Manufacturing And Automation Engineering

Top sponsor listing

Top sponsor listing

CN

CN

CN

CN

About manufacturing and automation engineering

Where to Find Manufacturing and Automation Engineering Suppliers?

China remains the global epicenter for manufacturing and automation engineering services, with key industrial hubs in Guangdong, Jiangsu, and Fujian provinces driving innovation and scale. Guangdong province hosts a dense network of precision machinery and custom fabrication specialists, supported by Shenzhen’s advanced electronics supply chain and Dongguan’s mature tooling infrastructure. Fujian's Xiamen region has emerged as a center for automation equipment integration, particularly in hardware processing and robotic assembly systems.

These clusters benefit from vertically integrated ecosystems where CNC machining, sheet metal fabrication, casting, and injection molding coexist within localized supply chains. This proximity reduces component lead times by 20–35% and enables rapid prototyping cycles. Buyers gain access to suppliers capable of handling low-volume prototypes and high-volume production runs, often within the same facility. Average monthly output across mid-tier providers ranges from 50,000 to 200,000 units depending on complexity, with standard lead times averaging 15–30 days for machined components and 25–40 days for fully assembled automation systems.

How to Choose Manufacturing and Automation Engineering Suppliers?

Selecting reliable partners requires systematic evaluation across technical, operational, and transactional dimensions:

Quality Management Systems

Prioritize suppliers with ISO 9001 certification as a baseline for process control. For export-bound projects, verify compliance with regional standards such as CE (EU), UL (North America), or RoHS for material safety. Request documented inspection protocols, including first-article inspection reports (FAIR) and statistical process control (SPC) data for critical tolerances.

Production Capacity Verification

Assess core capabilities through measurable indicators:

- Facility size exceeding 2,000m² indicates scalability for medium-to-high volume orders

- In-house capabilities in CNC machining, sheet metal forming, die casting, and surface treatment ensure reduced outsourcing dependencies

- Dedicated R&D or engineering teams support complex customization and design-for-manufacturability (DFM) feedback

Cross-reference on-time delivery performance (target ≥95%) with response time metrics (≤2 hours preferred) to gauge operational responsiveness.

Customization and Transaction Security

Confirm available customization options including material selection (e.g., aluminum, stainless steel, POM, ABS), color, labeling, packaging, and logo imprinting. Use secure payment mechanisms such as escrow or milestone-based disbursements for initial engagements. Analyze reorder rates—suppliers with rates above 30% typically demonstrate consistent quality and service reliability.

What Are the Best Manufacturing and Automation Engineering Suppliers?

| Company Name | Location | Main Services | On-Time Delivery | Reorder Rate | Avg. Response | Online Revenue | Verification |

|---|---|---|---|---|---|---|---|

| Dongguan Ronghang Hardware Mould Co., Ltd. | Guangdong, CN | Machining, CNC, OEM Mechanical Engineering | 95% | 32% | ≤2h | US $370,000+ | Custom Manufacturer |

| Changzhou Naite Metal Technology Co., Ltd. | Jiangsu, CN | Machining, Sheet Metal, Casting, Hardware Fabrication | 93% | 25% | ≤1h | US $30,000+ | - |

| Xiamen Xinliansheng Automation Equipment Co., Ltd. | Fujian, CN | Automation Equipment, Machining, Sheet Metal, Hoses | 66% | 100% | ≤1h | US $5,000+ | - |

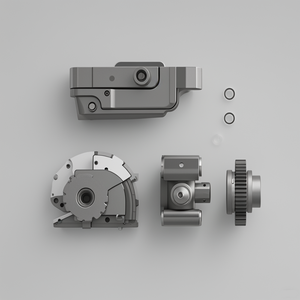

| Shenzhen Liqi Precision Machinery Co., Ltd. | Guangdong, CN | CNC Machining, Automation Machinery Components | 100% | - | ≤6h | - | - |

| Guangdong Engineering Plastics Industries (Group) Co., Ltd. | Guangdong, CN | Precision Plastic Processing, CNC, Laser Cutting | 100% | <15% | ≤5h | US $260,000+ | Custom Manufacturer |

Performance Analysis

Dongguan Ronghang stands out with a 32% reorder rate and strong online revenue, indicating market trust and repeat business in OEM mechanical engineering. Shenzhen Liqi and Guangdong Engineering Plastics achieve perfect 100% on-time delivery, signaling robust production planning despite varying response speeds. Xiamen Xinliansheng reports a 100% reorder rate, suggesting high customer retention likely driven by niche automation solutions, though its 66% on-time delivery raises potential fulfillment risks. Changzhou Naite offers fast ≤1h response times and broad service coverage, suitable for buyers prioritizing communication efficiency. Suppliers with verified "Custom Manufacturer" status demonstrate formalized production frameworks ideal for long-term partnerships.

FAQs

What materials are commonly used in manufacturing and automation components?

Typical materials include aluminum alloys (6061, 7075), stainless steel (SUS304, SUS316), carbon steel, brass, and engineering plastics such as POM (Delrin), ABS, and PC. Material selection depends on mechanical requirements, corrosion resistance, weight constraints, and cost targets.

What is the typical minimum order quantity (MOQ)?

MOQ varies significantly: CNC-machined parts often start at 1–100 pieces, while cast or molded components may require 1,000+ units due to tooling costs. Some suppliers offer zero-MOQ for prototyping at higher per-unit pricing.

How long does customization take?

Design and sampling phases typically require 7–14 days for simple modifications and 3–6 weeks for full custom tooling or automation system development. Production lead time follows based on complexity and volume.

Do suppliers provide design and engineering support?

Yes, many offer DFM analysis, 3D modeling, and prototype validation. Verified manufacturers frequently assign dedicated engineers to assist with drawings, GD&T specifications, and tolerance optimization.

What logistics and export services are available?

Established suppliers manage international shipping via air freight (for samples) and sea freight (for bulk orders). FOB terms are common, but CIF/door-to-door options exist. Ensure Incoterms are clearly defined during negotiation to allocate risk appropriately.