Lcd Display Module Manufacturer

Top sponsor listing

Top sponsor listing

1/37

1/37

1/33

1/33

1/40

1/40

About lcd display module manufacturer

Where to Find LCD Display Module Manufacturers?

China remains the global epicenter for LCD display module manufacturing, with Shenzhen and Guangdong province serving as primary hubs due to their advanced electronics ecosystems. These regions host vertically integrated supply chains encompassing glass substrates, driver ICs, backlight units, and touch panel integration, enabling rapid prototyping and scalable production. Shenzhen alone accounts for over 40% of China’s flat-panel display output, supported by a dense network of component suppliers and contract manufacturers operating within compact industrial zones.

The concentration of technical expertise and infrastructure allows manufacturers to support both high-volume OEM orders and low-MOQ custom designs. Facilities in this region typically maintain in-house capabilities for PCB design, firmware development, and optical bonding, reducing external dependencies. Buyers benefit from lead times averaging 15–25 days for standard modules and 30–45 days for fully customized solutions, with localized logistics minimizing shipping delays. Cost efficiency is further enhanced by economies of scale, with per-unit pricing often 20–35% lower than equivalent Western or Southeast Asian suppliers.

How to Choose LCD Display Module Suppliers?

Selecting reliable partners requires systematic evaluation across technical, operational, and transactional dimensions:

Technical & Production Capabilities

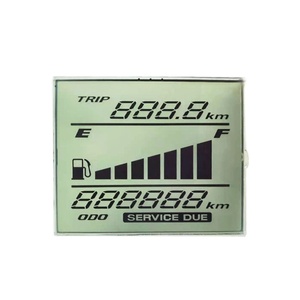

Verify that suppliers possess in-house engineering teams capable of handling customizations such as resolution adjustments, interface protocols (SPI, MCU, RGB, MIPI), and environmental adaptations (wide temperature range, sunlight readability). Prioritize manufacturers with dedicated TFT-LCD and OLED module lines, as well as experience in segment displays and round-form LCDs. Confirmed R&D capacity—ideally exceeding 10% of total staff—is critical for supporting non-standard designs.

Quality Assurance Systems

Ensure compliance with internationally recognized standards including ISO 9001 for quality management, ISO 14001 for environmental control, and adherence to RoHS/REACH directives for hazardous substance restrictions. Request test reports for key parameters: contrast ratio, luminance, viewing angle stability, and ESD protection levels. For medical, automotive, or industrial applications, confirm AEC-Q100 or IEC 60601 compliance where applicable.

Order Flexibility and Transaction Metrics

Assess minimum order quantities (MOQs), which can range from 1 piece for sample validation to 2,000+ units for bulk pricing. Evaluate responsiveness using verified metrics: sub-1-hour response time indicates strong customer service infrastructure. On-time delivery rates above 95% are recommended; reorder rates below 15% may signal niche specialization rather than dissatisfaction. Confirm packaging standards and export experience, particularly for sensitive electro-optical components requiring anti-static and shock-resistant materials.

What Are the Top LCD Display Module Manufacturers?

| Company Name | Main Products | On-Time Delivery | Reorder Rate | Avg. Response | Online Revenue | Customization Options | Verification Status |

|---|---|---|---|---|---|---|---|

| Shenzhen Kalaide Photoelectric Technology Co., Ltd. | LCD Modules, Mini Monitors | 100% | 27% | ≤5h | US $5,800,000+ | Color, material, size, logo, packaging, graphics | Custom Manufacturer |

| Guangdong SCCdisplay Technology Co.,Ltd. | LCD Modules, OLED/E-Paper Modules | 100% | 34% | ≤1h | US $60,000+ | Customized segments, anti-glare finishes | - |

| Shenzhen Dongxingqiang Technology Co., Ltd. | TFT LCDs, AMOLED Displays | 92% | <15% | ≤3h | US $60,000+ | High-resolution panels, MIPI interfaces | Custom Manufacturer |

| Shenzhen Gang Shun Microelectronics Co., Ltd. | OLED/E-Paper Modules, Touch Screens | 96% | <15% | ≤1h | US $9,000+ | Rounded displays, small-format modules | - |

| Shenzhen Cotiwei Electronics Co., Ltd. | LCD Modules, LCD Monitors | 100% | <15% | ≤1h | - | Standard and semi-custom configurations | - |

Performance Analysis

Shenzhen Kalaide stands out with the highest reported revenue and comprehensive customization options, making it suitable for large-scale deployments requiring branding and dimensional flexibility. Guangdong SCCdisplay excels in responsiveness and repeat order volume, indicating strong client satisfaction in niche display segments. While Shenzhen Dongxingqiang reports a slightly lower on-time delivery rate (92%), its focus on high-end AMOLED and MIPI-integrated modules positions it for advanced consumer electronics and industrial UI projects. Smaller-volume specialists like Gang Shun Microelectronics offer fast turnaround and ultra-low MOQs (down to 1 piece), ideal for prototyping and IoT device integration.

FAQs

What certifications should an LCD display module manufacturer have?

At minimum, verify ISO 9001 for quality systems. For exports to Europe or North America, ensure RoHS and CE compliance. Automotive or medical applications require additional validation such as AEC-Q100 or IEC 60601. Request copies of test reports for electrical safety, EMI/EMC, and environmental durability.

What is the typical MOQ and pricing structure?

MOQs vary widely: some suppliers offer single-piece sampling at premium rates (e.g., $6.90–$90/unit), while bulk orders start at 200–2,000 pieces with prices as low as $2.12/unit. Volume discounts are common beyond 5,000 units. Custom tooling may incur NRE fees ranging from $500–$5,000 depending on complexity.

How long does customization take?

Simple modifications (firmware, polarizer type) take 10–15 days. Full mechanical redesigns involving new glass layouts, connectors, or backlight assemblies require 30–50 days, including prototype validation. Suppliers with in-house mold and PCB fabrication reduce cycle times significantly.

Can suppliers integrate touch functionality?

Yes, many manufacturers offer resistive or capacitive touch overlays with I²C or USB interfaces. Confirm compatibility with host controllers and request optical clarity and durability specs (e.g., scratch resistance ≥3H, touch lifespan ≥1 million presses).

What logistics and payment terms are standard?

FCA (Shenzhen) or FOB terms are most common. Air freight delivers samples in 5–7 days; sea freight takes 20–30 days for full containers. Escrow-based transactions and Trade Assurance equivalents provide financial protection. Pre-shipment inspections via third parties (e.g., SGS) are advised for orders exceeding $10,000.