Intel 386 486 Cpu Scrap Producer

About intel 386 486 cpu scrap producer

Where to Find Intel 386 and 486 CPU Scrap Producers?

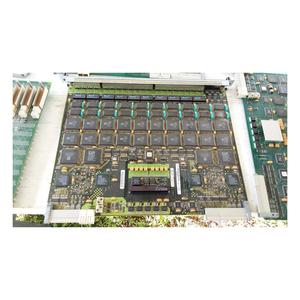

Global supply of legacy Intel 386 and 486 CPU scrap is concentrated among specialized electronic waste processors in Asia, Europe, and Africa, with Thailand, Germany, Denmark, Australia, and Uganda emerging as key sourcing hubs. These suppliers primarily source ceramic-based microprocessor scrap from decommissioned industrial computing systems, telecommunications infrastructure, and surplus inventory channels.

Suppliers operate within vertically integrated recycling ecosystems that include sorting, de-capping, and preliminary precious metal recovery. The focus on ceramic packaging—common in high-reliability variants of the 386 and 486 series—enables higher gold yield compared to plastic-encapsulated units. Most producers offer trimmed or untrimmed scrap forms, with pricing directly linked to pin gold content, batch size, and purity classification. Bulk availability is supported by established networks for collecting end-of-life server components and obsolete computing hardware.

How to Choose Intel 386 and 486 CPU Scrap Suppliers?

Evaluating suppliers requires adherence to technical and transactional due diligence protocols:

Material Specification Verification

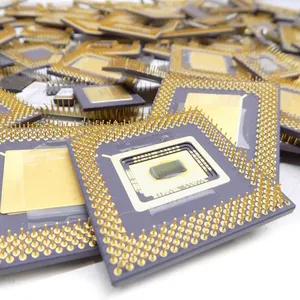

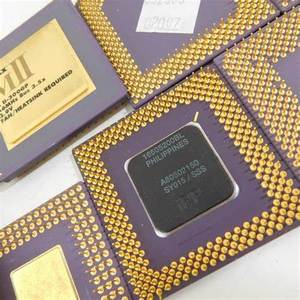

Confirm material composition through supplier-provided categorization: ceramic vs. plastic substrates, presence of gold-plated pins (typically 0.2–0.5g Au per unit), and whether scrap is trimmed (pins removed) or whole. High-yield batches often consist of fully plated PGA (Pin Grid Array) packages commonly found in server-grade 486DX and OverDrive processors.

Production and Processing Capability

Assess operational scale via minimum order quantity (MOQ) thresholds and processing volume. Leading suppliers support MOQs starting at 100 kg, with some offering bulk contracts exceeding 1,000 metric tons annually. Facilities handling large volumes typically maintain dedicated lines for magnetic separation, size reduction, and density-based sorting to ensure consistent feedstock quality for downstream refining.

- Preferred MOQ range: 100–500 kg for sample validation

- Bulk pricing tiers observed between $4–$25/kg, dependent on gold content and form factor

- Response time under 24 hours indicates active inventory management and operational readiness

Transaction Reliability Indicators

Prioritize suppliers with documented response efficiency (≤9h average) and repeat buyer engagement. While formal certifications such as ISO 14001 or R2/RIOS are not explicitly listed, consistent online transaction volume and multi-product listings in metal scrap categories suggest established export practices. Third-party trade assurance mechanisms should be utilized to mitigate risk in initial procurement cycles.

What Are the Top Intel 386 and 486 CPU Scrap Suppliers?

| Company Name | Location | Main Products | Typical Price Range | Min. Order | Avg. Response Time | Product Listings (Scrap Focus) | Specialization Notes |

|---|---|---|---|---|---|---|---|

| WELL FRESH (THAILAND) Company Limited | Thailand | Copper Scrap, Rice, Chicken | $2/kg | 1 kg | ≤23h | 5 | Low MOQ entry point; suitable for sampling |

| Under Pressure GmbH | Germany | Copper Scrap, Spices, Recycled Plastic | $2.70–$17.35/kg | 100–1,000 MT | ≤5h | 5 | High-volume capability; wide price band suggests grade segmentation |

| Abo Leil ApS | Denmark | Used Cars, Tractors, Copper Scrap | $4–$9/kg | 100–1,000 kg | ≤6h | 5 | Balanced pricing; scalable order sizes |

| WWW LOGISTICS PTY LTD | Australia | Aluminum Scrap, Animal Feed, Fertilizer | $4–$25/kg | 100 kg | ≤6h | 5 | Premium segment offerings; broad price spread indicates multiple grades |

| JAMNAGAR UGANDA LIMITED | Uganda | CPUs, Copper Scrap, Loose Diamonds | $8–$12/kg | 25 kg | ≤9h | 5 | Niche focus on plated pins; mid-tier MOQ and pricing |

Performance Analysis

Under Pressure GmbH demonstrates strongest scalability with multi-metric-ton capacity and aggressive response times (≤5h), positioning it as a strategic partner for industrial refiners. Abo Leil ApS and WWW LOGISTICS PTY LTD offer competitive mid-volume options with transparent tiered pricing. JAMNAGAR UGANDA LIMITED stands out for its specialization in high-yield gold-pin scrap, catering to precision recovery operations. WELL FRESH provides the lowest entry barrier for testing material quality but may lack volume consistency. Buyers should align supplier selection with processing scale, gold recovery efficiency targets, and logistical feasibility.

FAQs

What determines the value of Intel 386 and 486 CPU scrap?

Value is primarily driven by substrate type (ceramic units contain significantly more gold than plastic), pin plating thickness, and whether pins are intact or trimmed. Ceramic 486DX and OverDrive processors yield 0.3–0.6 grams of gold per unit, making them economically viable for refining at current bullion prices.

What is the typical lead time for CPU scrap orders?

Standard lead time ranges from 7–15 days after payment confirmation, depending on destination and order size. Air freight is recommended for samples (25–100 kg); sea freight is cost-effective for containerized shipments above 1,000 kg.

Can suppliers provide material test reports or sample batches?

Yes, most suppliers accommodate small-batch orders (as low as 1 kg) for quality verification. Request photographic documentation of lot condition and, if possible, ash assay or fire assay results for gold content validation prior to large-scale procurement.

Are there export regulations for CPU scrap shipments?

Export compliance depends on destination country’s e-waste import policies. While functional CPUs may fall under Basel Convention restrictions, non-functional scrap intended for recycling is generally exempt when declared accurately. Confirm Harmonized System (HS) code 8548.90 (waste electrical apparatus) for customs clearance.

How is pricing structured for different scrap grades?

Pricing reflects refinement readiness: whole CPUs ($4–$9/kg), trimmed pins ($10–$15/kg), and high-purity ceramic scrap with exposed die ($12–$25/kg). Volume discounts are standard for orders exceeding 500 kg, with negotiated rates common for recurring contracts.