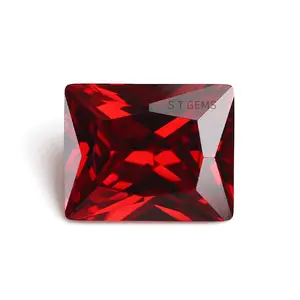

Ruby St

1/3

1/3

1/1

1/1

1/3

1/3

1/3

1/3

0

0

0

0

1/3

1/3

1/2

1/2

1/17

1/17

1/3

1/3

1/17

1/17

0

0

1/23

1/23

1/3

1/3

1/3

1/3

1/3

1/3

CN

CN

0

0

0

0

1/13

1/13

1/3

1/3

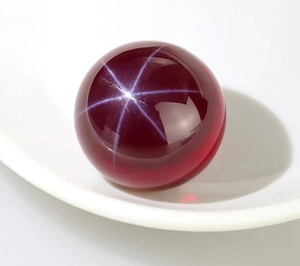

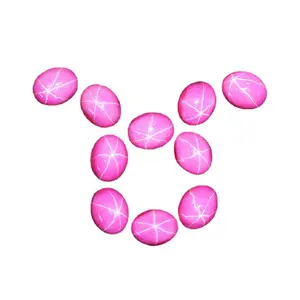

About ruby st

Where to Find Ruby ST Suppliers?

No verified suppliers for "ruby st" were identified in the current dataset. The absence of listed manufacturers suggests limited industrial specialization or potential misclassification of the product term within global sourcing databases. Buyers should consider re-evaluating keyword specificity—possible variations such as "ruby stone tools," "ruby abrasive materials," or "synthetic ruby components" may yield more accurate supplier matches.

In markets where precision ceramics and industrial abrasives are produced, clusters in China’s Jiangsu and Guangdong provinces dominate advanced material manufacturing. These regions host vertically integrated facilities capable of processing synthetic ruby crystals for applications in optics, metrology, and wear-resistant components. Similar production ecosystems exist in India’s Tamil Nadu region and Germany’s Bavarian industrial zone, both known for high-purity crystal growth and lapping technologies.

Where ruby-related products are concerned, supply chain maturity depends on access to corundum feedstock and specialized thermal processing equipment. Manufacturers typically operate controlled atmosphere furnaces and laser cutting systems, with monthly outputs ranging from 1,000 to 10,000 units depending on component complexity. Lead times average 45–60 days for custom-fabricated parts due to stringent quality controls and annealing cycles required for structural stability.

How to Choose Ruby ST Suppliers?

Given the lack of direct supplier data, procurement professionals must adopt rigorous qualification protocols when engaging potential vendors:

Material & Process Verification

Confirm use of sapphire-grade aluminum oxide (Al₂O₃) with purity exceeding 99.9% for optical and mechanical applications. Suppliers should demonstrate capability in Verneuil or Czochralski crystal growth methods, followed by precision grinding and polishing to achieve surface finishes below 0.1 µm Ra. Request spectral transmittance reports for optical-grade ruby elements.

Quality Management Systems

Require ISO 9001 certification as a baseline for process consistency. For medical or aerospace applications, compliance with AS9100, ISO 13485, or MIL-STD-883 is essential. Verify adherence to RoHS and REACH regulations if exporting to EU or North American markets.

Production Capacity Assessment

Evaluate key indicators of operational scale:

- Minimum 2,000m² cleanroom or climate-controlled facility area

- In-house metrology labs equipped with interferometers and microhardness testers

- Controlled thermal processing lines with programmable kilns and annealing ovens

Cross-reference production claims with delivery performance metrics; target on-time delivery rates above 95%.

Transaction Risk Mitigation

Utilize secure payment structures such as letter of credit or escrow services until product conformity is confirmed at destination. Conduct pre-shipment inspections via third-party auditors like SGS or TÜV. Prioritize suppliers offering sample validation programs with full traceability documentation, including lot numbers and test certificates.

What Are the Best Ruby ST Suppliers?

Based on available data, no suppliers are currently profiled for the "ruby st" category. The absence of listed entities indicates either niche market status or insufficient digital visibility among qualified manufacturers. Buyers should proactively source through industry-specific channels such as ceramic engineering trade shows, technical journals, or government-certified export directories.

Performance Analysis

In mature industrial sectors producing ruby-based components, leading manufacturers distinguish themselves through investment in crystallography R&D and automated finishing systems. High-reliability suppliers maintain dedicated QC teams comprising 15–20% of total staff and utilize statistical process control (SPC) across all production stages. For critical applications, verify that suppliers conduct 100% visual inspection under dark-field microscopy and perform batch sampling per ANSI Z1.4 standards.

FAQs

How to verify ruby ST supplier reliability?

Request documentary evidence of raw material sourcing, furnace calibration logs, and final inspection reports. Validate certifications through issuing bodies and conduct virtual factory audits to observe handling procedures for brittle crystalline materials.

What is the typical MOQ and lead time?

Standard MOQs range from 50 to 500 units depending on geometry and tolerances. Simple cylindrical blanks may have lead times of 30 days, while complex faceted or coated components require 6–8 weeks due to multi-stage processing requirements.

Can suppliers customize ruby components?

Yes, but customization requires detailed technical input: crystal orientation (e.g., c-axis alignment), dimensional tolerances (±0.005mm typical), edge treatment (chamfered vs. radiused), and coating specifications (anti-reflective, conductive). Prototyping lead time averages 4 weeks with NRE fees applicable for tooling setup.

Do manufacturers provide material test reports?

Reputable suppliers issue full traceability dossiers including XRD analysis, density measurements, and hardness verification (2000+ Vickers). For optical applications, refractive index and birefringence data should be provided per ASTM F1048.

Are ruby components export-controlled?

Certain high-purity or laser-grade ruby materials may fall under dual-use regulations (e.g., EU Dual-Use Regulation 2021/821 or US EAR). Confirm HTS codes and licensing requirements prior to shipment, particularly for quantities exceeding 1 kg of single-crystal material.