Jabil Robotics

About jabil robotics

Where to Find Robotics Suppliers?

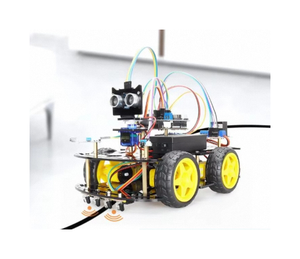

China remains a central hub for robotics manufacturing, with key production clusters in Shenzhen, Suzhou, and Jiangxi enabling specialized capabilities across industrial automation, collaborative robots (cobots), and educational robotics. Shenzhen-based suppliers leverage proximity to electronics supply chains and advanced R&D ecosystems, supporting rapid prototyping and high-volume production of precision robotic arms. Suzhou’s industrial automation cluster benefits from integration with motion control component manufacturers—such as servo motors and reducers—reducing system integration costs by 15–25%. Jiangxi and surrounding regions focus on consumer-grade and educational robotics, offering cost-efficient assembly lines for STEM kits and programmable robot platforms.

These regional advantages translate into scalable production models with lead times averaging 20–35 days for standard configurations. Suppliers in these zones typically operate vertically integrated facilities that encompass design, PCB assembly, mechanical processing, and final testing, ensuring tighter quality control and faster iteration cycles. Buyers benefit from localized access to critical subsystems—including controllers, end-effectors, and vision modules—as well as flexible MOQ structures ranging from single units to container-load orders.

How to Choose Robotics Suppliers?

Effective supplier selection requires systematic evaluation across technical, operational, and transactional dimensions:

Technical Expertise & Product Range

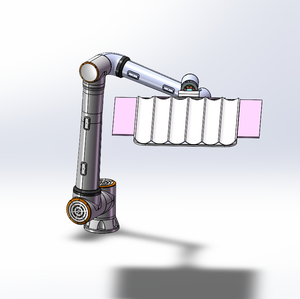

Verify alignment between supplier offerings and application requirements. Industrial automation suppliers should demonstrate proven experience in six-axis cobots, SCARA robots, or palletizing systems with documented payload and repeatability specifications. For educational or consumer robotics, assess software accessibility, programming interfaces (e.g., open-source compatibility), and safety certifications.

Production and Quality Assurance

Evaluate infrastructure indicators such as facility scale, in-house engineering capacity, and process controls. Key benchmarks include:

- On-time delivery rate ≥95% as an indicator of operational reliability

- Response time ≤4 hours to ensure responsive communication

- In-house R&D or customization capabilities for tailored integrations

While ISO 9001 certification is not explicitly stated in available data, prioritize suppliers who provide verifiable test reports, product warranties, and compliance documentation (CE, RoHS) upon request.

Transaction Security and After-Sales Support

Utilize secure payment mechanisms such as escrow services to mitigate risk. Analyze reorder rates as a proxy for customer satisfaction—suppliers with reorder rates exceeding 50% indicate strong post-sale performance. Confirm availability of technical support, spare parts supply, and firmware updates, particularly for long-term deployment scenarios.

What Are the Best Robotics Suppliers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Reorder Rate | Avg. Response | MOQ | Price Range (USD) |

|---|---|---|---|---|---|---|---|

| Shenzhen Era Automation Co., Ltd. | Collaborative Robots, AGV, Material Handling Equipment | US $350,000+ | 100% | 50% | ≤2h | 1 set | $1,990–6,999 |

| Suzhou Yihaoyuan Automation Technology Co., Ltd. | Collaborative Robots, Motor Controllers, Speed Reducers | US $30,000+ | 100% | 50% | ≤2h | 3 sets | $4,500–24,000 |

| Huiling-Tech Robotic Co., Ltd. | Articulated Robots, SCARA Cobots, Linear Guides | US $20+ | 100% | <15% | ≤5h | 1–10 units/boxes | $4,500–12,000 |

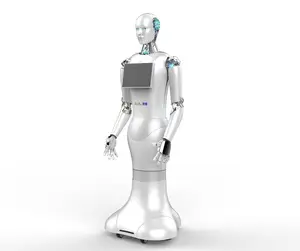

| Jiangxi New Silk Road Industry & Trade Company Limited | Educational Robot Kits, Smart Robots | US $210,000+ | 98% | 28% | ≤3h | 1–5 pieces | $78–170 |

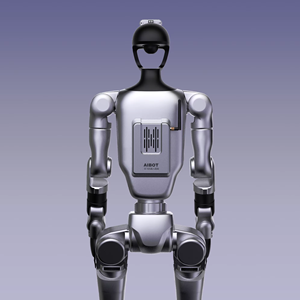

| Jiangyin Thousands Chemicals Co., Ltd. | Robot Dogs, AI-Powered Mobile Robots | US $190,000+ | 95% | 17% | ≤4h | 1 piece | $300–14,500 |

Performance Analysis

Shenzhen Era Automation and Suzhou Yihaoyuan stand out for industrial applications, both achieving 100% on-time delivery and 50% reorder rates—indicating robust production planning and customer trust. Shenzhen offers lower entry pricing ($1,990 minimum) ideal for pilot deployments, while Suzhou specializes in higher-payload robotic arms suited for welding and palletizing. Huiling-Tech presents technically capable products but exhibits lower reorder activity and slower response times, suggesting potential gaps in after-sales service. Jiangxi New Silk Road delivers competitive pricing for educational robotics with high transaction volume, making it suitable for bulk procurement in academic markets. Jiangyin Thousands Chemicals provides access to advanced mobile robotics, including AI-enabled quadruped platforms, though customization scope should be validated through direct technical consultation.

FAQs

How to verify robotics supplier reliability?

Cross-check declared performance metrics—on-time delivery, response time, and reorder rate—with historical transaction data via trusted B2B platforms. Request evidence of quality control procedures, component sourcing standards, and pre-shipment inspection protocols. For industrial use cases, confirm compatibility with existing factory networks (e.g., Modbus, Ethernet/IP).

What is the typical lead time for robotics orders?

Standard robotic systems ship within 20–30 days after order confirmation. Custom configurations involving modified payloads, specialized end-of-arm tooling, or software integration may require 45–60 days. Air freight enables delivery in 5–10 days; sea freight takes 25–40 days depending on destination port.

Can suppliers accommodate customization requests?

Yes, multiple suppliers offer customization in color, branding, packaging, and functional parameters. Shenzhen and Suzhou-based manufacturers support OEM/ODM services for structural and control system modifications. Submit detailed technical drawings or operational requirements to initiate feasibility assessments.

Are samples available before bulk ordering?

Most suppliers allow sample purchases at near-unit cost. Sample pricing typically reflects 80–100% of listed prices, with shipping fees applied. Buyers are advised to conduct functionality, durability, and integration testing prior to full-scale procurement.

What are common MOQs in the robotics sector?

MOQs vary by product type: industrial robots often require 1–3 sets, while educational kits can be ordered individually. High-value systems (e.g., $24,000 palletizing robots) may require multi-unit commitments. Negotiation is possible for repeat buyers or bundled purchases across product lines.