Robots And Artificial Intelligence

Top sponsor listing

Top sponsor listing

1/3

1/3

1/22

1/22

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/13

1/13

0

0

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/1

1/1

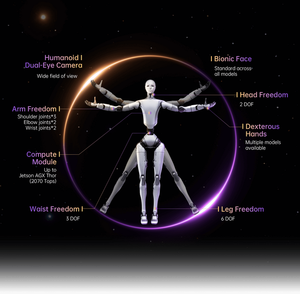

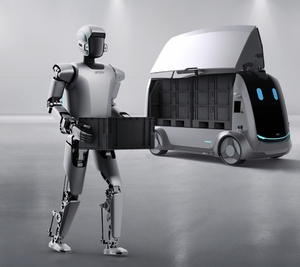

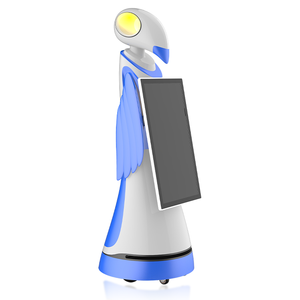

About robots and artificial intelligence

Where to Find Robots and Artificial Intelligence Suppliers?

Global production of robotics and artificial intelligence (AI) systems is concentrated in advanced manufacturing hubs across East Asia, North America, and Western Europe, with China, Japan, Germany, and the United States leading in both volume and technological innovation. Within China, industrial clusters in Guangdong, Jiangsu, and Shanghai specialize in intelligent automation, benefiting from government-backed R&D initiatives and proximity to semiconductor and electronics supply chains. These regions host over 70% of Asia’s robotics manufacturers, enabling rapid prototyping and integration of AI-driven control systems.

The ecosystem supports vertically integrated development—from PCB fabrication and sensor assembly to machine learning model deployment—allowing for reduced time-to-market. Buyers gain access to suppliers capable of delivering turnkey robotic solutions, including collaborative robots (cobots), autonomous mobile robots (AMRs), and custom AI software stacks. Key advantages include competitive pricing (25–40% lower than U.S.-based developers for equivalent functionality), lead times averaging 45–60 days for standard units, and scalability for high-volume deployments. Regional infrastructure ensures component availability within localized networks, minimizing dependency on global logistics bottlenecks.

How to Choose Robots and Artificial Intelligence Suppliers?

Prioritize these verification protocols when selecting partners:

Technical Compliance

Require ISO 9001 certification as a baseline for quality management. For international deployment, confirm compliance with IEC 61508 (functional safety of electrical systems) and ISO 10218 (industrial robot safety). AI-integrated systems should adhere to data governance standards such as GDPR or CCPA where applicable. Request documentation for algorithm validation, cybersecurity measures, and fail-safe operational protocols.

Production Capability Audits

Assess technical infrastructure through verifiable benchmarks:

- Minimum 3,000m² facility with dedicated clean rooms for electronic assembly

- R&D teams comprising at least 15% of total staff, specializing in embedded systems and AI/ML engineering

- In-house capabilities in motion control programming, vision system calibration, and edge computing integration

Cross-reference product release cycles with firmware update frequency (target: quarterly updates or better) to assess ongoing support commitment.

Transaction Safeguards

Utilize escrow-based payment terms tied to milestone deliveries, especially for customized AI training or hardware modifications. Evaluate supplier track records via transaction histories that include export documentation, warranty fulfillment rates, and post-deployment technical support responsiveness. Pre-delivery testing should include functional trials under real-world conditions, with performance benchmarking against industry standards such as ISO 9283 (robot accuracy and repeatability).

What Are the Best Robots and Artificial Intelligence Suppliers?

No verified supplier data is currently available for this category.

Performance Analysis

In the absence of specific supplier profiles, procurement strategies should emphasize due diligence in technical validation and risk mitigation. Focus on manufacturers demonstrating long-term engagement in industrial automation, evidenced by patent filings, peer-reviewed publications, or participation in recognized robotics consortia. Prioritize companies with documented export experience to regulated markets (EU, U.S., Japan), indicating adherence to stringent safety and interoperability requirements. For AI-dependent applications, verify transparency in model training datasets and provision for retraining or fine-tuning post-deployment.

FAQs

How to verify robots and artificial intelligence supplier reliability?

Validate certifications through official registries and request third-party audit reports covering design validation, production consistency, and software lifecycle management. Analyze customer references focusing on system uptime, mean time between failures (MTBF), and effectiveness of remote diagnostics.

What is the average sampling timeline?

Standard robotic unit sampling requires 20–35 days, depending on complexity. AI-customized models (e.g., object recognition algorithms trained on proprietary datasets) may extend timelines to 50–60 days. Add 7–14 days for international air freight delivery.

Can suppliers ship robots and AI systems worldwide?

Yes, established manufacturers manage global logistics, including sea and air freight options. Confirm Incoterms (FOB, CIF, DDP) and ensure compliance with destination-country regulations on electronic equipment, radio frequency emissions (FCC, CE-RED), and AI usage policies. Battery-equipped mobile robots require UN38.3 certification for safe transport.

Do manufacturers provide free samples?

Sample policies vary significantly. Full-unit demonstrations are typically offered only after signed NDAs and technical evaluations. Some suppliers waive sample fees for orders exceeding five units. For AI-only components (e.g., inference engines), trial licenses or sandbox environments may be provided at no cost.

How to initiate customization requests?

Submit detailed specifications including payload capacity, degrees of freedom (for manipulators), navigation method (SLAM, LiDAR, vision-based), and required AI functions (classification, anomaly detection, path optimization). Leading suppliers deliver simulation models within 72 hours and physical prototypes within 4–6 weeks for approved designs.