Making Computer Chips

About making computer chips

Where to Find Suppliers for Making Computer Chips?

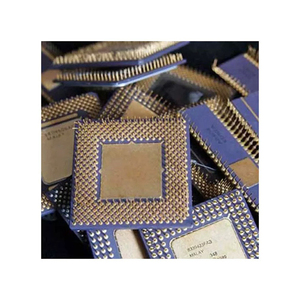

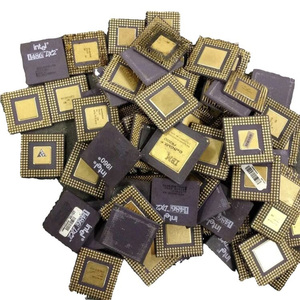

The global supply chain for materials and components used in computer chip manufacturing is highly specialized, with key suppliers concentrated in regions offering strong industrial recycling and semiconductor processing infrastructure. While primary semiconductor fabrication remains dominated by high-tech hubs in East Asia and North America, secondary materials—particularly recycled ceramic CPU scrap and silicon-rich processor waste—are increasingly sourced from industrial recyclers in China, Germany, and Latin America. These suppliers provide critical raw inputs for gold recovery, substrate reuse, and metallurgical refining essential to sustainable chip production.

Suppliers specializing in ceramic CPU scrap offer consistent material composition, with processors typically derived from decommissioned servers, data center hardware, and obsolete computing equipment. The scrap contains measurable concentrations of precious metals—including gold, palladium, and copper—embedded in alumina-based ceramic substrates, making it valuable for downstream refining. Bulk availability, standardized grading, and compliance with environmental handling protocols are central to procurement efficiency in this niche market.

How to Choose Suppliers for Making Computer Chips?

Selecting reliable suppliers requires a structured evaluation of material quality, transaction reliability, and operational responsiveness:

Material Specifications and Grading

Verify the type and purity of available scrap: ceramic-based CPU processors are preferred over plastic-encapsulated variants due to higher metal yield and thermal stability. Request material composition reports detailing average gold content (typically 0.2–0.5 grams per kg) and absence of hazardous contaminants. Premium-grade scrap should be free from excessive PCB residue or mixed electronic waste.

Production and Processing Capabilities

Assess supplier capacity based on order volume requirements:

- Minimum Order Quantity (MOQ) ranges from 50 kg to 10 tons, with bulk suppliers offering lower per-kilogram pricing below $4/kg

- Dedicated processors handling 5,000+ kg monthly indicate scalability for industrial buyers

- In-house sorting and pre-processing improve consistency and reduce contamination risk

Cross-reference listed MOQs with actual shipping records to confirm fulfillment capability.

Transaction Reliability and Compliance

Prioritize suppliers with verified response times under 5 hours and documented on-time delivery performance. Although formal certifications like ISO 9001 or RoHS compliance are not commonly declared in this segment, insist on traceable sourcing and adherence to IEC 62321 standards for substance restrictions in electronics recycling. Use secure payment mechanisms such as escrow services to mitigate risk in initial transactions.

What Are the Leading Suppliers for Making Computer Chips?

| Company Name | Main Products | Price Range (USD/kg) | Min. Order | Response Time | Reorder Rate | Online Revenue | Product Examples |

|---|---|---|---|---|---|---|---|

| GOLDINGHAM CONTRACTS LIMITED | Plants Oil, Tractors, Animal Feed | $4–18 | 1000 kg | ≤2h | Not specified | Not specified | Ceramic CPU scrap, gold recovery processors |

| JAK Installationen GmbH | Copper Scrap, Aluminum Scrap, Pork | $2.33–5.55 | 50 kg | ≤2h | Not specified | Not specified | Premium ceramic CPU scrap, RAM modules |

| Audax GmbH | Aluminum Scrap, Laundry Softener | $0.75–90 | 100 boxes / 1 pc | ≤10h | Not specified | Not specified | Wholesale IC scraps, single-unit RAM sales |

| ABA FRIO LTDA | Recycled Plastic, Spices, Animal Feed | $4–12 | 100–7000 kg | ≤5h | Not specified | Not specified | High-grade ceramic CPU scrap, bulk chips |

| STOW AGRICULTURAL LIMITED | Aluminum Ingots, Sugar, Wood Boards | $2–200 | 1000 kg / 10 tons | ≤4h | Not specified | Not specified | CPU ceramic scrap, motherboards, 486/386 processors |

Performance Analysis

Suppliers like JAK Installationen GmbH and STOW AGRICULTURAL LIMITED offer competitive pricing starting below $2.50/kg with low MOQs, suitable for small-scale refining operations. In contrast, ABA FRIO LTDA caters to large-volume buyers with orders exceeding 5,000 kg, providing economies of scale at $6–$12/kg. GOLDINGHAM CONTRACTS LIMITED and JAK Installationen stand out for rapid response times (≤2h), indicating strong customer service infrastructure. Audax GmbH presents an outlier pricing model with $90/unit listings, likely targeting prototype or R&D buyers needing individual tested processors. Buyers seeking consistent industrial throughput should prioritize suppliers with MOQs aligned to containerized shipping loads (e.g., 10-ton increments) to optimize logistics costs.

FAQs

What is the typical lead time for computer chip scrap shipments?

Standard lead times range from 15–25 days after payment confirmation, including sorting, packaging, and export documentation. Air freight reduces delivery to 5–7 days for samples under 100 kg. Sea freight is recommended for orders above 1 ton due to cost efficiency and regulatory ease for classified electronic scrap.

Can suppliers provide material test reports?

Reputable suppliers can furnish basic material breakdowns upon request, including average precious metal content and substrate type. For precise metallurgical analysis, independent lab testing post-receipt is advised, particularly when integrating scrap into high-purity refining processes.

Are there restrictions on exporting computer chip scrap?

Yes, international shipments must comply with Basel Convention guidelines for transboundary movement of electronic waste. Buyers are responsible for confirming import eligibility in their jurisdiction. Proper HS code classification (e.g., 8548.90 for spent electronic components) ensures smooth customs clearance.

Do suppliers support customization or specific processor types?

Some suppliers offer targeted batches, such as 486/386-era CPUs or server-grade processors with higher gold content. Custom sorting may incur additional fees and extended lead times. Confirm availability through direct inquiry and request photographic verification of batch contents.

How is pricing influenced by market demand?

Prices correlate with fluctuating precious metal markets—particularly gold and palladium futures. Long-term contracts with price adjustment clauses help hedge against volatility. Spot purchases may vary up to 20% quarterly based on commodity indexes and global e-waste recovery trends.