Supplier Positioning Model Explained

CN

CN

1/17

1/17

1/20

1/20

CN

CN

1/5

1/5

1/35

1/35

1/20

1/20

1/3

1/3

About supplier positioning model explained

Where to Find Supplier Positioning Model Suppliers?

China remains the central hub for advanced positioning model manufacturing, with key production clusters in Jiangsu, Shandong, and Beijing offering specialized technological ecosystems. Jiangsu's precision instrument sector leverages proximity to semiconductor and GNSS research centers, enabling integration of high-accuracy RTK and UWB technologies. Shandong’s Jinan region hosts automation-focused manufacturers that combine robotic motion control with industrial-grade positioning systems, supported by localized steel and CNC machining networks. Beijing-based suppliers emphasize R&D-intensive applications in construction site monitoring and personnel tracking, utilizing BeiDou satellite navigation and IoT-enabled sensor arrays.

These regional hubs benefit from vertically integrated supply chains—spanning RF modules, GPS antennas, microcontrollers, and structural components—reducing component lead times by up to 40%. Buyers gain access to agile production environments capable of fulfilling both standardized and engineered-to-order solutions within 15–30 days. Cost efficiencies are notable, with Chinese suppliers achieving 25–35% lower unit pricing compared to European or North American equivalents due to optimized labor and material sourcing structures.

How to Choose Supplier Positioning Model Suppliers?

Procurement decisions should be guided by rigorous evaluation criteria:

Technical Capability Verification

Confirm supplier expertise in core positioning technologies such as RTK (Real-Time Kinematic), UWB (Ultra-Wideband), GNSS, and visual-sensing fusion algorithms. For industrial automation or construction applications, demand documented testing results for accuracy (e.g., ±1cm for RTK systems) and environmental resilience (IP67 rating, operating temperature range). ISO 9001 certification is a baseline indicator of quality management; CE marking is essential for compliance in European markets.

Production and Engineering Capacity

Assess infrastructure maturity through objective metrics:

- Facility size exceeding 2,000m² indicates scalable operations

- In-house design teams specializing in wireless communication and embedded systems

- CNC machining, welding, and surface treatment capabilities on-site

Cross-reference these with performance data: prioritize suppliers maintaining ≥99% on-time delivery and sub-4-hour average response times.

Customization and Transaction Security

Evaluate flexibility for OEM/ODM requests including logo imprinting, color variation, packaging redesign, and software interface modifications. Require secure transaction frameworks—preferably third-party escrow or platform-backed payment protection. Conduct sample validation to verify positional accuracy under real-world conditions before scaling orders.

What Are the Best Supplier Positioning Model Suppliers?

| Company Name | Location | Verified Type | Main Products | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue | Price Range (USD) |

|---|---|---|---|---|---|---|---|---|

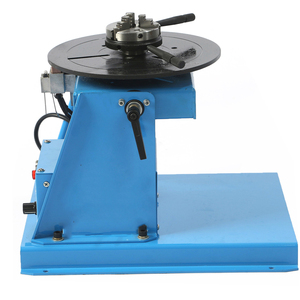

| Kassel (Jinan) Automation Technology Co., Ltd. | Shandong, CN | Custom Manufacturer | Single/Dual-Axis Positioners, Linear Guides | 100% | ≤1h | - | - | $3,542–6,471 |

| Jiangsu Bangjie Trading Co., Ltd. | Jiangsu, CN | Multispecialty Supplier | GPS RTK Systems, Visual Positioning Devices | 99% | ≤2h | 24% | US $690,000+ | $1,800–5,800 |

| Feichi Intelligent Control IoT Equipment (Suzhou High-Tech Zone) Co., Ltd. | Jiangsu, CN | - | RTK GPS Modules, Drone Positioning Units | 76% | ≤5h | 25% | US $40,000+ | $105–150 |

| Beijing Huaxing Beidou Intelligent Control Technology Co., Ltd. | Beijing, CN | - | UWB Personnel Tracking, Vehicle Positioning | 100% | ≤4h | 66% | US $7,000+ | $68.63–210 |

| Xiangjing (Shanghai) Mechanical And Electrical Tech Co., Ltd. | Shanghai, CN | Multispecialty Supplier | Robotic Positioners, H/U-Type Welding Turntables | 100% | ≤7h | 20% | US $50,000+ | $1,000–10,000 |

Performance Analysis

Kassel (Jinan) and Xiangjing (Shanghai) demonstrate strong engineering focus with robust single/dual-axis positioner portfolios priced above $3,500, suitable for heavy industrial automation. Jiangsu Bangjie offers competitively priced GPS-RTK systems ($1,800–5,800), backed by high online revenue and reliable delivery performance. Beijing Huaxing stands out in niche safety-critical applications, achieving a 66% reorder rate through dependable UWB-based personnel tracking at sub-$210 price points. While Feichi provides low-cost drone positioning modules, its 76% on-time delivery rate presents higher fulfillment risk. Prioritize suppliers with ≥99% delivery reliability and in-house technical support when deploying mission-critical positioning infrastructure.

FAQs

How to verify supplier positioning model accuracy claims?

Request test reports showing field-calibrated deviation under dynamic conditions. For RTK/UWB systems, validate centimeter-level precision using independent measurement tools. Insist on firmware version documentation and update protocols to ensure long-term signal stability.

What is the typical MOQ and lead time?

Standard models typically require 1 unit as minimum order quantity (MOQ), with lead times ranging from 10–25 days depending on complexity. Custom configurations may extend timelines to 35 days. Expedited production is available from select suppliers with dedicated assembly lines.

Can suppliers integrate positioning models into existing systems?

Yes, many suppliers offer API access, SDKs, or protocol compatibility (Modbus, NMEA 0183) for seamless integration with SCADA, BIM, or fleet management platforms. Confirm interface specifications during technical onboarding.

Do manufacturers support global shipping and compliance?

Established suppliers manage international logistics via air or sea freight under FOB or CIF terms. Ensure product conformity with regional regulations (FCC, CE, RoHS) and confirm inclusion of necessary export documentation.

Are samples available for performance testing?

Most suppliers provide samples at full or partial cost, refundable upon bulk order placement. Allow 7–14 days for sample production and an additional 5–10 days for international delivery via express carriers.