Mechatronics And Manufacturing Automation

CN

CN

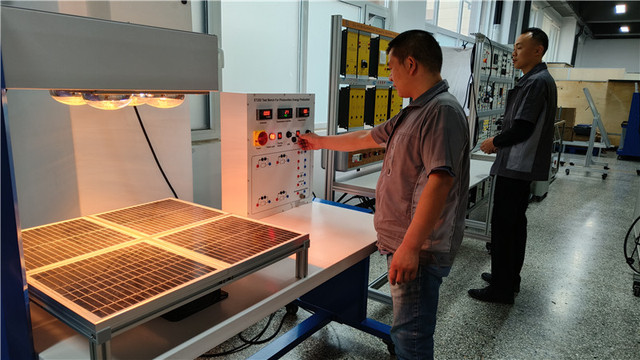

About mechatronics and manufacturing automation

Where to Find Mechatronics and Manufacturing Automation Suppliers?

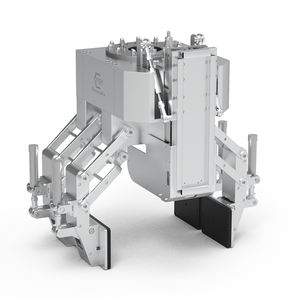

China leads global production of mechatronics and manufacturing automation systems, with key supplier clusters concentrated in Beijing, Shandong, and Guangdong provinces. These regions host specialized manufacturers focused on industrial training equipment, programmable logic controller (PLC) integration, robotic workcells, and flexible manufacturing systems (FMS). Companies based in Beijing and Jinan demonstrate strong R&D capabilities in modular educational platforms, while Qingdao-based firms emphasize industrial-scale automation solutions for welding, assembly, and process control.

The ecosystem benefits from vertically integrated supply chains, enabling rapid prototyping and scalable production. Many suppliers operate within industrial zones where component sourcing, precision machining, electrical integration, and logistics services are co-located, reducing lead times by up to 30%. Buyers gain access to standardized training systems priced between $4,500–$30,000 and custom industrial lines exceeding $200,000, all supported by responsive technical teams and high on-time delivery performance.

How to Choose Mechatronics and Manufacturing Automation Suppliers?

Selecting reliable partners requires systematic evaluation across three core areas:

Technical Capability Verification

Confirm supplier expertise in critical subsystems: PLC programming (Siemens S7, Allen Bradley), pneumatic actuation, sensor integration, and human-machine interface (HMI) design. Prioritize vendors offering modular configurations—such as those supporting FMS or computer-integrated manufacturing (CIM)—as evidence of advanced engineering capacity. For educational buyers, verify curriculum alignment and software compatibility (e.g., ladder logic editors, SCADA interfaces).

Production and Customization Capacity

Assess infrastructure indicators:

- Minimum 10+ product listings indicating market presence

- Demonstrated customization options: language localization, circuit color coding, PID control tuning, labeling, and cabinet configuration

- In-house design teams capable of adapting mechanical structure, component layout, and digital control parameters

Cross-reference response time metrics (target ≤5 hours) and reorder rates to gauge operational efficiency and customer satisfaction.

Transaction Reliability & Support

Favor suppliers with documented quality management practices and verifiable online revenue streams. Analyze after-sales support responsiveness and request documentation for system calibration, safety compliance (CE/ROHS if applicable), and spare parts availability. Pre-shipment testing protocols should include full functional validation of electromechanical sequences and fault diagnostics.

What Are the Best Mechatronics and Manufacturing Automation Suppliers?

| Company Name | Location | Main Products (Listings) | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue | Customization Options |

|---|---|---|---|---|---|---|---|

| Beijing Qyx Technology Co., Ltd. | Beijing, CN | Educational Equipment (99) | 100% | ≤9h | - | - | Limited |

| Adikers Jinan Equipment Co., Ltd. | Jinan, CN | Multiline Supplier | 100% | ≤2h | <15% | US $2,000+ | Extensive |

| Jinan Should Shine Didactic Equipment Co., Ltd. | Jinan, CN | Multiline Supplier | 100% | ≤1h | 25% | US $770,000+ | Yes |

| Yalong Intelligent Equipment Group Co., Ltd. | Guangdong, CN | Educational Equipment (114) | 100% | ≤14h | - | - | Limited |

| Stuaa Automation (Qingdao) Co., Ltd. | Qingdao, CN | Industrial Robots & Welding Lines (299+) | 100% | ≤5h | - | - | System-Level |

Performance Analysis

Adikers Jinan and Jinan Should Shine stand out for rapid communication and proven transaction volume, with the latter achieving a 25% reorder rate—a strong indicator of post-sale satisfaction. Beijing Qyx and Yalong specialize in standardized educational systems, offering consistency for institutional procurement but limited configurability. Stuaa Automation represents an industrial-grade option, delivering high-value robotic integration lines ($300K+) suitable for end-user manufacturing environments. Suppliers in Shandong consistently outperform in responsiveness, with average reply times under 5 hours, making them ideal for iterative technical discussions and urgent RFQ cycles.

FAQs

How to verify mechatronics supplier reliability?

Cross-check declared certifications (ISO, CE, RoHS) through official registries. Request factory audit reports or video walkthroughs to confirm in-house production capabilities. Evaluate technical documentation quality—including wiring diagrams, user manuals, and troubleshooting guides—as a proxy for engineering rigor.

What is the typical lead time for automation systems?

Standard educational units ship within 20–30 days. Customized or large-scale industrial systems (e.g., smart production lines) require 45–60 days for fabrication, integration, and testing. Expedited builds may reduce timelines by 10–15% with premium fees.

Do suppliers offer customization for international clients?

Yes. Leading suppliers provide language localization (English, Spanish, Arabic), voltage adaptation (110V/220V), and HMI interface modifications. Some support integration with third-party PLCs or SCADA platforms upon request.

Can I request a sample or prototype before bulk ordering?

Most suppliers allow single-unit purchases for evaluation. Prototypes with modified parameters (e.g., control logic, sensor layout) can be developed within 3–4 weeks, subject to engineering resource availability.

Are there minimum order quantities (MOQ)?

MOQ is typically 1 set across all listed suppliers, facilitating pilot testing and small-scale deployment. Volume discounts apply at 5+ units, particularly for standardized training platforms.