Envelope Printing Machine Producer

1/15

1/15

1/25

1/25

1/14

1/14

1/15

1/15

1/16

1/16

1/15

1/15

1/11

1/11

1/10

1/10

1/16

1/16

About envelope printing machine producer

Where to Find Envelope Printing Machine Producers?

China remains the global hub for envelope printing machine manufacturing, with key production clusters in Zhejiang, Guangdong, and Jiangsu provinces. These regions host vertically integrated facilities combining precision engineering, digital printing technology, and paper processing expertise. Zhejiang and Jiangsu specialize in high-speed, fully automated envelope production lines, leveraging local supply chains for servo motors, control systems, and die-cutting components. Guangdong’s Shenzhen-based manufacturers focus on digital inkjet integration, offering compact systems tailored for commercial print shops and packaging customization services.

The industrial ecosystem supports rapid prototyping and scalable production, with many suppliers operating end-to-end workflows—from sheet feeding and window patching to inline printing and sealing. This integration reduces component lead times by 20–35% compared to fragmented supply models. Buyers benefit from consolidated sourcing, where single-supplier procurement covers printing, folding, gluing, and numbering functions. Average delivery cycles range from 30 to 45 days for standard configurations, with localized material sourcing enabling 15–25% cost efficiency over Western-built equivalents.

How to Choose Envelope Printing Machine Suppliers?

Selecting reliable producers requires structured evaluation across technical, operational, and transactional dimensions:

Technical Capabilities Verification

Confirm compatibility with substrate types (e.g., offset paper, kraft, silicone-coated stock) and printing methods (inkjet, flexographic, or hot foil). Machines should support variable data printing (VDP) for personalized envelopes, with minimum resolution of 300 DPI. For high-volume operations, prioritize full-auto systems capable of 3,000–8,000 envelopes per hour. Validate motor specifications, PLC controls, and pneumatic system integrity through technical documentation.

Production Infrastructure Assessment

Evaluate supplier capacity using these benchmarks:

- Minimum factory area of 2,000m² indicating dedicated assembly lines

- In-house R&D teams focused on automation and software integration

- On-site testing protocols for machine calibration and long-run durability

Cross-reference online revenue indicators and on-time delivery rates (>95% preferred) to assess order management reliability.

Quality & Transaction Assurance

While formal ISO 9001 certification is not universally listed, prioritize suppliers with documented quality control procedures and third-party inspection options. Use secure payment mechanisms that release funds post-delivery verification. Request sample runs to evaluate registration accuracy, glue consistency, and print clarity before bulk ordering. Confirm export experience, particularly for CE-marked electrical systems compliant with EU machinery directives.

What Are the Leading Envelope Printing Machine Producers?

| Company Name | Location | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Min. Order Value | Customization |

|---|---|---|---|---|---|---|---|---|

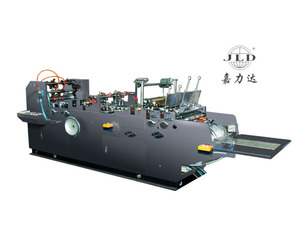

| Zhejiang Jialida Packing Machinery Co., Ltd. | Zhejiang, CN | Paper Product Making Machinery, Packaging Machines | US $80,000+ | 100% | ≤1h | <15% | $10,000 | Limited |

| Shenzhen Telegroup Printing Technology Co., Ltd. | Guangdong, CN | Inkjet Printers, Digital Printers, Printing Machinery | US $10,000+ | 60% | ≤4h | <15% | $3,500 | Yes |

| Suzhou Ruicai Electron Co., Ltd. | Jiangsu, CN | Paper Processing Machinery, Inkjet Printers | US $150,000+ | 96% | ≤10h | <15% | $2,000 | Limited |

| Shenzhen Focus Technology Development Co., Ltd. | Guangdong, CN | Digital Inkjet Systems, Bag & Envelope Printers | US $310,000+ | - | ≤2h | 100% | $5,000 | Yes |

| Henan Vodafone Digital Technology Co., Ltd. | Henan, CN | Digital Printers, Foil Printing Machines, PVC Printers | US $150,000+ | 98% | ≤3h | 20% | $1,900 | Yes |

Performance Analysis

Zhejiang Jialida leads in delivery reliability (100%) and response speed, offering high-end fully automatic envelope machines priced up to $56,000, suitable for industrial-scale operations. Shenzhen Focus Technology stands out with a 100% reorder rate, indicating strong customer retention despite unreported on-time metrics—its focus on single-pass digital inkjet systems caters to niche customization demands. Suzhou Ruicai and Henan Vodafone combine competitive pricing ($2,000–$14,000 range) with solid delivery performance (96–98%) and customization capabilities, ideal for mid-tier commercial printers. Shenzhen Telegroup offers entry-level options from $3,500 but shows lower delivery reliability (60%), suggesting potential fulfillment risks. Buyers seeking automation should prioritize Zhejiang- and Jiangsu-based suppliers; those requiring digital personalization may leverage Guangdong’s tech-integrated solutions.

FAQs

What is the typical MOQ for envelope printing machines?

Most suppliers set a minimum order quantity of 1 set, with select models requiring 2 sets for batch optimization. No supplier imposes large-volume MOQs, facilitating pilot procurement and small business adoption.

What are common customization options?

Available customizations include color schemes, logo branding, material feed adjustments, label placement, and graphic interface localization. Some suppliers offer firmware modifications for integration with existing print management systems.

What are average lead times after order confirmation?

Standard machines ship within 20–30 days. Customized systems may require 35–50 days depending on technical modifications. Pre-shipment testing typically adds 3–5 days.

Do suppliers provide technical support and installation guidance?

Most offer remote setup assistance via video or manual. On-site commissioning is rarely included standard; buyers should negotiate this as an add-on service. Training duration ranges from 1–3 hours for basic operation.

Are spare parts and maintenance services available post-purchase?

Core components like print heads, rollers, and sensors are available for replacement. Suppliers typically provide 12-month warranties on critical subsystems. Long-term service contracts are uncommon; buyers should stock essential wear parts locally.