Silicon Is Which Type Of Semiconductor

Top sponsor listing

Top sponsor listing

About silicon is which type of semiconductor

What Type of Semiconductor Is Silicon?

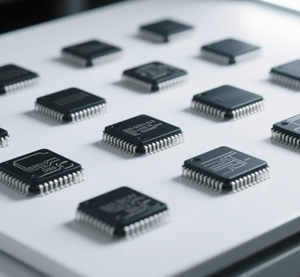

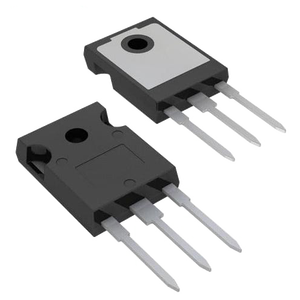

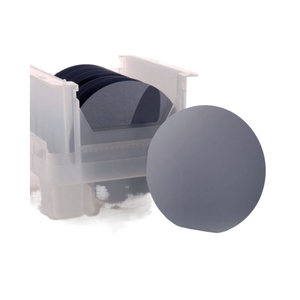

Silicon is an intrinsic **semiconductor**, classified as a **group IV element** in the periodic table, making it the foundational material for over 95% of all commercial semiconductor devices. In its pure crystalline form, silicon exhibits moderate electrical conductivity that increases with temperature—a defining trait of semiconductors. Its bandgap of approximately 1.12 eV at room temperature enables controlled electron flow under applied voltage, thermal excitation, or doping, which makes it ideal for transistors, diodes, integrated circuits (ICs), and photovoltaic cells.

Doping silicon with group III elements (e.g., boron) creates p-type semiconductors, while doping with group V elements (e.g., phosphorus) yields n-type variants. This ability to precisely modulate electrical properties through impurity introduction underpins modern electronics manufacturing. The dominance of silicon stems from its abundance, low cost, excellent thermal stability, and compatibility with scalable fabrication processes such as photolithography and chemical vapor deposition (CVD).

Where to Source Silicon-Based Semiconductor Suppliers?

The global supply chain for silicon semiconductors is anchored in East Asia, particularly China, where vertically integrated production ecosystems support wafer growth, device fabrication, and module assembly. Key suppliers leverage established infrastructure in regions like Zhejiang, Shandong, and Hubei provinces, benefiting from proximity to polysilicon refineries, specialized labor pools, and export logistics hubs.

Suppliers vary significantly in specialization: some focus on raw silicon wafers and ingots, others on discrete components (e.g., thyristors, rectifiers), and a growing number offer advanced modules including SiC (silicon carbide) power devices. Data indicates clustering around dual-capability providers—those combining material processing with packaging and testing services—enabling faster time-to-market and tighter quality control across the value chain.

How to Evaluate Silicon Semiconductor Suppliers?

Effective supplier assessment requires verification across three core dimensions:

Material & Process Capability

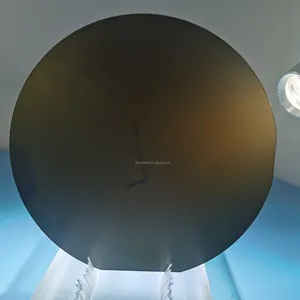

Confirm access to standardized silicon substrates (e.g., monocrystalline, polycrystalline, epitaxial wafers) with specified resistivity (typically 1–10 Ω·cm), thickness tolerance (±5 µm), and surface finish (polished/prime grade). For high-power applications, assess availability of wide-bandgap alternatives like silicon carbide (SiC) wafers. Verify processing methods such as float-zone (FZ) or Czochralski (CZ) crystal growth, critical for achieving carrier purity and uniformity.

Production Capacity and Scalability

Evaluate key indicators:

- Monthly output volume reflected in listing counts (e.g., >100 active SKUs suggests scale)

- Minimum Order Quantity (MOQ) flexibility (range observed: 1–100 pieces)

- Customization capabilities (size, doping type, packaging, labeling)

- Response time (≤6 hours preferred for rapid sourcing cycles)

Cross-reference on-time delivery performance (>95% recommended) and reorder rates to gauge reliability and customer retention.

