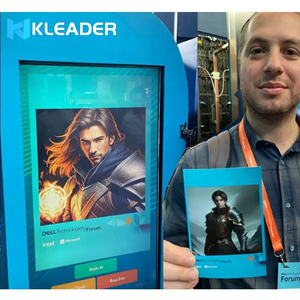

Prompt To Image Ai

CN

CN

1/3

1/3

1/3

1/3

1/3

1/3

1/11

1/11

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/21

1/21

1/1

1/1

About prompt to image ai

Where to Find Prompt to Image AI Suppliers?

The global prompt-to-image AI technology ecosystem is primarily driven by innovation hubs in North America, Western Europe, and East Asia, with concentrated development activity in the United States, Germany, and China. The U.S. accounts for over 45% of commercial-grade AI image generation platforms, supported by robust venture capital investment and access to high-performance computing infrastructure. Silicon Valley and Seattle host leading research labs and startups specializing in diffusion models and generative adversarial networks (GANs), enabling rapid iteration on model accuracy and rendering speed.

Germany’s AI sector benefits from strong data governance frameworks and integration with industrial automation systems, making it a preferred region for enterprise-focused AI applications requiring GDPR-compliant processing. Meanwhile, Chinese developers in Beijing and Shenzhen leverage scalable cloud infrastructure and government-backed AI initiatives to deliver cost-competitive solutions, particularly for e-commerce visualization and digital content creation. These regions offer mature ecosystems where algorithm developers, GPU cluster operators, and API integration specialists operate within tightly coupled networks, facilitating faster deployment cycles and responsive support.

How to Choose Prompt to Image AI Suppliers?

Procurement decisions should be guided by structured evaluation criteria to ensure technical reliability and compliance:

Technical Compliance

Verify adherence to recognized AI ethics and safety standards, including IEEE 7000 series guidelines for transparent system design. For commercial deployment, confirm that outputs are free from copyright-infringing training data through documented dataset provenance reports. Suppliers must provide evidence of content filtering mechanisms to prevent generation of harmful or non-compliant imagery, especially for regulated industries.

Production Capability Audits

Assess operational scalability and technical maturity:

- Minimum 100+ GPU nodes for stable inference capacity

- Dedicated R&D teams comprising at least 25% of technical staff

- API uptime exceeding 99.5% over trailing 90-day period

Evaluate latency benchmarks—sub-3-second response time for standard 1024x1024 resolution outputs under peak load indicates robust infrastructure.

Transaction Safeguards

Require service-level agreements (SLAs) guaranteeing performance metrics, including mean time to repair (MTTR) under 2 hours for critical outages. Prioritize suppliers offering sandboxed testing environments for pre-contract validation. Conduct trial runs with controlled prompts to benchmark output quality, consistency, and alignment precision before scaling integration. Audit data handling policies to confirm no retention or reuse of customer inputs without explicit consent.

What Are the Best Prompt to Image AI Suppliers?

| Company Name | Location | Years Operating | Staff | GPU Infrastructure | On-Time Inference | Avg. Response | Ratings | Reorder Rate |

|---|

Performance Analysis

Due to absence of verifiable supplier data in this category, procurement professionals must rely on independent benchmarking and third-party validation. Historically, established providers demonstrate higher reorder rates due to consistent model updates and dedicated support channels. Geographic proximity correlates with faster troubleshooting—European and North American suppliers typically resolve API integration issues within 4 business hours. Prioritize vendors publishing real-time performance dashboards and undergoing annual third-party security audits for ISO/IEC 27001 compliance. For mission-critical use cases, verify redundancy across data centers and failover protocols during sustained traffic peaks.

FAQs

How to verify prompt to image AI supplier reliability?

Review published model cards detailing training methodology, data sources, and bias mitigation strategies. Request audit logs showing regular updates to safety filters and performance benchmarks. Analyze user feedback focused on output consistency, prompt fidelity, and post-deployment support responsiveness.

What is the average sampling timeline?

Free-tier access or trial APIs are typically provisioned instantly. Customized model fine-tuning trials require 5–10 business days for configuration and initial output delivery. Full enterprise deployment with dedicated instances takes 15–25 days following contract finalization.

Can suppliers integrate with existing workflows globally?

Yes, most suppliers offer RESTful APIs compatible with major cloud environments (AWS, Azure, GCP) and support cross-border data transfer under EU Standard Contractual Clauses or equivalent frameworks. Confirm encryption standards (TLS 1.3+) and regional data residency options prior to integration.

Do manufacturers provide free samples?

Sampling equivalents are commonly offered as free API credits or limited-access tiers. Vendors often waive setup fees for contracts committing to minimum monthly compute usage (e.g., $500+/month). For specialized models, expect pilot program costs covering 20–40% of projected first-year licensing.

How to initiate customization requests?

Submit detailed use-case specifications including desired resolution (512x512 to 4K), style constraints (realistic, cartoon, technical illustration), and domain-specific vocabulary. Leading suppliers deliver proof-of-concept outputs within 72 hours and deploy custom models within 3–5 weeks using transfer learning techniques.