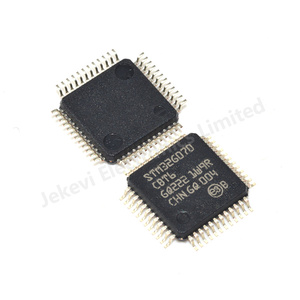

Make Computer Chips

About make computer chips

Where to Source Computer Chip Suppliers?

The global supply of computer chips is increasingly diversified across specialized industrial and recycling hubs, with key suppliers concentrated in India, Germany, Malaysia, and East Africa. These regions support distinct segments of the semiconductor value chain—from reclaimed processor scrap to functional supercomputing units—enabling buyers to access both raw material inputs and near-ready components. India and Malaysia host advanced electronics processing facilities specializing in high-grade ceramic CPU scrap recovery, while German exporters focus on bulk recyclable streams integrated into larger e-waste logistics operations.

Suppliers leverage localized expertise in precious metal extraction and component testing, offering cost-efficient entry points for gold-bearing chip materials. Operations are often vertically aligned with downstream refining capabilities, reducing intermediary dependencies. Buyers benefit from competitive pricing structures, particularly for kilogram- or ton-scale orders, and rapid response times averaging under 5 hours. The presence of dedicated IC and power management component ecosystems in Southeast Asia further supports technical scalability for industrial buyers.

How to Evaluate Computer Chip Suppliers?

Effective supplier assessment requires adherence to structured verification protocols focused on material quality, transaction reliability, and operational capacity.

Material Composition & Processing Standards

Verify detailed specifications for gold content, substrate type (ceramic vs. organic), and plating yield. High-grade ceramic CPU scrap typically contains 0.2–0.5 grams of gold per unit, influencing price bands between $4–$20/kg. For functional computing chips, confirm compatibility with target applications (e.g., ASICs for mining rigs). Request spectral analysis reports or XRF test data where available to validate metal concentrations.

Production and Supply Capacity

Assess scale through minimum order quantities (MOQs) and inventory availability:

- Scrap processors: MOQs range from 25–500 kg, with bulk suppliers requiring 10+ tons

- Functional chip vendors: Offer single-unit sales (as low as 1 piece) for performance CPUs

- Response time: Prioritize suppliers with ≤5-hour average reply windows to ensure communication efficiency

Cross-reference product listings with historical reorder rates and on-time delivery metrics where disclosed.

Transaction Security and Verification

Utilize secure payment frameworks such as third-party escrow for initial transactions. Confirm supplier legitimacy through business registration records and export documentation. Conduct sample testing to benchmark gold recovery yields or chip functionality before scaling procurement. For large-volume contracts, require documented quality control procedures and batch traceability systems.

What Are the Leading Computer Chip Suppliers?

| Company Name | Main Products | Price Range | Min. Order | Response Time | Product Type | Specialization |

|---|---|---|---|---|---|---|

| JAMNAGAR UGANDA LIMITED | CPUs, Copper Scrap, Spices | $4–12/kg | 25–30 kg | ≤8h | Gold-Ceramic CPU Scrap | High-yield gold pin recovery |

| SHANTO WEALY MEDICAL INSTRUMENT COMPANY LIMITED | Ceramic CPU Scrap, Sugar, Rice | $5–7/kg | 500 kg | ≤2h | Ceramic Processor Scrap | Bulk industrial supply |

| PUNK HASH SOLUTIONS SDN. BHD. | ICs, Heat Sinks, Power Supplies | $1–11.90/unit | 1 piece | ≤5h | Supercomputing CPU Chips | Functional ASICs for computing |

| Vision Trade GmbH | Recycled Plastic, Engine Parts | $5–20/kg | 100–500 kg | ≤9h | Refurbished & Recyclable CPUs | European-based e-scrap distribution |

| Lehnen Maschinen GmbH | Used Machinery, Animal Feed | $7–660/kg | 10 kg – 10 tons | ≤3h | High-Gold Content Processors | Large-scale e-waste sourcing |

Performance Analysis

SHANTO WEALY and Lehnen Maschinen stand out for high-volume buyers, offering standardized pricing at 500kg and 10-ton thresholds with rapid response times (≤3h). PUNK HASH SOLUTIONS provides a unique advantage for technology integrators, selling fully functional supercomputing chips by the unit, enabling prototyping and small-batch assembly. JAMNAGAR UGANDA LIMITED offers entry-level access with low MOQs (25kg), suitable for preliminary gold recovery trials. Vision Trade GmbH bridges European compliance standards with global sourcing, though response latency (≤9h) may affect time-sensitive negotiations. Suppliers with diversified product portfolios (e.g., machinery, spices) may prioritize non-electronic lines, necessitating clear contractual terms for fulfillment prioritization.

FAQs

How to verify computer chip material quality?

Request sample batches for independent assay testing. Use X-ray fluorescence (XRF) analyzers to verify gold concentration in pins and connectors. For functional chips, conduct burn-in tests under load to assess computational stability and thermal performance.

What are typical lead times for computer chip shipments?

Standard orders are dispatched within 7–15 days after payment confirmation. Air freight delivers samples in 5–10 days; sea freight for bulk orders (1+ tons) takes 25–40 days depending on destination port congestion and customs processing.

Can suppliers customize packaging or sorting?

Yes, many suppliers offer pre-sorted categories (e.g., Intel Pentium-only lots, trimmed RAM fingers) and vacuum-sealed packaging for moisture-sensitive components. Custom sorting incurs additional fees, typically 5–10% of total order value.

Do suppliers provide certificates of origin or RoHS compliance?

Compliance documentation varies. Industrial recyclers rarely provide RoHS certifications unless explicitly requested. Buyers importing into EU markets should require waste shipment codes (Basel Convention Y48) and material declarations to meet environmental regulations.

What payment methods are accepted for large orders?

Common options include T/T (bank transfer), L/C at sight for containerized shipments, and platform-mediated escrow for first-time transactions. Letters of Credit are recommended for orders exceeding $50,000 to mitigate non-delivery risk.