Scraper Tool Producer

Top sponsor listing

Top sponsor listing

0

0

1/3

1/3

1/18

1/18

1/3

1/3

1/3

1/3

0

0

1/16

1/16

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/2

1/2

1/3

1/3

1/2

1/2

1/10

1/10

About scraper tool producer

Where to Find Scraper Tool Producers?

China remains the dominant hub for scraper tool manufacturing, with key production clusters concentrated in Zhejiang, Guangdong, and Jiangsu provinces. These regions host vertically integrated supply chains specializing in hand tools and industrial equipment, enabling cost-efficient production and rapid scalability. Hangzhou and Yangjiang, in particular, are recognized for their hardware and metalworking expertise, supporting high-volume output of stainless steel, plastic, and composite scraper tools used across construction, automotive, food processing, and maintenance sectors.

The industrial ecosystem in these zones features mature networks of material suppliers, precision machining workshops, and packaging providers operating within close proximity. This integration reduces logistics overhead and accelerates lead times, typically ranging from 15 to 30 days for standard orders. Manufacturers benefit from localized access to raw materials such as 304 stainless steel, rubber compounds, and food-grade plastics, lowering input costs by 15–25% compared to non-specialized regions. Buyers gain flexibility in order volume, with many producers accommodating MOQs between 100 and 1,200 units depending on design complexity.

How to Choose Scraper Tool Producers?

Selecting reliable suppliers requires a structured evaluation of operational performance, technical capability, and compliance readiness:

Quality & Delivery Performance

Prioritize manufacturers with documented on-time delivery rates exceeding 95%. Verified data shows top-tier producers maintain 100% fulfillment records, indicating robust production planning and inventory control. Reorder rates below 20% suggest stable buyer satisfaction without dependency on repeat corrections. Response times under 4 hours reflect organizational efficiency and strong customer service infrastructure.

Production and Customization Capacity

Assess customization capabilities including material selection (e.g., stainless steel, plastic, rubber), color options, ergonomic handle design, and branding via logo imprinting or custom packaging. Leading suppliers offer end-to-end OEM/ODM support, including graphic design, label printing, and multi-language instruction inserts. Confirm whether tool specifications align with industry standards—for example, food-grade models should comply with FDA or EU 1935/2004 regulations.

Technical Compliance and Certifications

While explicit certification data is not provided, buyers should request ISO 9001 certification for quality management systems. For specialized applications—such as food-safe scrapers—verify compliance with relevant safety standards through material test reports and third-party audits. Industrial-grade tools may require durability testing documentation, particularly for blade hardness and corrosion resistance.

What Are the Best Scraper Tool Producers?

| Company Name | Main Products (Listings) | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Customization Options | MOQ Range | Price Range (USD) |

|---|---|---|---|---|---|---|---|---|

| Hangzhou Prosperity Imp. & Exp. Co., Ltd. | Other Car Care Products (197), Other Hand Tools (144) | US $60,000+ | 100% | ≤10h | <15% | Color, material, size, logo, packaging, label, graphic | 100–1,200 pcs | $1–$1.20 |

| Yangjiang Jinzong Hardware Products Co., Ltd. | Data not available | US $20,000+ | 93% | ≤4h | 33% | Color, material, logo, packaging, label, graphic | 100–1,200 pcs | $0.84–$1.20 |

| Dongtai Kaiheng Tools Co., Ltd. | Other Hand Tools (136) | US $2,000+ | 100% | ≤4h | <15% | None specified | 10 boxes | $2.10–$20.50 |

| Qingdao Shianku Food Safety Technology Co., Ltd. | Brush (83), Brooms & Dustpans (37) | US $20,000+ | 93% | ≤2h | 26% | None specified | 2–50 pcs | $1.38–$6.85 |

| Tongcheng Peachblossom Brush Co., Ltd. | Data not available | US $160,000+ | 100% | ≤4h | 20% | Color, material, size, logo, links, packaging, label | 100–1,200 pcs/inches | $0.18–$0.52 |

Performance Analysis

Tongcheng Peachblossom Brush Co., Ltd. leads in transaction volume with over US $160,000 in reported online revenue and offers the lowest price point ($0.18/unit), making it a competitive choice for high-volume procurement. Despite higher pricing, Dongtai Kaiheng specializes in industrial deburring and trimming blades, suggesting niche engineering focus rather than mass-market positioning. Qingdao Shianku distinguishes itself with ultra-low MOQs (as low as 2 pieces) and sub-2-hour response times, ideal for small businesses or sampling needs. Hangzhou Prosperity and Dongtai Kaiheng both report perfect on-time delivery records, signaling strong operational reliability. Yangjiang Jinzong balances responsiveness and reorder frequency, indicating consistent product acceptance despite moderate retention metrics.

FAQs

How to verify scraper tool producer reliability?

Evaluate on-time delivery history, response speed, and reorder rate as proxies for service consistency. Request factory audits or video tours to confirm production lines and quality control processes. Verify material sourcing practices, especially for food-contact or corrosion-resistant applications.

What is the typical minimum order quantity (MOQ)?

MOQs vary significantly: general-purpose tools often require 100–1,200 pieces, while specialty or food-grade models may be available in smaller batches (as low as 2–50 units). Box-based orders (e.g., 10 boxes per batch) are common for blade-centric products.

Can scraper tool producers accommodate customization?

Yes, leading suppliers support material substitution, color variation, ergonomic adjustments, and branding elements such as logos and packaging labels. Confirm digital artwork submission requirements and setup fees for mold or print plate development prior to order placement.

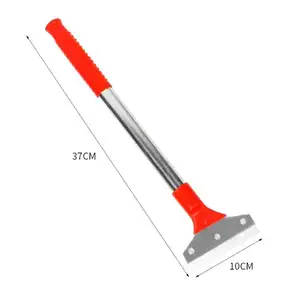

What are common materials used in scraper tools?

Stainless steel (especially 304 grade) dominates industrial and food-safe models due to corrosion resistance. Plastic and rubber composites are used for soft-edged scrapers in surface-sensitive applications. Dual-material designs combine rigid blades with flexible handles for enhanced usability.

How long does production and shipping take?

Manufacturing lead times typically range from 15 to 30 days after sample approval. Air freight delivers samples within 7–10 days internationally; sea freight for bulk orders takes 25–40 days depending on destination port congestion and customs procedures.