Protective Net Factories

1/6

1/6

1/3

1/3

1/8

1/8

1/3

1/3

1/3

1/3

1/19

1/19

1/15

1/15

1/12

1/12

1/3

1/3

1/13

1/13

1/3

1/3

1/13

1/13

1/16

1/16

1/1

1/1

1/3

1/3

1/3

1/3

0

0

About protective net factories

Where to Find Protective Net Factories?

China is the leading global hub for protective net manufacturing, with key industrial clusters concentrated in Shandong, Henan, and Hebei provinces. These regions host vertically integrated factories specializing in HDPE, nylon, polyester, and PVC-based safety and protective mesh systems. Shandong stands out for its concentration of sports and construction-grade netting producers, leveraging proximity to Qingdao Port for efficient export logistics. Henan’s manufacturers emphasize cost-effective mass production of agricultural and balcony safety nets, supported by regional polymer supply chains. Hebei, particularly Anping County, serves as a historic center for wire and plastic mesh fabrication, offering advanced weaving and coating technologies.

These clusters enable economies of scale, with many facilities operating dedicated extrusion and knitting lines that support monthly outputs exceeding 500,000 square meters. Integrated production—from raw material compounding to final cutting and packaging—reduces lead times and enhances customization agility. Buyers benefit from mature supplier ecosystems where material sourcing, quality control, and shipping coordination occur within tightly managed networks, typically achieving standard order fulfillment in 15–25 days.

How to Choose Protective Net Suppliers?

Selecting reliable suppliers requires systematic evaluation across technical, operational, and transactional dimensions:

Material & Production Capabilities

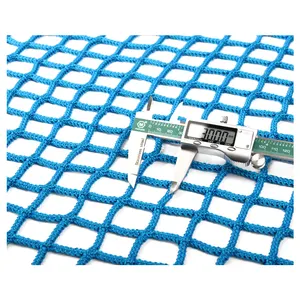

Verify the use of UV-stabilized HDPE, high-tenacity nylon, or fire-retardant PVC depending on application requirements. Confirm access to automated braiding, heat-setting, and ultrasonic welding equipment. Suppliers should demonstrate in-house capacity for mesh density customization (ranging from 10gsm to 180gsm) and tensile strength testing. Factories with co-extrusion lines can offer enhanced durability through multi-layer film integration.

Quality Assurance Protocols

Prioritize suppliers adhering to ISO 9001 standards for consistent quality management. For export markets, compliance with CE, RoHS, or ASTM F1167 (for fall protection) may be required. Request test reports for knot strength, elongation at break, and UV resistance (minimum 1,500 hours QUV exposure). On-site audits or video inspections should confirm organized production floors, calibrated tension testers, and batch traceability systems.

Customization & Transaction Reliability

Assess flexibility in size, color, logo printing, and packaging configuration. Minimum Order Quantities (MOQs) vary widely—from 10 square meters for specialty nets to 1,000 square meters for bulk HDPE rolls. Evaluate response time (target ≤2 hours), on-time delivery rate (benchmark ≥97%), and reorder frequency. Use secure payment mechanisms such as escrow services, especially when engaging newer suppliers without long-term performance records.

What Are the Leading Protective Net Factories?

| Company Name | Location | Main Materials | Production Focus | MOQ Range | On-Time Delivery | Avg. Response | Online Revenue | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Shandong Jinfan Mesh Co., Ltd. | Shandong, CN | HDPE, Nylon | Construction, Sports Nets | 300 sqm | 50% | ≤2h | US $200+ | <15% |

| Shandong Binzhou Jianlimei Sporting Goods Co., Ltd. | Shandong, CN | Polyester, Nylon | Sports, Playground Safety | 10–100 sqm | 100% | ≤3h | US $10,000+ | 33% |

| Henan Suntex Plastic Co., Ltd. | Henan, CN | HDPE, PE | Insect, Balcony, Cat Nets | 500–1,000 sqm | 97% | ≤3h | US $340,000+ | <15% |

| Qingdao Sunten Plastic Co., Ltd. | Shandong, CN | PE, PVC | Construction, Custom Nets | 1 sqm | 100% | ≤1h | US $20,000+ | <15% |

| Anping Weicai Wire Mesh Products Co., Ltd. | Hebei, CN | Nylon, HDPE + Metal | Balcony, Playground, Marine | 10–500 sqm | 100% | ≤2h | US $20,000+ | <15% |

Performance Analysis

Shandong Binzhou Jianlimei and Qingdao Sunten stand out for responsiveness and reliability, with 100% on-time delivery and low MOQs enabling agile procurement. Henan Suntex demonstrates strong export volume, reflected in high online revenue, though its reorder rate suggests room for improvement in customer retention. Anping Weicai offers hybrid metal-plastic solutions ideal for high-security balcony applications, while Shandong Jinfan’s lower delivery performance warrants closer monitoring despite competitive pricing. Buyers seeking rapid prototyping should prioritize factories like Qingdao Sunten, which accept orders as small as one square meter and respond within an hour.

FAQs

What materials are commonly used in protective nets?

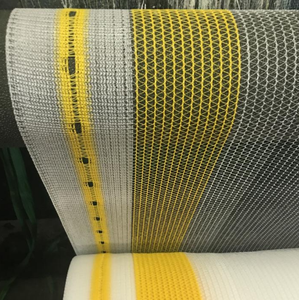

The most prevalent materials are high-density polyethylene (HDPE) for outdoor durability, nylon for high tensile strength and elasticity, polyester for dimensional stability, and PVC-coated variants for weather and fire resistance. Material selection depends on end-use requirements such as UV exposure, load-bearing needs, and flame retardancy.

What is the typical lead time for protective net orders?

Standard orders are typically fulfilled within 15–25 days after deposit confirmation. Sample lead times range from 5–10 days, depending on customization complexity. Expedited production may be available for urgent requests, subject to factory capacity.

Can protective nets be customized in size and color?

Yes, most factories support custom dimensions, mesh aperture, denier count, and Pantone-matched coloring. Additional options include grommet placement, hemmed edges, and printed branding. Digital proofs are usually provided before production begins.

Do suppliers provide product certifications?

While not all suppliers hold formal ISO or CE certifications, leading manufacturers can provide material test reports for tensile strength, UV degradation, and flame spread index. Buyers should request documentation specific to their regulatory or safety compliance needs.

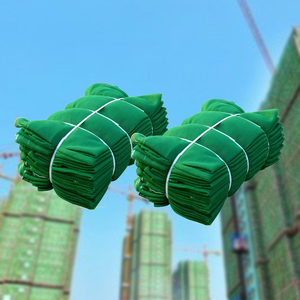

How are large protective net shipments packed and shipped?

Nets are typically rolled and packed in woven poly bags or cardboard tubes to prevent creasing. Full-container loads (FCL) are cost-efficient for bulk orders, while less-than-container (LCL) options suit smaller volumes. Sea freight is standard; air shipping is viable for samples or urgent deliveries.