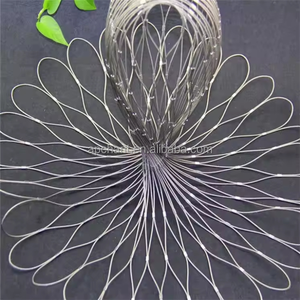

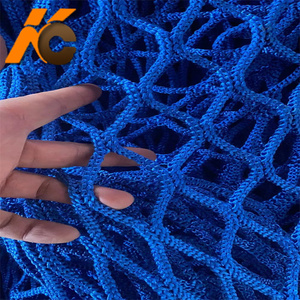

Protective Net Wire Factories

1/3

1/3

1/3

1/3

1/3

1/3

0

0

0

0

1/3

1/3

1/3

1/3

1/15

1/15

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/22

1/22

1/3

1/3

0

0

0

0

1/8

1/8

1/3

1/3

1/2

1/2

About protective net wire factories

Where to Find Protective Net Wire Factories?

China remains the global epicenter for protective net wire manufacturing, with key industrial clusters concentrated in Shandong and Hebei provinces. These regions host vertically integrated production ecosystems specializing in both plastic-reinforced and metal-based safety nets. Shandong’s Binzhou and Hebei’s Anping County are particularly notable—Anping alone accounts for over 70% of China’s wire mesh output, leveraging decades of metallurgical expertise and localized steel supply chains.

Suppliers in these hubs operate under mature industrial frameworks, combining automated weaving, galvanization, and UV-stabilized extrusion lines to produce protective nets for construction, pet safety, agriculture, and sports applications. The proximity of raw material suppliers, logistics networks, and skilled labor reduces lead times by 20–30% compared to offshore alternatives. Buyers benefit from scalable production capacity, with leading factories reporting monthly outputs exceeding 500,000 square meters and minimum order quantities (MOQs) as low as 1–10 square meters for sample validation.

How to Choose Protective Net Wire Suppliers?

Selecting a reliable supplier requires systematic evaluation across technical, operational, and transactional dimensions:

Material & Construction Standards

Verify base materials: HDPE-coated steel wire, galvanized iron, stainless steel (304 grade), or nylon-reinforced composites. For outdoor or structural use, confirm UV stabilization, tensile strength (≥3 kN/m), and corrosion resistance. Industrial-grade fall protection nets must meet ISO 14122-3 or EN 13374 Class A standards. Request test reports on knot strength, mesh uniformity, and load-bearing performance.

Production Capabilities

Assess infrastructure through verifiable metrics:

- Own production lines confirmed via facility videos or audit reports

- Monthly output capacity exceeding 100,000 sqm for bulk orders

- In-house coating, welding, and knitting processes to ensure quality control

- Customization capability for mesh size (typically 50x50mm to 100x100mm), color, roll dimensions, and edge finishing

Cross-reference supplier claims with online revenue indicators and reorder rates where available. Prioritize suppliers with documented on-time delivery performance above 95%.

Transaction Security & Quality Assurance

Utilize secure payment mechanisms such as escrow services for initial transactions. Evaluate response time (≤2 hours is standard) and communication clarity. Conduct pre-shipment inspections or request third-party QC reports. Sampling is strongly advised—most suppliers offer prototypes within 7–14 days, with costs often offset against future bulk orders.

What Are the Leading Protective Net Wire Factories?

| Company Name | Location | Main Materials | Key Products | Monthly Output Capacity | On-Time Delivery | Avg. Response | Online Revenue | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Shandong Binzhou Yan Li Industry And Trade Co., Ltd. | Binzhou, Shandong, CN | HDPE, Nylon, Steel Wire | Pet Safety Nets, Balcony Protection, Anti-Fall Nets | Est. 200,000+ sqm | 100% | ≤2h | US $160,000+ | 17% |

| Anping Yuntong Metal Wire Mesh Co., Ltd. | Anping, Hebei, CN | Galvanized Steel, Iron Wire | Industrial Fall Protection, Plant Safety Nets | Est. 150,000+ sqm | 50% | ≤2h | US $2,000+ | <15% |

| Anping Weicai Wire Mesh Products Co., Ltd. | Anping, Hebei, CN | HDPE, Steel, Plastic Composites | Sports Field Nets, Playground Nets, Cat Protection | Est. 300,000+ sqm | 100% | ≤2h | US $20,000+ | <15% |

| Anping Maoyu Wire Metal Products Co., Ltd. | Anping, Hebei, CN | Galvanized Steel, Stainless Steel | Balcony Nets, Welded Wall Nets | Est. 100,000+ sqm | 100% | ≤2h | US $400+ | - |

| Anping ZhiHang Wire Mesh Products Co., Ltd. | Anping, Hebei, CN | 304 Stainless Steel, Braided Cable | Zoo Enclosures, High-Altitude Safety Nets | Est. 120,000+ sqm | 100% | ≤1h | US $20,000+ | <15% |

Performance Analysis

Shandong Binzhou Yan Li stands out with high online revenue and a 17% reorder rate, indicating strong market acceptance for its pet and balcony safety nets. Anping Weicai leads in volume and product diversity, supported by robust plastic and metal processing lines. While several Anping-based suppliers report 100% on-time delivery, Yuntong’s 50% fulfillment rate signals potential scalability challenges despite competitive pricing. ZhiHang demonstrates superior responsiveness (≤1h), making it suitable for urgent procurement cycles. Stainless steel specialists like ZhiHang and Maoyu cater to high-end architectural and zoo safety applications requiring corrosion resistance and long service life.

FAQs

What materials are commonly used in protective net wire production?

The most prevalent materials include HDPE-coated steel wire for weather resistance, galvanized iron for cost-effective fencing, 304 stainless steel for high-corrosion environments, and nylon-reinforced plastic for lightweight pet barriers. Material selection depends on application—construction sites require high tensile strength, while residential balconies prioritize aesthetics and ease of installation.

What is the typical MOQ and lead time?

MOQs vary by supplier and product type: plastic-based nets may require as little as 1–10 pieces, while bulk wire mesh orders often start at 500–2,000 square meters. Lead times average 15–25 days post-design approval, with expedited production possible for standardized items. Sample lead times range from 7–14 days.

Can protective nets be customized?

Yes, most factories support customization in mesh size, color (black, green, beige), roll length, and fixation hardware. OEM branding and packaging are widely available. Technical drawings or site specifications are required for precise quoting. Factories with in-house R&D teams can adapt designs for non-standard openings or load requirements.

Do suppliers provide certification documentation?

While not all list certifications explicitly, reputable manufacturers comply with ISO 9001 quality management systems. For export markets, verify compliance with regional standards such as CE (EU), AS/NZS 4687 (Australia), or OSHA guidelines (USA). Request material test certificates and process control records during due diligence.

How should buyers manage logistics and export compliance?

Most suppliers handle FOB shipping from major Chinese ports (Tianjin, Qingdao, Shanghai). CIF terms are negotiable for large orders. Confirm packaging methods (waterproof wrapping, wooden pallets) and container loading efficiency. Importers must verify tariff classifications and safety regulations in destination countries, especially for construction-grade protective equipment.