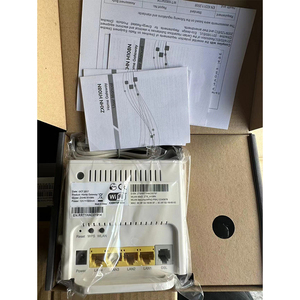

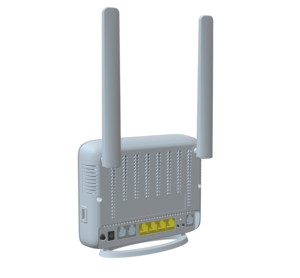

Dsl Modem

1/20

1/20

1/3

1/3

1/3

1/3

1/3

1/3

1/15

1/15

0

0

1/3

1/3

1/3

1/3

1/2

1/2

1/3

1/3

1/3

1/3

1/1

1/1

1/2

1/2

1/11

1/11

1/3

1/3

0

0

1/33

1/33

1/3

1/3

1/3

1/3

About dsl modem

Where to Find DSL Modem Suppliers?

China remains a dominant hub for DSL modem manufacturing, with key production clusters concentrated in Shenzhen and Beijing. These regions host specialized electronics manufacturers leveraging vertically integrated supply chains, advanced SMT assembly lines, and proximity to component suppliers for efficient production. Shenzhen, as a global technology center, offers rapid prototyping and high-volume output capabilities, particularly for wireless-enabled DSL modems integrating Wi-Fi 5/6 standards. Beijing-based firms focus on G.fast and VDSL2 CPE solutions, often serving telecom operators and ISPs requiring compliance with regional network infrastructure standards.

The industrial ecosystem enables cost-effective production through localized access to PCBs, chipsets (e.g., Broadcom, Lantiq), RF modules, and power adapters. Manufacturers benefit from streamlined logistics within industrial zones where testing labs, contract assemblers, and packaging facilities operate within close proximity. Buyers can expect lead times of 15–30 days for bulk orders, with economies of scale reducing unit costs significantly at volumes exceeding 1,000 units. Customization options—including firmware configuration, branding, port layouts, and dual-band module integration—are widely supported across tier-1 suppliers.

How to Choose DSL Modem Suppliers?

Procurement decisions should be guided by the following evaluation criteria:

Technical Compliance & Certifications

Verify adherence to international standards such as CE, FCC Part 15, RoHS, and ISO 9001. For deployment in regulated markets, ensure products support ITU-T G.993.2 (VDSL2), G.992.5 (ADSL2+), or G.fast (G.9700/G.9701) specifications. Request test reports for EMI/EMC, signal stability, and thermal performance under continuous operation.

Production and Customization Capacity

Assess supplier infrastructure based on the following indicators:

- Minimum monthly output capacity exceeding 50,000 units for sustained volume fulfillment

- In-house capabilities for PCB design, firmware development, and environmental stress testing

- Support for hardware customization: WAN/LAN port count, integrated power supplies, antenna configurations, and fiber/PON combo variants

Cross-reference online transaction data with on-time delivery rates (target ≥95%) and reorder frequency to gauge operational reliability.

Quality Assurance and Transaction Security

Prioritize suppliers offering third-party inspection services and secure payment terms via escrow. Analyze after-sales metrics including defect return rates (<2% typical benchmark) and technical support responsiveness. Sample validation is critical—test boot time, sync stability, throughput consistency, and VLAN/bridge mode functionality prior to mass production.

What Are the Best DSL Modem Suppliers?

| Company Name | Location | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | MOQ Range | Price Range (USD) | Customization |

|---|---|---|---|---|---|---|---|---|

| Zisa Technologies (Beijing) Inc. | Beijing, CN | US $410,000+ | 100% | ≤2h | 16% | 1–10 pcs | $26.90–$120 | Yes (ports, firmware, logo, refurbished options) |

| Hwatel (Beijing) Technology Co., Ltd. | Beijing, CN | US $4,000+ | 55% | ≤5h | 40% | 1 pc | $70–$250 | Limited (mainly repeaters, extenders) |

| Shenzhen Hooolink Technology Co., Limited | Shenzhen, CN | US $170,000+ | 100% | ≤4h | 25% | 100–1000 pcs | $12.36–$19.00 | Hardware variants (Wi-Fi N, VDSL/ADSL) |

| Shenzhen Yingdakang Technology Co., Ltd. | Shenzhen, CN | Not disclosed | 100% | ≤5h | No data | 1000 pcs | $10.80–$43.00 | Firmware, branding, multi-port designs |

| Shenzhen Zexing Zhiyun Technology Co., Ltd. | Shenzhen, CN | US $50,000+ | 100% | ≤15h | <15% | 1–1000 sets | $11.50–$35.00 | Color, labeling, Wi-Fi 6E, mesh, indoor/outdoor |

Performance Analysis

Zisa Technologies stands out for low MOQ flexibility and strong technical customization, ideal for niche deployments or ISP trials. Despite lower reorder rates, its 100% on-time delivery and sub-2-hour response time reflect robust customer service. Hwatel shows high customer retention (40% reorder rate) but lags in punctuality (55%), indicating potential logistical constraints. Shenzhen-based suppliers dominate cost efficiency, with Hooolink and Yingdakang offering sub-$15 units at scale—suitable for budget-conscious bulk buyers. Zexing Zhiyun provides modern feature sets including Wi-Fi 6E support and mesh readiness, though slower response times suggest room for operational improvement. All top-tier suppliers offer OEM/ODM services, with firmware upgrades, regulatory certifications, and packaging adjustments commonly available upon request.

FAQs

How to verify DSL modem supplier reliability?

Cross-check claimed certifications with official databases. Request evidence of product compliance testing (e.g., IOL reports for DSL interoperability). Evaluate supplier credibility through order history, buyer reviews focusing on post-delivery support, and verification of physical operations via video audit.

What is the average lead time for bulk DSL modem orders?

Standard production lead time ranges from 15 to 25 days after deposit confirmation. Orders requiring custom firmware or hardware modifications may extend to 35 days. Air freight adds 5–10 days; sea shipping typically requires 25–40 days depending on destination port.

Can suppliers provide pre-shipping product samples?

Yes, most suppliers offer samples for $10–$50, often refundable against future orders. Sample lead time averages 5–7 days. Buyers should specify requirements for firmware version, region-specific settings, and interface language during sampling.

Do manufacturers support firmware customization?

Reputable suppliers provide configurable firmware including TR-069/TR-064 support, VLAN tagging, QoS settings, and remote management protocols. Some offer white-label interfaces with custom login screens and default IP configurations tailored to operator networks.

Are refurbished or recycled DSL modems available?

Selected suppliers, including Zisa Technologies, list refurbished units tested for full functionality. These are typically deployed for network upgrades or temporary installations, offering up to 40% cost savings over new units while maintaining core performance metrics.