Robotics And Iot

Top sponsor listing

Top sponsor listing

1/22

1/22

CN

CN

1/29

1/29

1/1

1/1

0

0

1/3

1/3

0

0

1/3

1/3

1/36

1/36

1/3

1/3

0

0

CN

CN

1/3

1/3

1/24

1/24

1/1

1/1

1/5

1/5

1/3

1/3

1/3

1/3

0

0

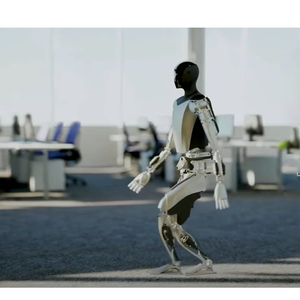

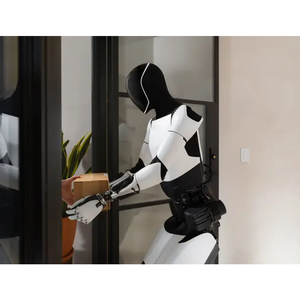

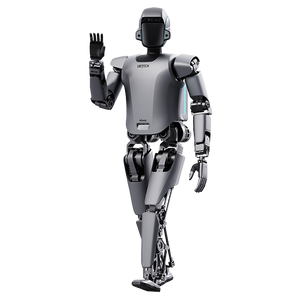

About robotics and iot

Where to Find Robotics and IoT Suppliers?

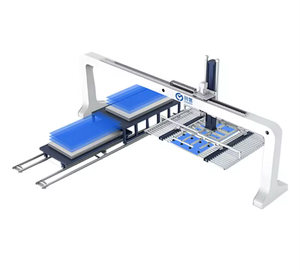

Global robotics and IoT manufacturing is anchored in East Asia, with China, South Korea, and Japan leading in high-tech industrial ecosystems. Within China, Shenzhen, Shanghai, and Suzhou have emerged as primary innovation and production hubs due to their dense networks of electronics manufacturers, automation engineers, and semiconductor suppliers. Shenzhen alone hosts over 8,000 IoT-focused enterprises, supported by the Guangdong-Hong Kong-Macao Greater Bay Area’s advanced SMT (surface-mount technology) lines and rapid prototyping infrastructure.

These clusters enable vertically integrated development cycles—from PCB design and firmware programming to cloud integration and edge computing deployment. Proximity to Tier-1 component suppliers reduces material lead times by 25–40% compared to offshore alternatives. Buyers benefit from scalable production models: standard IoT sensor modules can be produced at volumes exceeding 50,000 units per month, while collaborative robots (cobots) are assembled in facilities equipped with automated calibration systems for consistent repeatability within ±0.02mm. Average delivery timelines for pilot batches range from 21–35 days, with mass production lead times between 45–60 days depending on complexity.

How to Choose Robotics and IoT Suppliers?

Apply rigorous evaluation criteria when selecting technology partners:

Technical Compliance

Confirm adherence to international quality and safety benchmarks. ISO 9001 certification is essential for process control, while IEC 61508 or ISO 13849-1 compliance is required for safety-critical robotic systems. For IoT devices, verify RoHS and REACH compliance for hazardous substances, and ensure FCC/CE marking for wireless communication modules operating under IEEE 802.15.4, LoRa, Wi-Fi 6, or 5G NR standards.

Production Capability Audits

Assess core technical infrastructure:

- Minimum 3,000m² cleanroom or ESD-protected production area for electronics assembly

- In-house R&D team comprising firmware developers, mechanical engineers, and AI specialists (minimum 15% of total staff)

- Automated testing stations for environmental stress screening (thermal cycling, vibration, humidity exposure)

Validate scalability through documented output capacity—target suppliers capable of 10,000+ units/month for standardized IoT nodes or serial production of robotic arms up to 6-axis configurations.

Transaction Safeguards

Utilize secure payment structures such as letter of credit or escrow arrangements tied to milestone inspections. Review supplier export history, particularly shipments to North America and EU regions, which indicate familiarity with regulatory documentation and packaging requirements. Pre-shipment verification should include functional testing of connectivity protocols, OTA update capability, and robot kinematic accuracy using laser interferometry or photogrammetric validation.

What Are the Best Robotics and IoT Suppliers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Supplier data not currently available. Conduct direct audits via trade shows (e.g., Canton Fair, Hannover Messe) or industry registries to identify qualified manufacturers. | ||||||||

Performance Analysis

In the absence of verified supplier profiles, procurement teams must prioritize due diligence through independent facility assessments and technical benchmarking. Leading robotics and IoT producers typically demonstrate strong software-hardware integration, offering SDKs, API access, and cloud dashboard compatibility. High-performing suppliers maintain on-time delivery rates above 97%, backed by dual-source component strategies to mitigate semiconductor shortages. Reorder rates above 30% often correlate with robust post-sales support, including remote diagnostics and firmware maintenance. Prioritize vendors with documented experience in your target application sector—industrial automation, smart logistics, healthcare robotics, or building management systems.

FAQs

How to verify robotics and IoT supplier reliability?

Cross-validate certifications with accredited bodies and request audit trails for product lifecycle management. Evaluate engineering depth through code reviews, schematic disclosures, and participation in open-source IoT frameworks. Analyze client references in similar use cases, focusing on system uptime, cybersecurity resilience, and upgrade pathways.

What is the average sampling timeline?

Prototype development for basic IoT sensors takes 10–20 days; complex robotic units with AI vision or force feedback require 30–45 days. Add 5–12 days for international air shipping. Expect NRE (non-recurring engineering) fees for custom designs, typically ranging from $2,000–$10,000 based on integration scope.

Can suppliers ship robotics and IoT systems worldwide?

Yes, experienced exporters manage global logistics via air or sea freight under EXW, FOB, or DDP terms. Ensure compliance with destination regulations—especially for radio-frequency devices subject to local licensing (e.g., FCC Part 15 in the U.S., RED Directive in the EU). Battery-powered units must meet UN 38.3 certification for safe transport.

Do manufacturers provide free samples?

Free samples are uncommon for advanced systems. Most suppliers charge full cost recovery for initial units, though partial refunds may apply upon conversion to bulk orders (typically MOQ 100–500 units). Development kits may be offered at discounted rates for qualified partners.

How to initiate customization requests?

Submit detailed technical specifications including desired payload capacity, degrees of freedom (for robots), wireless protocol stack, power budget, enclosure IP rating, and cloud architecture preferences. Top-tier suppliers respond with feasibility studies, 3D mechanical models, and firmware architecture diagrams within 5 business days.