Lcd Modules Distributor

Top sponsor listing

Top sponsor listing

1/3

1/3

0

0

1/16

1/16

1/3

1/3

1/20

1/20

0

0

1/30

1/30

1/3

1/3

CN

CN

1/37

1/37

1/2

1/2

1/1

1/1

1/4

1/4

1/3

1/3

1/8

1/8

1/23

1/23

1/36

1/36

About lcd modules distributor

Where to Find LCD Modules Distributor Suppliers?

China remains the central hub for LCD modules manufacturing and distribution, with Shenzhen emerging as a key industrial cluster due to its dense ecosystem of electronics component suppliers, OEMs, and logistics networks. The city hosts numerous specialized firms offering both standard and custom LCD modules, supported by integrated supply chains that streamline procurement of glass substrates, driver ICs, backlight units, and touch sensors. This concentration enables rapid prototyping, scalable production, and efficient global shipping—critical advantages for buyers in consumer electronics, industrial equipment, automotive systems, and medical devices.

Suppliers in this region benefit from proximity to Tier-1 component manufacturers and contract assemblers, reducing lead times and enabling just-in-time inventory models. Most distributors operate within vertically aligned facilities capable of handling full-stack services—from PCB integration to final module assembly—allowing for tighter quality control and faster turnaround. Buyers can typically expect delivery windows of 15–30 days for stocked items, with customization projects ranging from 25–45 days depending on complexity.

How to Choose an LCD Modules Distributor?

Selecting a reliable distributor requires rigorous evaluation across technical, operational, and transactional dimensions:

Technical & Product Range Verification

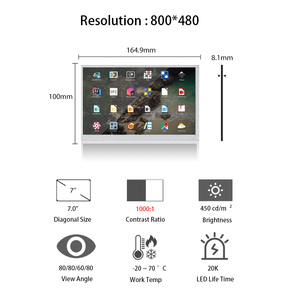

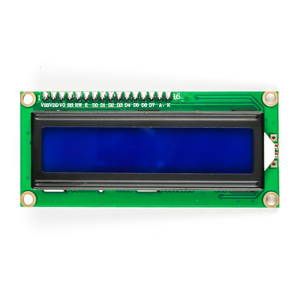

Confirm the supplier’s portfolio includes relevant display technologies such as TFT, STN, FSTN, or VA-based monochrome modules, along with support for resistive or capacitive touch integration. Key product categories should include character displays (e.g., 16x2), graphic dot matrix, segment LCDs, and full-color TFT modules. Verify compatibility with interface standards like SPI, I²C, or RGB parallel, especially for embedded applications.

Customization Capability Assessment

Evaluate whether the supplier offers design flexibility in:

- Size and resolution (from sub-1 inch micro-displays to over 27-inch industrial panels)

- Polarizer type (transmissive, transflective, reflective)

- Backlight options (LED, WLED, RGB)

- Custom graphics, logos, labeling, and packaging configurations

- Material selection for extreme environments (wide temperature range, UV resistance)

Suppliers with in-house engineering teams can provide tailored solutions for niche applications such as EV charging stations, medical instrumentation, or ruggedized industrial HMIs.

Performance Metrics and Reliability Screening

Prioritize partners demonstrating consistent performance through measurable KPIs:

- On-time delivery rate ≥95%

- Average response time ≤4 hours

- Reorder rate below 15% indicating low customer churn

- Verified transaction volume (e.g., >US$100,000 annual online revenue) as proxy for market presence

Cross-reference these metrics with order history and customer feedback where available.

Quality Assurance and Compliance

While formal certifications (ISO 9001, RoHS, REACH) are not explicitly listed in available data, assess compliance readiness by reviewing product documentation for environmental conformity and requesting test reports for optical performance, durability, and electrical stability. For regulated industries, ensure traceability of materials and adherence to IPC-6012 or similar standards for PCBA integration.

What Are the Top LCD Modules Distributors?

| Company Name | Main Products | Customization Options | On-Time Delivery | Reorder Rate | Response Time | Online Revenue | Verification Status |

|---|---|---|---|---|---|---|---|

| Shenzhen Startek Electronic Technology Co., Ltd. | LCD Modules, Touch Screen, OLED/E-Paper Modules, LCD Monitors | Color, material, size, logo, packaging, label, graphic | 94% | <15% | ≤4h | US $850,000+ | Custom Manufacturer |

| Shenzhen Yuewei Photoelectric Technology Co., Ltd. | LCD Modules, Touch Screen, Portable Monitors, Industrial Computer Accessories | Not specified | 91% | 15% | ≤3h | US $4,000+ | - |

| Shenzhen Huaxianjing Industrial Co., Ltd. | Monochrome Segment LCDs, Micro LCD Modules, Custom VA Displays | Color, material, size, logo, packaging, label, graphic | 89% | <15% | ≤7h | US $140,000+ | Multispecialty Supplier |

| Shenzhen Jozi Technology Co., Limited | LCD Modules, LCD Boards & Accessories, Motherboards, Touch Screen Monitors | Not specified | 100% | 16% | ≤3h | US $8,000+ | - |

| Shenzhen Ibr Electronics Co., Ltd. | TFT LCD Modules, Display Panels (21.5", 27", 32") | Color, material, size, logo, packaging, label, graphic | 100% | <15% | ≤2h | US $50,000+ | - |

Performance Analysis

Shenzhen Startek stands out with the highest reported online revenue (US $850,000+) and broad product range covering OLED, e-paper, and gaming monitors, making it suitable for high-volume or diversified sourcing needs. Despite a slightly lower on-time delivery rate (94%), its strong customization capabilities and manufacturer status suggest robust engineering support.

Shenzhen Jozi and Shenzhen Ibr Electronics achieve perfect 100% on-time delivery, indicating strong logistical execution. Ibr Electronics also leads in responsiveness (≤2h), critical for time-sensitive procurement cycles. Jozi's inclusion of motherboard and accessory components suggests potential for bundled system-level supply.

Shenzhen Huaxianjing specializes in cost-effective monochrome and micro-LCD solutions, with prices starting under $1/unit, ideal for high-MOQ applications in meters, appliances, or IoT devices. However, slower response times (≤7h) may affect communication efficiency.

Yuewei Photoelectric focuses on larger-format displays but reports minimal online transaction volume, suggesting limited scale. Its 15% reorder rate aligns with industry averages, though lack of visible customization details may constrain design flexibility.

FAQs

What is the typical MOQ for LCD modules from Chinese distributors?

Most suppliers list a minimum order quantity of 1 piece for sample testing or small batches. However, unit pricing becomes competitive at volumes exceeding 500–1,000 units, particularly for custom designs requiring tooling or mask changes.

How long does it take to receive samples?

Standard module samples are typically shipped within 3–7 business days. Custom designs involving new glass layouts, polarizers, or backlight integration require 15–25 days for development and validation before dispatch.

Do LCD module distributors support dropshipping or direct OEM labeling?

Yes, many suppliers offer private labeling, custom packaging, and direct shipment services. These options are commonly used by system integrators and brand owners seeking white-glove fulfillment without holding inventory.

Are there any hidden costs in importing LCD modules?

Buyers should account for import duties, customs clearance fees, and shipping insurance. Additionally, voltage compatibility, signal interface matching, and regional safety certifications (e.g., FCC, CE) must be validated pre-shipment to avoid compliance delays.

How can I verify a distributor’s authenticity and production claims?

Request factory audit reports, video walkthroughs of assembly lines, and batch test certificates. Use third-party inspection services to validate product specifications upon receipt. Platforms providing transaction-backed performance data (e.g., verified revenue, delivery records) add transparency to supplier credibility.