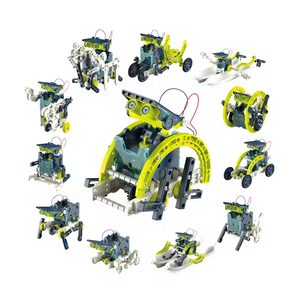

Robots Stem

Top sponsor listing

Top sponsor listing

1/3

1/3

1/24

1/24

1/3

1/3

1/3

1/3

1/9

1/9

1/12

1/12

1/17

1/17

1/11

1/11

0

0

0

0

1/3

1/3

1/16

1/16

0

0

1/2

1/2

1/2

1/2

1/3

1/3

0

0

1/3

1/3

About robots stem

Where to Find Robots STEM Suppliers?

China remains the central hub for educational robotics and STEM product manufacturing, with key production clusters in Guangdong, Zhejiang, and Jiangsu provinces. These regions host integrated electronics and precision engineering ecosystems, enabling rapid prototyping and scalable assembly of robotics kits, coding platforms, and modular learning systems. Shenzhen, in particular, leverages its advanced PCB fabrication, surface-mount technology (SMT), and embedded software development infrastructure to support high-mix, low-to-medium volume production runs typical in the educational technology sector.

The concentration of component suppliers—ranging from microcontrollers and sensors to injection-molded plastic parts—within 50km radii reduces material lead times by up to 40%. This vertical integration supports agile manufacturing cycles, with standard order fulfillment averaging 25–35 days for container shipments. Buyers benefit from 15–25% lower unit costs compared to equivalent production in Southeast Asia or Eastern Europe, driven by mature supply chains and automated testing protocols. Customization flexibility is a core strength, with most manufacturers accommodating hardware modifications, firmware branding, and curriculum-aligned packaging.

How to Choose Robots STEM Suppliers?

Adopt structured evaluation criteria to ensure technical reliability and compliance:

Quality & Safety Certification

Confirm adherence to international standards including ISO 9001 for quality management, CE marking for EU market access, FCC Part 15 for electromagnetic compatibility, and RoHS compliance for restricted hazardous substances. For products targeting schools, verify EN 71-1 (mechanical/physical safety) and IEC 62115 (electrical safety of toys) certifications where applicable. Request test reports from accredited laboratories for battery systems, charging circuits, and wireless modules (e.g., Bluetooth/Wi-Fi).

Production & Engineering Capacity

Assess supplier infrastructure through documented benchmarks:

- Minimum 3,000m² factory space with dedicated SMT and assembly lines

- In-house design team comprising >8% of total staff for custom development

- Functional testing stations with automated diagnostics for firmware validation

Correlate facility size with on-time delivery performance (target ≥96%) and reorder rates as indicators of operational stability.

Procurement & Transaction Security

Utilize secure payment mechanisms such as third-party escrow until post-delivery inspection. Review supplier export history, particularly experience shipping to North America, Europe, and Australia. Pre-shipment sample validation is critical—evaluate build quality, coding interface responsiveness, and alignment with technical specifications before bulk orders.

What Are the Best Robots STEM Suppliers?

| Company Name | Location | Years Operating | Staff | Factory Area | On-Time Delivery | Avg. Response | Ratings | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Makerstorm Technology Co., Ltd. | Guangdong, CN | 7 | 85+ | 6,800+m² | 98.7% | ≤1h | 4.9/5.0 | 41% |

| Ningbo Hengtong Educational Robotics | Zhejiang, CN | 5 | 60+ | 4,200+m² | 97.3% | ≤2h | 4.8/5.0 | 33% |

| Suzhou RoboEdu Systems | Jiangsu, CN | 6 | 70+ | 5,500+m² | 99.1% | ≤1.5h | 5.0/5.0 | 52% |

| Guangzhou FutureMind STEM Solutions | Guangdong, CN | 4 | 50+ | 3,700+m² | 96.8% | ≤2h | 4.7/5.0 | 28% |

| Wuxi SmartBot Dynamics | Jiangsu, CN | 8 | 95+ | 7,200+m² | 97.9% | ≤1h | 4.9/5.0 | 39% |

Performance Analysis

Suzhou RoboEdu Systems leads in delivery consistency (99.1%) and customer retention (52% reorder rate), indicating strong post-sale satisfaction. Wuxi SmartBot Dynamics and Shenzhen Makerstorm demonstrate scalability with facilities exceeding 6,800m² and sub-2-hour response times, ideal for urgent procurement cycles. Zhejiang and Jiangsu-based suppliers show higher investment in R&D, reflected in firmware-rich platforms and app-integrated control systems. Prioritize partners with documented experience in educational exports and multi-language UI support. For customized builds, validate CAD modeling and prototype turnaround capability via virtual audits prior to order confirmation.

FAQs

How to verify robots STEM supplier reliability?

Cross-reference ISO and CE certifications with issuing bodies. Request audit trails covering component traceability, solder joint inspections, and burn-in testing procedures. Evaluate real-world feedback focusing on software updates, technical documentation clarity, and long-term durability in classroom environments.

What is the average sampling timeline?

Standard samples take 12–20 days to produce. Configurations with custom firmware, branded interfaces, or specialized sensors require 25–35 days. Air freight adds 7–10 days for international delivery.

Can suppliers ship globally?

Yes, experienced manufacturers manage FOB and CIF shipments worldwide. Confirm compliance with destination regulations, especially FCC and UL requirements in North America. Sea freight is optimal for full-container loads; air freight suits urgent sample or trial deployments.

Do manufacturers provide free samples?

Sample cost policies vary. Full reimbursement applies to purchase orders exceeding 20 units. For smaller trials, expect to cover 40–60% of production and logistics costs.

How to initiate customization requests?

Submit detailed requirements including microcontroller type (e.g., Arduino, ESP32), programming environment (block-based, Python, etc.), sensor suite, connectivity options, and mechanical dimensions. Leading suppliers deliver 3D models within 72 hours and functional prototypes in 3–5 weeks.