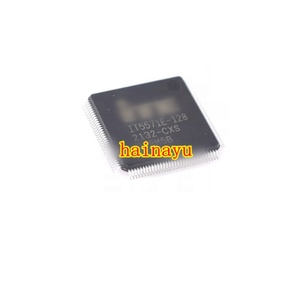

Semiconductor Based Integrated Circuits

CN

CN

About semiconductor based integrated circuits

Where to Find Semiconductor Based Integrated Circuits Suppliers?

China remains a dominant hub for semiconductor-based integrated circuits (ICs) manufacturing, with key production clusters concentrated in Shenzhen and Hong Kong. These regions host vertically integrated supply chains that support rapid component sourcing, testing, and distribution. Shenzhen alone accounts for over 65% of China’s electronics component exporters, leveraging proximity to semiconductor foundries, packaging facilities, and logistics networks that streamline B2B transactions.

The industrial ecosystem enables suppliers to maintain lean inventories while offering fast turnaround on both standard and obsolete IC models. Many firms operate within 10km of contract assembly plants, reducing transit delays and enabling just-in-time delivery models. Buyers benefit from localized access to testing labs, quality assurance teams, and technical specialists—critical for validating authenticity and performance of semiconductor components. Typical lead times range from 7–15 days for in-stock items, with cost advantages of 20–40% compared to equivalent Western distributors due to lower overhead and direct supplier relationships.

How to Choose Semiconductor Based Integrated Circuits Suppliers?

Procurement decisions should be guided by rigorous evaluation criteria to mitigate risks related to counterfeit parts, delivery reliability, and technical compliance:

Quality Assurance & Authenticity

Prioritize suppliers providing traceable sourcing documentation for ICs, including original manufacturer references (e.g., Broadcom, STMicroelectronics, Microchip). While formal certifications like ISO 9001 or IATF 16949 are not universally listed, consistent on-time delivery rates above 85% and low dispute records indicate operational discipline. Verify batch testing reports upon request, especially for power management ICs and programmable devices.

Supply Chain Reliability Metrics

Analyze supplier performance indicators derived from transaction histories:

- On-time delivery rate ≥89% indicates strong logistics control

- Reorder rate >20% reflects customer retention and product satisfaction

- Average response time ≤3 hours supports efficient communication

Cross-reference these metrics with product-specific data such as minimum order quantity (MOQ), pricing consistency, and stock availability across multiple SKUs.

Transaction Security & Procurement Safeguards

Utilize secure payment methods with escrow protection to ensure goods match specifications before release of funds. Request sample testing for high-volume orders—particularly for microcontrollers, FPGAs, or DC-DC converters—to validate electrical parameters against datasheets. Confirm whether components are new original, recycled, or remarked through clear labeling and supplier disclosure.

What Are the Best Semiconductor Based Integrated Circuits Suppliers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Reorder Rate | Avg. Response | MOQ | Price Range (USD) | Customization |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Yixinbang Technology Co., Ltd. | Power Management (PMIC), Transistors, RF Amplifiers | US $5,000+ | 100% | 50% | ≤1h | 1 piece | $0.05–0.10 | No |

| HongShengChuang Industrial Co., Limited | Development Boards, WiFi Modules, Ethernet Modules | US $2,000+ | 71% | <15% | ≤2h | 1 piece | $0.39–0.79 | No |

| Shenzhen Hongchuang Technology Co., Ltd. | Microcontrollers, FPGA, PCBA Kits | US $810,000+ | 29% | <15% | ≤14h | 1–10 pieces | $0.30–0.90 | No |

| Shenzhen Sinosky Electronics Co., Ltd. | STM32 MCUs, ATMEGA Series, SMD/DIP ICs | US $300,000+ | 89% | 27% | ≤3h | 10–100 pieces | $1.00–5.70 | Yes |

| Guangzhou Little Sesame Trading Co., Ltd. | Specialized ICs, Switches, RF Amplifiers | US $6,000+ | 92% | 20% | ≤21h | 1 piece | $0.19–0.96 | No |

Performance Analysis

Shenzhen Yixinbang stands out with a 100% on-time delivery record and a high reorder rate (50%), suggesting strong reliability and customer trust despite modest revenue volume. In contrast, Shenzhen Hongchuang reports substantial online sales but only 29% on-time fulfillment, indicating potential logistical bottlenecks. Guangzhou Little Sesame and Shenzhen Sinosky demonstrate balanced performance, combining delivery reliability (>89%) with mid-range reorder rates (20–27%).

Sinosky is the only supplier offering customization options—including packaging, labeling, and material selection—making it suitable for OEM integration projects. Most suppliers support low MOQs (1–10 pieces), facilitating prototyping and small-batch production. Pricing varies significantly based on IC complexity: basic logic ICs start at $0.05/unit, while advanced microcontrollers (e.g., STM32F4 series) average $4.30–$5.70 per unit at 10+ piece quantities.

FAQs

How to verify authenticity of semiconductor ICs?

Request lot numbers, date codes, and original manufacturer part numbers. Conduct visual inspection under magnification for re-marking signs. Use electrical bench testing to compare performance against published datasheets. Prefer suppliers who disclose sourcing channels and avoid those listing “compatible” or “equivalent” replacements without transparency.

What is the typical lead time for IC orders?

In-stock components ship within 1–5 business days. Backordered or globally sourced ICs may require 2–6 weeks depending on origin and customs processing. Expedited shipping options are commonly available for air freight delivery within 3–7 days internationally.

Do suppliers offer samples?

Yes, most suppliers provide samples at or near product price with no additional fee, particularly for orders expected to follow. Sample requests for high-pin-count or rare ICs may incur nominal charges to cover handling and shipping.

Can I customize packaging or labeling?

Limited customization is available. Shenzhen Sinosky Electronics offers color, logo, label, and packaging modifications for bulk orders. Most other suppliers sell standardized retail or tape-and-reel packaging without branding options.

Are RoHS and REACH compliance standards enforced?

While not explicitly stated in supplier profiles, the majority of listed ICs are surface-mount devices (SMD) conforming to RoHS directives. Buyers should request compliance documentation for regulated markets (EU, UK, California). Non-compliant parts are typically flagged by excessive lead content or lack of environmental markings.