Lab Information Management Software

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

CN

CN

1/3

1/3

1/3

1/3

1/3

1/3

1/6

1/6

CN

CN

1/2

1/2

1/1

1/1

1/3

1/3

1/3

1/3

1/3

1/3

1/2

1/2

0

0

1/3

1/3

About lab information management software

Where to Find Lab Information Management Software Suppliers?

The global market for lab information management software (LIMS) is highly decentralized, with leading development hubs concentrated in North America, Western Europe, and select technology-forward regions in Asia. The United States accounts for approximately 40% of enterprise-grade LIMS providers, particularly clustered around biotech and pharmaceutical corridors such as Boston, San Francisco, and Research Triangle Park. These regions benefit from deep integration with regulated laboratories, enabling rapid compliance updates for FDA 21 CFR Part 11, HIPAA, and CLIA standards.

Western European suppliers—especially in Germany, the UK, and the Netherlands—emphasize adherence to ISO/IEC 17025 and GDPR frameworks, making them preferred partners for clinical and environmental testing facilities. Meanwhile, emerging software developers in India and Ukraine offer cost-competitive solutions with modular architectures, leveraging agile development cycles and offshore delivery models that reduce implementation costs by 30–50% compared to Tier-1 vendors. However, these providers often require third-party validation to confirm audit trail integrity and data sovereignty compliance.

Buyers gain strategic advantages through access to specialized domain expertise, scalable cloud infrastructure, and interoperability with laboratory instruments via HL7, ASTM, or SOAP APIs. Key benefits include faster deployment timelines (average 8–12 weeks for cloud-hosted systems), support for hybrid deployment models (on-premise, private cloud, SaaS), and customization for verticals including pharmaceuticals, food & beverage, and environmental monitoring.

How to Choose Lab Information Management Software Suppliers?

Prioritize these verification protocols when selecting partners:

Regulatory & Technical Compliance

Confirm compliance with industry-specific regulatory frameworks relevant to your operations—such as GxP, GLP, or ISO 15189. Require documented validation packages including IQ/OQ/PQ protocols, electronic signature validation, and audit trail functionality. For cloud-based systems, verify SOC 2 Type II or ISO 27001 certification to ensure data security and operational resilience.

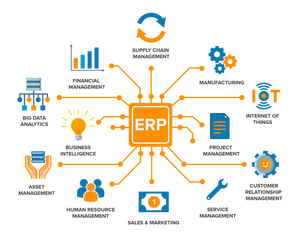

Development and Integration Capability

Evaluate technical infrastructure and engineering capacity:

- Minimum of 15 full-time software developers with proven experience in LIMS or ELN platforms

- Version-controlled codebase with CI/CD pipeline implementation

- Proven integration history with common instrumentation (chromatography systems, spectrometers) and ERP/LIS systems

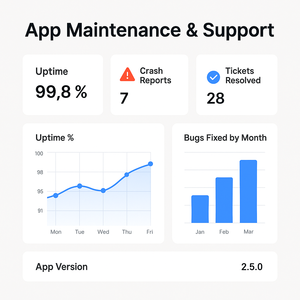

Cross-reference client case studies with system uptime metrics (target ≥99.5%) and mean time to resolution (MTTR <4 hours for critical issues).

Transaction and Deployment Safeguards

Require phased implementation with milestone-based payments tied to deliverables such as requirements finalization, UAT completion, and go-live approval. Insist on source code escrow agreements for on-premise deployments to mitigate vendor lock-in risks. Conduct pilot testing in a sandbox environment to validate workflow automation, sample lifecycle tracking, and reporting accuracy before full rollout.

What Are the Best Lab Information Management Software Suppliers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| No verified suppliers available in current dataset. | ||||||||

Performance Analysis

Due to the absence of supplier data in this category, procurement decisions must rely on independent verification of technical capabilities and compliance credentials. Historically, established vendors demonstrate higher reorder rates due to robust validation support and long-term maintenance contracts. Prioritize suppliers with documented experience in your specific testing domain and evidence of successful audits by regulatory bodies. Responsiveness (sub-2 hour support response) correlates strongly with customer retention in mission-critical environments. For custom deployments, verify API documentation, change control procedures, and disaster recovery plans prior to contract signing.

FAQs

How to verify lab information management software supplier reliability?

Cross-check certifications (ISO 27001, SOC 2, FDA compliance) with accredited auditors. Request references from clients in similar regulatory environments and conduct on-site or virtual audits of development and support operations. Analyze service level agreements (SLAs) for incident response, patch release frequency, and data backup protocols.

What is the average implementation timeline?

Standard cloud-based LIMS deployments take 6–10 weeks, including configuration, user training, and UAT. On-premise or highly customized systems may require 14–20 weeks depending on integration complexity and validation requirements.

Can suppliers deploy LIMS globally?

Yes, most established vendors support multi-site, multi-region deployments with localized language packs, regional compliance settings, and distributed hosting options. Confirm data residency policies and encryption standards to meet local privacy laws such as GDPR or CCPA.

Do vendors provide free trial or demonstration versions?

Most suppliers offer time-limited sandbox environments (typically 14–30 days) with preloaded test data and standard workflows. Proof-of-concept access is commonly provided at no cost, though extended use or custom configurations may incur fees.

How to initiate customization requests?

Submit detailed functional specifications including sample types, workflow stages, reporting formats, and instrument interfaces. Reputable vendors respond with process diagrams within 5 business days and deliver configured prototypes within 3–5 weeks for evaluation.