Quality Assurance and Transaction Security

While formal certifications (ISO 9001, IATF 16949, RoHS) are not explicitly stated in available data, prioritize suppliers demonstrating consistent transaction metrics—such as 100% on-time delivery and documented response times. Where possible, request test reports for carrier mobility, minority carrier lifetime, and leakage current. Use secure payment terms with inspection clauses prior to final disbursement, especially for high-value orders.

Who Are the Leading Silicon Semiconductor Suppliers?

| Company Name | Main Products (Listings) | On-Time Delivery | Reorder Rate | Response Time | Online Revenue | Price Range (Min. Order) | Customization Options |

|---|---|---|---|---|---|---|---|

| Xiangyang Jingyang Electronics Co., Ltd. | Semiconductors (3180), Thyristors (1909) | 75% | 60% | ≤4h | US $30,000+ | $99,999.99 (1 pc) | Yes |

| YIYUE SINGAPORE PTE. LTD. | Semiconductors (350), Modules (51) | - | - | ≤9h | - | $99,999.99 (1 pc) | No |

| Zhejiang Haina Semiconductor Co., Ltd. | Semiconductors (11), Ingots (3) | 100% | - | ≤17h | - | $2–$1,000 (100 pcs / 1 pc) | Yes |

| Zoolied Inc. | Lenses (243), Semiconductors (63) | 100% | 100% | ≤6h | US $1,000+ | $9.87–$59 (25–200 pcs) | Yes |

| Shandong Huamei New Material Technology Co., Ltd. | Ceramic Plates, Wafers, SiC Components | 100% | <15% | ≤1h | US $20,000+ | $15–$99 (1–10 pcs) | Yes |

Performance Analysis

Xiangyang Jingyang Electronics demonstrates extensive product breadth with over 3,000 semiconductor listings, indicating large-scale inventory or distribution capacity, though its 75% on-time delivery rate presents a risk factor for time-sensitive projects. Zoolied Inc. stands out with perfect reorder and on-time delivery records, combined with sub-6-hour responsiveness, suggesting strong operational discipline despite secondary positioning in optics. Zhejiang Haina focuses on upstream materials (ingots, reclaim wafers), offering lower price entry points ($2/piece) suitable for prototyping or small-batch production.

Shandong Huamei specializes in silicon carbide ceramics and customized semiconductor-grade components, serving niche industrial applications requiring high thermal and mechanical resilience. Despite a low reorder rate, its ≤1-hour response time and US $20,000+ revenue signal robust engagement. YIYUE Singapore targets high-value original equipment markets with premium-priced ABB/Hitachi Energy-branded modules, but lack of delivery and reorder metrics introduces uncertainty without third-party validation.

FAQs

Is silicon a direct or indirect bandgap semiconductor?

Silicon is an indirect bandgap semiconductor, meaning electron transitions between valence and conduction bands require both energy and momentum change. This limits its efficiency in light-emitting applications compared to direct bandgap materials like gallium arsenide (GaAs), but does not affect its performance in logic or power electronics.

What are typical lead times for silicon semiconductor orders?

Standard product lead times range from 15–30 days post-payment confirmation. Customized wafers or doped substrates may extend to 45 days depending on process complexity. Expedited fulfillment (within 7–10 days) is feasible with suppliers showing ≤6h response times and verified track records.

Can silicon wafers be recycled or reclaimed?

Yes, reclaimed wafers—used in non-critical testing or polishing processes—are commercially available. Suppliers like Zhejiang Haina list 12-inch reclaim wafers, reducing material costs by up to 70% for qualification runs or training purposes, provided contamination levels meet class 100 cleanroom standards.

Do suppliers offer doping customization?

Select manufacturers provide doping services (n-type with phosphorus/arsenic, p-type with boron) upon request. Confirm resistivity specifications, dopant concentration (in atoms/cm³), and junction depth capability before procurement. Documentation of diffusion or ion implantation processes enhances traceability.

Are silicon carbide (SiC) semiconductors compatible with standard silicon fabrication lines?

While SiC offers superior thermal conductivity and breakdown voltage for high-power systems, it requires specialized processing tools due to hardness and chemical inertness. Hybrid integration with silicon-based control ICs is common, but full SiC module production demands dedicated facilities not universally available among listed suppliers.