Silicon Chip Maker

Top sponsor listing

Top sponsor listing

About silicon chip maker

Where to Find Silicon Chip Maker Suppliers?

China remains a central hub for silicon-based semiconductor and integrated circuit (IC) component manufacturing, with key suppliers concentrated in Shenzhen, Huizhou, and Zhongshan—cities renowned for their electronics industrial ecosystems. These regions host vertically integrated supply chains encompassing wafer processing, IC packaging, RFID integration, and silicone-based product assembly. Shenzhen leads in high-volume electronic component distribution, supported by mature logistics networks and proximity to semiconductor foundries in the Pearl River Delta.

Suppliers in this sector typically operate within specialized niches: from raw silicon substrate fabrication to fully assembled RFID-enabled silicone devices. The clustering enables rapid prototyping, cost-efficient material sourcing, and scalable production runs. Buyers benefit from localized access to testing labs, packaging facilities, and compliance verification services, reducing time-to-market for both standard and custom silicon chip solutions. Lead times for sample batches range from 7–15 days, with mass production cycles averaging 20–35 days depending on customization complexity.

How to Choose Silicon Chip Maker Suppliers?

Selecting reliable partners requires rigorous evaluation across technical, operational, and transactional dimensions:

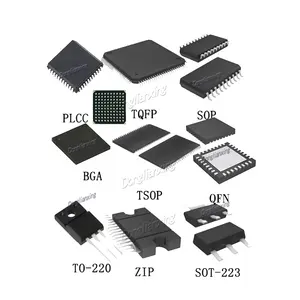

Technical Expertise & Product Range

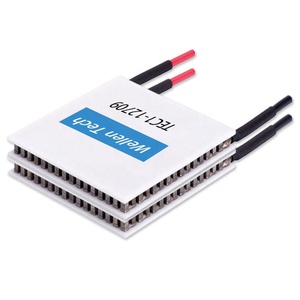

Assess whether suppliers specialize in raw silicon wafers, IC chips, or finished silicone-embedded devices (e.g., RFID wristbands, key fobs). Prioritize vendors offering detailed specifications such as frequency (13.56MHz for NFC), chip type (T5577, NTAG215), and conformance to ISO/IEC 14443 standards. For electronic components, verify availability of original-grade ICs and support for programming or pre-configuration.

Customization and Value-Added Services

Evaluate customization capabilities including:

- Silicone color, size, and shape options (for wearable/embedded applications)

- Logo printing, labeling, and graphic design integration

- PCB assembly, IC programming, and module encapsulation

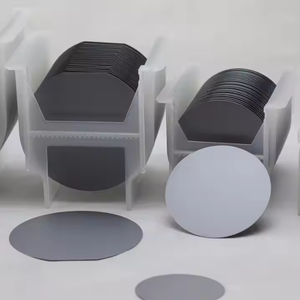

- Wafer doping type (N/P-type), diameter (2–8 inches), and resistivity customization

Cross-reference service offerings with supplier tags indicating design support, testing reports, or refurbishment services.

Quality Assurance and Transaction Metrics

Use performance indicators as proxies for reliability:

- On-time delivery rate ≥95%

- Reorder rate >20% indicates customer satisfaction

- Average response time ≤2 hours reflects operational responsiveness

- Minimum order quantity (MOQ) flexibility—from 1 piece (components) to 100 units (assembled devices)

While formal certifications (ISO 9001, RoHS, CE) are not explicitly listed in available data, request documentation directly to confirm compliance with environmental and quality management systems.

What Are the Best Silicon Chip Maker Suppliers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Reorder Rate | Avg. Response | Customization Options | Typical MOQ | Price Range (USD) |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Maoxing Weiye Technology Co., Ltd. | Original IC Chips, MOSFETs, EV Controllers | US $130,000+ | 100% | 28% | ≤2h | Potentiometer, PCB assembly, IC programming, packaging | 1 piece | $1.00–$6.84 |

| Huizhou City Hui Xin Intelligent Technology Co., Ltd. | RFID Silicone Wristbands, Keychains, NFC Tags | US $90,000+ | 93% | 25% | ≤2h | Color, size, logo, label, graphic, packaging | 100 pieces | $0.10–$1.10 |

| Shenzhen Oufade Electronics Co., Ltd. | ICs, Transistors, Microcontrollers, FPGAs | US $40,000+ | 100% | 16% | ≤1h | Limited customization; focus on component distribution | Not specified | N/A |

| Wonik Semicon Co., Ltd. | Silicon Substrates, N/P-Type Wafers | US $2,000+ | 100% | <15% | ≤1h | Wafer diameter (2–8 inch), doping type, thickness | 1 piece | $10.00–$100.00 |

| Zhongshan Maxtor Rubber Products Co., Ltd. | LED Strips with Silicone Encapsulation | US $10,000+ | 100% | 18% | ≤2h | Limited to LED strip form factor and brightness | 100 meters | $0.85–$0.96/meter |

Performance Analysis

Shenzhen Maoxing Weiye stands out for high reorder rates (28%) and extensive customization, including IC programming and PCB assembly, making it ideal for buyers requiring functional modules. Huizhou Hui Xin excels in consumer-facing RFID products with full branding capabilities and competitive pricing, suitable for promotional or access control applications. Wonik Semicon caters to R&D and pilot production needs with low MOQs and precise wafer engineering, though its lower reorder rate suggests limited post-sale engagement. Shenzhen Oufade offers broad inventory depth in discrete semiconductors but minimal customization, positioning it as a volume distributor rather than a design partner.

FAQs

How to verify silicon chip maker reliability?

Request evidence of product authenticity (original vs. recycled components), batch testing reports, and material composition data. Conduct factory audits via video tour to assess handling practices, storage conditions, and anti-static controls. Analyze transaction history through verifiable order metrics such as on-time delivery and customer retention.

What is the typical MOQ for silicon chips?

MOQ varies by product type: bare silicon wafers and ICs often allow 1-piece sampling, while molded silicone RFID items require 100–500 units. High-volume orders typically start at 1,000+ units with tiered pricing.

Can suppliers provide customized programming for IC chips?

Yes, select suppliers offer pre-programming services for RFID/NFC tags, microcontrollers, and memory chips. Confirm compatibility with protocols like ISO14443-A, I²C, or SPI, and request sample data sheets or UID verification logs.

Are silicon-based RFID products RoHS compliant?

Most suppliers adhere to RoHS standards for lead-free materials, especially for EU and North American markets. Request compliance certificates or third-party test results for heavy metal content before large-scale procurement.

How are silicon chip products packaged and shipped?

Sensitive ICs are vacuum-sealed with desiccants and ESD protection. Silicone RFID items are packed in anti-static bags or blister packs. Air freight is recommended for samples (5–10 days); sea freight is cost-effective for bulk shipments (25–40 days).