Supplier Segmentation Risk Reduction

CN

CN

CN

CN

About supplier segmentation risk reduction

Where to Find Supplier Segmentation Risk Reduction Solutions?

Supplier segmentation and risk reduction services are increasingly centralized in China’s industrial hubs, particularly in Fujian, Henan, and Guangdong provinces. These regions host specialized supply chain firms and manufacturing integrators that combine logistics infrastructure with advanced procurement analytics. Xiamen and Zhengzhou have emerged as key nodes for integrated sourcing solutions, offering proximity to port facilities and mature ecosystems of component suppliers, quality auditors, and export compliance specialists.

The clustering enables operational efficiencies through shared resources—such as third-party inspection networks and regional warehousing—reducing lead times by 20–30% compared to decentralized sourcing models. Buyers benefit from vertically aligned service providers capable of managing multi-tier supplier qualification, performance monitoring, and contingency planning. With average online transaction volumes exceeding US $10,000 annually per supplier, the market demonstrates strong commercial activity and digital engagement, facilitating transparent evaluation of historical performance metrics such as on-time delivery and reorder rates.

How to Choose Supplier Segmentation Risk Reduction Partners?

Selecting effective partners requires systematic assessment across three core dimensions:

Performance Transparency

Prioritize suppliers publishing verifiable operational data. Key indicators include on-time delivery rates (target ≥98%), response times under 5 hours, and reorder rates above 25%, which correlate with client satisfaction and service consistency. Suppliers disclosing real-time transaction volume (e.g., US $490,000+ annual online revenue) offer greater accountability.

Operational Capabilities

Evaluate breadth of service integration:

- Proven experience in supplier classification frameworks (e.g., critical/strategic/standard categorization)

- Implementation of risk scoring models based on financial stability, geographic exposure, and compliance history

- Demonstrated use of digital tools for supplier monitoring and audit trail generation

Cross-reference claims with available product listings tied to specific risk mitigation services or DDP fulfillment structures.

Customization & Compliance Support

Confirm capability to adapt segmentation strategies to regional regulatory environments (e.g., EU, Middle East, Australia). Verify support for customized reporting, language localization, and labeling requirements. For high-risk categories, demand evidence of structured contingency sourcing plans and alternative supplier pipelines.

What Are the Leading Supplier Segmentation Risk Reduction Providers?

| Company Name | Main Products/Services | On-Time Delivery | Reorder Rate | Response Time | Online Revenue | Verification Status |

|---|---|---|---|---|---|---|

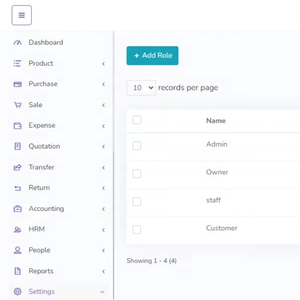

| Xiamen Tesen Supply Chain Co., Ltd. | Dropshipping Agent, DDP Fulfillment, Sourcing | 100% | 66% | ≤5h | US $10,000+ | Trusted service provider |

| US Huitong Pipeline Equipment CoLtd | Flanges, Nickel Pipe Fittings, Stainless Steel Pipes | - | - | ≤3h | - | - |

| Zhengzhou Huitong Pipeline Equipment Co., Ltd. | Pipe Fittings, Flanges, Stainless Steel Sheets | 100% | 20% | ≤8h | US $10,000+ | - |

| Hangzhou Gemai Electronics Co., Ltd. | Weighing Scales, Indicators, Custom Electronic Devices | 100% | <15% | ≤3h | US $490,000+ | Multispecialty Supplier |

| Foshan Hoyu Pipeline Technology Co., Ltd. | Pipe Fittings, Ball Valves, Flanges, Clamps | 100% | 28% | ≤1h | US $110,000+ | - |

Performance Analysis

Xiamen Tesen stands out with a 66% reorder rate and full on-time delivery record, indicating strong client retention and execution reliability. Hangzhou Gemai Electronics reports the highest transaction volume (US $490,000+), reflecting extensive market reach despite a lower reorder rate, suggesting transactional rather than long-term contract engagement. Foshan Hoyu excels in responsiveness (≤1h) and maintains a solid 28% reorder rate, positioning it well for time-sensitive procurement cycles. While several suppliers report 100% on-time delivery, absence of reorder data in some cases limits insight into sustained performance. US Huitong and Zhengzhou Huitong focus on industrial components but lack comprehensive public performance metrics, increasing due diligence requirements.

FAQs

How to verify supplier segmentation and risk reduction capabilities?

Request documented case studies showing implementation of supplier tiering models, risk assessment matrices, or dual-sourcing strategies. Validate integration with logistics systems (e.g., DDP shipping records) and confirm access to real-time supplier performance dashboards.

What is the typical minimum order quantity (MOQ)?

MOQ varies by service type: logistics and sourcing agents may require as little as 1 kg or 1 piece, while bulk material suppliers often set thresholds at 10–12 kilograms or per-case units. Service-based MOQs are typically project- or volume-dependent rather than unit-based.

Do these suppliers support international compliance standards?

Leading providers demonstrate adherence through DDP (Delivered Duty Paid) shipping options and region-specific fulfillment (e.g., Germany, Australia, Middle East). Confirm alignment with destination regulations including import licensing, customs brokerage, and product conformity requirements.

Can buyers request customization in risk mitigation frameworks?

Yes, select suppliers offer tailored reporting, language support, labeling, and packaging adjustments. Hangzhou Gemai, for example, lists customization options for print materials, logo integration, and sensor configurations, indicating capacity for process-level adaptation.

What are the lead times for implementing a segmented supplier strategy?

Standard implementation ranges from 15–30 days depending on complexity. Expedited assessments (e.g., single-category sourcing) can be completed within 10 days. Allow additional time for sample validation, legal documentation, and integration with existing procurement systems.