Microcontroller Digikey

About microcontroller digikey

Where to Find Microcontroller Suppliers?

China remains a dominant force in the global semiconductor component supply chain, with Shenzhen emerging as a primary hub for microcontroller distribution and sourcing. The city's proximity to major IC fabrication centers in Guangdong Province, combined with its mature electronics ecosystem, enables rapid access to both legacy and current-generation microcontrollers. Suppliers in this region specialize in managing inventory for industrial automation, consumer electronics, and embedded systems applications.

The Shenzhen-based supplier network benefits from integration with downstream testing, packaging, and logistics services, allowing for streamlined order fulfillment. Many suppliers operate within vertically aligned procurement channels, offering fast turnaround on low-volume orders (1–100 pieces) while maintaining scalability for bulk production runs. Key advantages include competitive pricing due to localized inventory networks, short lead times (typically 3–7 days for in-stock items), and flexible MOQs starting at one unit. This infrastructure supports cost-efficient prototyping and replacement part sourcing, particularly for design engineers and after-sales service providers.

How to Choose Microcontroller Suppliers?

Effective supplier selection requires structured evaluation across technical, operational, and transactional dimensions:

Technical Authenticity & Product Range

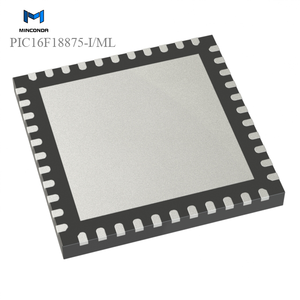

Verify that suppliers list accurate product specifications including manufacturer part numbers, package types, operating temperature ranges, and memory configurations. Cross-reference listings against original manufacturer datasheets to confirm authenticity. Prioritize suppliers who categorize products by core architecture (e.g., 8-bit, 32-bit MCU) and functional category (e.g., embedded controllers, application-specific ICs).

Operational Reliability Metrics

Assess performance using verifiable indicators:

- On-time delivery rate ≥95% indicates consistent logistics execution

- Response time ≤4 hours reflects proactive communication capacity

- Reorder rate >30% suggests customer retention and satisfaction

- Minimum online revenue of US $100,000+ correlates with inventory depth and market presence

Suppliers with diversified IC portfolios (e.g., >500,000 listings across memory, FPGA modules, and power management ICs) are better positioned to support multi-component procurement needs.

Transaction Security & Quality Assurance

Require transparent sourcing policies and prefer vendors with documented quality control procedures. While formal certifications like ISO 9001 are not always listed, consistent on-time delivery and low dispute rates serve as practical proxies for reliability. Utilize secure payment mechanisms and request sample testing—especially for high-pin-count or automotive-grade MCUs—to validate device functionality before full-scale ordering.

What Are the Best Microcontroller Suppliers?

| Company Name | Location | Main Product Categories | IC Listings (Other) | On-Time Delivery | Avg. Response | Online Revenue | Reorder Rate | Min. Order Quantity |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Shengxincheng Electronics Co., Ltd. | Shenzhen, CN | Microcontrollers, Other ICs | 392,181 | 100% | ≤3h | US $100+ | <15% | 1 piece |

| GOODVIEW GLOBAL LIMITED | Hong Kong, CN | Microcontrollers, FPGAs, PMICs | 548,515 | 95% | ≤4h | US $1,300,000+ | 41% | 1–105 pieces |

| Shenzhen Fujiacheng Electronic Co., Ltd. | Shenzhen, CN | Wireless Modules, Oscillators, ICs | 418,182 | 85% | ≤5h | US $30,000+ | 30% | 1 piece |

| Shenzhen Chuangyun Xinyuan Technology Co., Ltd | Shenzhen, CN | RF Connectors, Specialized ICs | 604,507 | 100% | ≤5h | US $80,000+ | 57% | 1–187 pieces |

| Shenzhen Jiayousheng Electronics Co., Ltd. | Shenzhen, CN | Embedded Controllers, ICs | N/A | 88% | ≤3h | US $140,000+ | 33% | 1 piece |

Performance Analysis

Shenzhen Shengxincheng Electronics and Shenzhen Chuangyun Xinyuan stand out for perfect on-time delivery records (100%), making them reliable for time-sensitive procurement. GOODVIEW GLOBAL LIMITED leads in transaction volume (US $1.3M+ online revenue) and customer retention (41% reorder rate), indicating strong market trust and inventory stability. While most suppliers offer single-unit MOQs ideal for sampling and small-batch development, tier-2 suppliers may require higher quantities (74–187 pieces) for certain interface or specialized MCUs. Buyers should note that response times vary significantly—prioritize suppliers with sub-4-hour average replies for urgent technical inquiries. Reorder rates above 30% correlate with dependable post-sale support and consistent product quality.

FAQs

How to verify microcontroller supplier authenticity?

Cross-check part numbers and packaging details against manufacturer datasheets. Request batch traceability information and inspect product images for marking consistency. Prefer suppliers who disclose origin and testing processes, especially for obsolete or hard-to-find MCUs.

What is the typical lead time for microcontroller orders?

In-stock items ship within 3–7 business days. For backordered or globally sourced components, expect 2–6 weeks depending on air freight logistics. Expedited shipping options are commonly available for prototype deliveries.

Can I order single pieces for testing?

Yes, all listed suppliers offer minimum order quantities of 1 piece for select microcontrollers, facilitating low-cost sampling and design validation. Pricing typically ranges from $0.01 to $3.72 per unit depending on complexity and availability.

Do suppliers provide technical documentation?

Availability varies. Leading suppliers often include basic datasheets or reference schematics upon request. For complex architectures (e.g., 32-bit MCUs, FPGA-based modules), confirm access to SDKs, pinout diagrams, and programming guides before procurement.

Are there customization options for firmware or pre-programming?

Most suppliers focus on component distribution rather than value-added programming services. Custom firmware loading or configuration typically requires coordination with third-party engineering partners or OEMs. Confirm whether blank or pre-flashed devices are being supplied.