Supplier Lifecycle And Performance

About supplier lifecycle and performance

Where to Find Supplier Lifecycle and Performance Solutions?

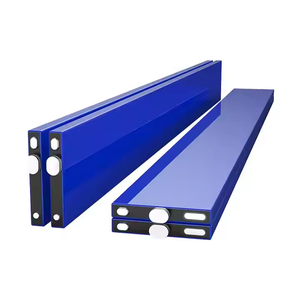

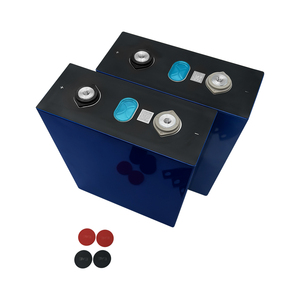

China leads global production of high-cycle-life battery technologies, with key manufacturing clusters in Guangdong and Shandong provinces. Shenzhen and Guangzhou in Guangdong host over 70% of advanced lithium-ion cell producers, leveraging concentrated supply chains for prismatic, cylindrical, and LFP (LiFePO4) chemistries. Shandong’s emerging energy storage hub supports large-format battery production, particularly for long-duration applications requiring 6,000–30,000 life cycles.

These industrial zones benefit from vertically integrated ecosystems—encompassing electrode coating, cell assembly, and pack integration—within compact geographic radii. This enables rapid prototyping, scalable output, and cost efficiency. Buyers access suppliers with monthly production capacities exceeding 500,000 units for cylindrical cells and 100,000+ units for prismatic formats. Lead times average 15–25 days for standard orders, with localized material sourcing reducing BOM costs by 18–25% compared to non-Asian manufacturers.

How to Choose Suppliers Based on Lifecycle and Performance Metrics?

Evaluate potential partners using the following technical and operational benchmarks:

Technical Specifications & Chemistry Validation

Confirm cycle life claims through third-party test reports (e.g., IEC 62620 or GB/T 36276). For LiFePO4 cells, verify depth-of-discharge (DoD) parameters at rated cycle counts (e.g., 6,000 cycles at 80% DoD). Distinguish between laboratory-rated and real-world performance by requesting field degradation data.

Production and Quality Assurance Infrastructure

Assess core capabilities through verifiable indicators:

- Minimum 3,000m² dedicated cleanroom space for cell assembly

- In-house formation and aging lines with automated grading systems

- Compliance with ISO 9001 standards; CE, RoHS, and UN38.3 certifications for export readiness

Cross-reference declared reorder rates (>25%) and on-time delivery records (>97%) as proxies for product reliability and operational consistency.

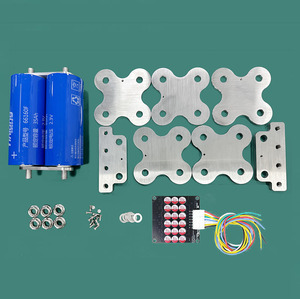

Customization and Scalability Verification

Confirm support for tailored configurations including voltage, capacity, casing material, labeling, and communication protocols (e.g., CAN bus). Prioritize suppliers offering sample validation within 10–14 days and batch traceability via QR coding. Use minimum order quantities (MOQs) as leverage—ranging from 4 pieces for high-value modules to 100+ for commodity-grade cylindrical cells—to negotiate pricing and lead time.

What Are the Leading Suppliers for Lifecycle and Performance-Oriented Batteries?

| Company Name | Location | Main Product Types | Key Chemistries | Max Cycle Life | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue |

|---|---|---|---|---|---|---|---|---|

| Shenzhen Qishou Technology Limited | Shenzhen, CN | Prismatic LiFePO4 Cells, Battery Modules | LiFePO4 | 12,000 cycles | 100% | ≤3h | 25% | US $1.5M+ |

| Shenzhen Topway Technology Co., Ltd. | Shenzhen, CN | Cylindrical, Prismatic, Pouch Cells | LCO, NMC, LiFePO4 | 6,000 cycles | 100% | ≤8h | 30% | US $210K+ |

| Wangheng (Shandong) Information Technology Limited | Shandong, CN | LFP Cells, LTO Batteries | LiFePO4, Lithium Titanate (LTO) | 30,000 cycles (LTO) | 98% | ≤6h | 23% | US $250K+ |

| Shanghai Jinanta New Energy Co., Ltd. | Shanghai, CN | VRLA, LiFePO4 Packs, Power Stations | Lead-Acid, LiFePO4 | 6,000 cycles | 97% | ≤1h | <15% | US $90K+ |

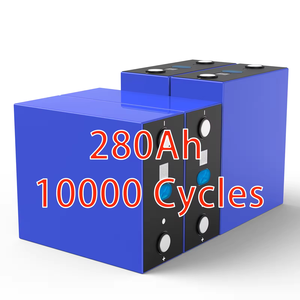

| Guangzhou Unipower Electronics Co., Ltd. | Guangzhou, CN | Deep-Cycle LiFePO4 Batteries, Battery Packs | LiFePO4, A123-type | 10,000 cycles | 100% | ≤4h | <15% | US $20K+ |

Performance Analysis

Shenzhen-based suppliers dominate responsiveness and customization depth, with Qishou and Topway offering high cycle life and flexible MOQs. Wangheng stands out with ultra-long-life LTO technology (30,000 cycles), ideal for high-frequency charge/discharge applications despite higher unit costs. Shanghai Jinanta provides hybrid solutions across lithium and lead-acid platforms but shows lower customer retention. Guangzhou Unipower delivers premium deep-cycle modules with strong technical support, though lower online revenue suggests niche market positioning. Prioritize suppliers with documented cycle testing, in-house R&D, and alignment with application-specific durability requirements.

FAQs

How to verify battery lifecycle claims?

Request full charge/discharge cycle test reports under controlled conditions (temperature, C-rate, DoD). Verify whether data comes from internal labs or accredited third parties. Compare warranty terms—reputable suppliers typically offer 5–10 years or 3,000–7,000 cycles with capacity retention ≥80%.

What are typical MOQs and pricing ranges?

MOQs vary by format: 4–8 pieces for assembled LiFePO4 modules ($15–$115/unit), 100+ pieces for cylindrical cells ($0.17–$7/unit). Prices reflect chemistry, energy density, and testing rigor. Bulk discounts apply above 1,000 units.

Can suppliers support OEM/ODM customization?

Yes, most offer custom labeling, packaging, housing color, and BMS integration. Engineering support includes CAD models, electrical schematics, and prototype builds within 2–3 weeks for validated orders.

What quality control measures should be audited?

Verify presence of incoming material inspection (IMI), in-process quality checks (IPQC), and final testing (FQC). Key processes include vacuum sealing, helium leak testing, and 48-hour aging trials. Demand batch-level traceability and failure mode analysis reports.

Are shipping and export documentation included?

Most suppliers manage air and sea freight under FOB terms. Confirm inclusion of MSDS, UN38.3, and IEC 62133 certificates for hazardous goods compliance. Sea shipment remains optimal for containerized orders due to cost efficiency.