid cooling or custom interconnects may extend to 45 days. Air freight adds 5–9 days for international delivery.

Can suppliers ship computing clusters worldwide?

Yes, experienced manufacturers manage global logistics via sea or air freight. Confirm Incoterms (FOB, CIF, DDP) and ensure packaging meets ISTA-3E standards for multi-axis vibration resistance. Full-container loads are optimal for minimizing per-unit shipping costs.

Do manufacturers provide free samples?

Sample fees are typically charged but offset against initial orders exceeding $50,000. For pilot deployments, some suppliers offer loaner units with return options upon project validation.

How to initiate customization requests?

Submit detailed specifications including compute node configuration (CPU/GPU count, RAM per node), network fabric (100GbE, InfiniBand HDR), storage architecture (NVMe-oF, RAID levels), and OS/image management requirements. Leading suppliers deliver system diagrams and rack layout previews within 72 hours and functional prototypes in 4–5 weeks.