Artificial Intelligence And Neural Networks

1/3

1/3

1/2

1/2

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/5

1/5

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

0

0

0

0

0

0

0

0

0

0

1/2

1/2

0

0

1/25

1/25

About artificial intelligence and neural networks

Where to Find Artificial Intelligence and Neural Networks Suppliers?

The global supply landscape for artificial intelligence (AI) and neural networks is concentrated in technology hubs with advanced research infrastructure, skilled engineering talent, and strong government or private-sector investment in AI development. Key regions include the United States (particularly Silicon Valley and Boston), China (Beijing, Shenzhen, and Shanghai), Canada (Toronto-Waterloo corridor), and Western Europe (Germany, France, and the UK). These ecosystems foster innovation through collaboration between academic institutions, tech incubators, and enterprise R&D centers.

Suppliers in these clusters offer access to mature software frameworks, cloud-based AI platforms, and specialized hardware accelerators such as GPUs and TPUs. Regional advantages vary: North American suppliers lead in enterprise-grade AI solutions and ethical AI governance frameworks, while Chinese providers emphasize integration with industrial automation and large-scale data processing. European developers often comply with strict data privacy standards (e.g., GDPR), making them preferred partners for regulated sectors like healthcare and finance. The proximity of algorithm developers, data engineers, and cybersecurity experts within these zones enables rapid prototyping and deployment cycles.

How to Choose Artificial Intelligence and Neural Networks Suppliers?

Procurement decisions should be guided by structured evaluation criteria to ensure technical reliability, regulatory compliance, and long-term scalability:

Technical Compliance

Verify adherence to recognized quality management systems such as ISO/IEC 25010 for software quality and ISO/IEC 27001 for information security. For AI-specific applications, assess alignment with IEEE P7000 series standards on ethical system design. In safety-critical domains—such as autonomous systems or medical diagnostics—confirm certification under domain-specific regulations (e.g., FDA clearance, IEC 62304).

Development Capability Audits

Evaluate supplier competencies through objective benchmarks:

- Minimum team size of 20+ engineers, with at least 30% holding advanced degrees in computer science or machine learning

- Proven track record in developing deep learning models (CNNs, RNNs, transformers) using TensorFlow, PyTorch, or equivalent frameworks

- Demonstrated experience in model training pipelines, including data preprocessing, hyperparameter tuning, and validation against industry benchmarks

Request documentation of past deployments, focusing on accuracy metrics, inference latency, and model retraining frequency to confirm real-world performance.

Transaction Safeguards

Require contractual provisions covering intellectual property rights, data confidentiality, and model explainability. Utilize milestone-based payment structures tied to deliverables such as proof-of-concept validation, stress testing reports, and API integration. Conduct third-party code audits before final acceptance. Prioritize suppliers who provide transparent documentation of training datasets, bias mitigation strategies, and adversarial robustness testing.

What Are the Best Artificial Intelligence and Neural Networks Suppliers?

| Company Name | Location | Years Operating | Staff | Specialization | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Supplier data currently unavailable | ||||||||

Performance Analysis

Due to absence of available supplier data, no comparative assessment can be conducted. Buyers are advised to initiate market scanning via technical conferences (e.g., NeurIPS, ICML), open-source contributions (GitHub repositories), and peer-reviewed publications to identify credible vendors. Focus on companies demonstrating reproducible results, active community engagement, and clear documentation practices. Established players typically exhibit higher reorder rates due to consistent support and iterative model improvements.

FAQs

How to verify artificial intelligence supplier reliability?

Cross-validate technical claims through independent benchmarking on representative datasets. Request case studies with measurable outcomes (e.g., precision/recall scores, F1 improvement over baseline). Confirm compliance with data protection laws applicable to your jurisdiction. Review audit trails for model development and deployment processes.

What is the average sampling timeline?

Proof-of-concept development typically takes 4–8 weeks, depending on problem complexity and data availability. Simple classification models may be delivered in 3 weeks, while custom neural architectures or multimodal systems require 10–14 weeks. Add 1–2 weeks for integration testing and API stabilization.

Can suppliers deploy AI models globally?

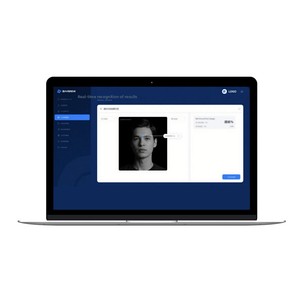

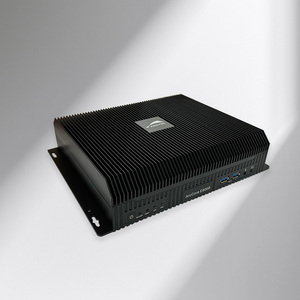

Yes, most AI suppliers support international deployment via cloud APIs (AWS, Azure, GCP) or containerized edge solutions (Docker, Kubernetes). Ensure compliance with local data residency requirements and network latency constraints. Some jurisdictions impose restrictions on facial recognition or predictive analytics—verify legal permissibility prior to rollout.

Do manufacturers provide free samples?

Full AI systems are rarely offered free of charge. However, many suppliers provide limited-functionality demos, sandbox environments, or trial licenses (typically 14–30 days). Proof-of-concept engagements may be partially subsidized if followed by commercial contracts exceeding predefined thresholds.

How to initiate customization requests?

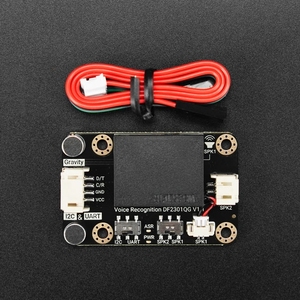

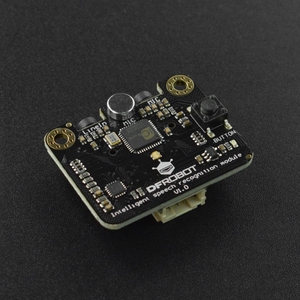

Submit detailed specifications including use case objectives, input data types (text, image, sensor), required inference speed (<100ms recommended), and accuracy targets. Reputable vendors will respond with a solution architecture, data pipeline proposal, and risk assessment within 5 business days. Expect initial model iterations within 3 weeks of data handover.