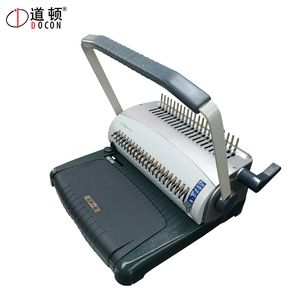

Manual Binding Machine Manufacturer

1/34

1/34

1/23

1/23

1/29

1/29

1/9

1/9

1/10

1/10

About manual binding machine manufacturer

Where to Find Manual Binding Machine Manufacturers?

China remains the global epicenter for manual binding machine production, with concentrated manufacturing hubs in Guangdong, Zhejiang, and Fujian provinces. These regions host vertically integrated supply chains that combine precision metalworking, plastic extrusion, and assembly under one ecosystem, enabling cost efficiencies of 20–35% compared to Western or Southeast Asian producers. Shenzhen and Dongguan in Guangdong province specialize in compact desktop models used in small offices and print shops, while Hangzhou and Ningbo in Zhejiang focus on commercial-grade units for high-volume binding operations.

The industrial clusters benefit from proximity to raw material suppliers—steel for frames, thermoplastics for coil mechanisms, and adhesives for hot-melt systems—reducing logistics overhead and lead times. Most manufacturers operate facilities within 5,000–15,000m², supporting monthly outputs ranging from 1,000 to over 10,000 units depending on model complexity. Buyers gain access to agile production networks capable of fulfilling both bulk orders (MOQs as low as 1 piece for select suppliers) and customized configurations, including color, labeling, and packaging modifications.

How to Choose Manual Binding Machine Suppliers?

Procurement decisions should be guided by three core evaluation criteria:

Production and Technical Capability

Assess whether suppliers maintain in-house engineering teams and CNC machining capabilities for tooling and mold development. Look for evidence of diversified product lines—including comb, spiral, wire, and perfect binding systems—as an indicator of technical versatility. Prioritize manufacturers with dedicated R&D functions and documented process controls, especially those offering customization options such as logo imprinting, material selection, and ergonomic adjustments.

Quality Assurance and Compliance

While explicit ISO or CE certifications are not always declared in available data, performance indicators such as on-time delivery rates (target ≥99%) and response times (≤4 hours) serve as proxies for operational discipline. Suppliers with verified online revenues exceeding US $80,000 demonstrate sustained market presence and quality consistency. Cross-reference transaction metrics: reorder rates below 15% suggest limited customer churn, indicating satisfaction with product reliability and after-sales service.

Order Flexibility and Risk Mitigation

Evaluate minimum order quantities (MOQs), which range from 1 piece for entry-level models to 200 pieces for budget-oriented units. Favor suppliers offering flexible MOQs without significant per-unit price penalties. Utilize secure payment mechanisms and request product samples before full-scale ordering. Confirm packaging standards and export readiness, particularly for international shipments requiring compliance with destination-market electrical or safety regulations—even for manually operated equipment.

What Are the Leading Manual Binding Machine Manufacturers?

| Company Name | Location | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Min. Order Flexibility |

|---|---|---|---|---|---|---|---|

| Dongyang Zequan Office Supplies Co., Ltd. | Zhejiang, CN | Manual glue binders, heavy-duty staplers, power binding machines | US $170,000+ | 99% | ≤2h | <15% | 1 piece |

| Shenzhen Star Print Electronic Equipment Co., Ltd. | Guangdong, CN | Hot-melt wireless binders, clip binding machines, desktop laminators | US $80,000+ | 100% | ≤1h | 17% | 1 set |

| Huizhou Xintai Machinery Equipment Co., Ltd. | Guangdong, CN | Spiral coil binders, book binding machines, hole punches | US $7,000+ | 100% | ≤4h | <15% | 1 piece |

| Dongguan Nanbo Mechanical Equipment Co., Ltd. | Guangdong, CN | Plastic coil binders, comb ring machines, automatic double-coil systems | US $10,000+ | 100% | ≤3h | <15% | 2 sets |

| Hangzhou Supu Business Machine Co., Ltd. | Zhejiang, CN | Double-wire binders, commercial magazine binders, paper processing machinery | US $1,000+ | 66% | ≤7h | <15% | 1 set |

Performance Analysis

Dongyang Zequan leads in scalability and customization depth, supported by its status as a verified custom manufacturer and strong revenue volume. Shenzhen Star Print excels in responsiveness (≤1h average reply time) and maintains a balanced reorder rate of 17%, suggesting reliable product performance despite higher pricing tiers. Huizhou Xintai and Dongguan Nanbo offer competitive entry-level pricing with full flexibility for single-unit trials, ideal for buyers testing market fit. Hangzhou Supu, while technically capable, shows lower on-time delivery performance (66%), indicating potential fulfillment risks for time-sensitive contracts. Prioritize suppliers with 100% on-time delivery records and sub-4-hour response times for mission-critical procurement.

FAQs

What materials are commonly used in manual binding machines?

Frames are typically constructed from cold-rolled steel or reinforced ABS plastic. Binding mechanisms use galvanized steel pins, aluminum combs, or thermoplastic coils. Hot-melt models incorporate PUR or EVA adhesive systems housed in aluminum heating chambers.

What is the typical lead time for sample and bulk orders?

Sample units ship within 3–7 days after confirmation. Bulk production lead times range from 15 to 30 days, depending on order size and customization level. Air freight delivers samples globally within 5–10 days; sea freight takes 25–40 days for containerized shipments.

Can manufacturers customize binding machines for private labeling?

Yes, several suppliers—particularly Dongyang Zequan—offer OEM services including custom colors, logos, packaging, and user interface labeling. Minimum requirements vary but typically start at 50–100 units for branded variants.

Are spare parts and technical support available post-purchase?

Most suppliers provide basic spare components (pins, dies, pressure pads) and instructional documentation. Long-term technical support availability depends on buyer-supplier engagement history; proactive communication channels should be established prior to order finalization.

How do I verify a supplier’s production claims?

Request factory audit reports, video walkthroughs of assembly lines, and batch testing records. Validate transaction history through verifiable revenue indicators and on-time delivery statistics. Conduct third-party inspections upon shipment if procuring at scale.