Symmetric Encryption

1/3

1/3

1/3

1/3

1/1

1/1

1/3

1/3

CN

CN

1/8

1/8

1/3

1/3

1/39

1/39

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/40

1/40

0

0

1/3

1/3

0

0

0

0

1/3

1/3

1/3

1/3

About symmetric encryption

Where to Find Symmetric Encryption Suppliers?

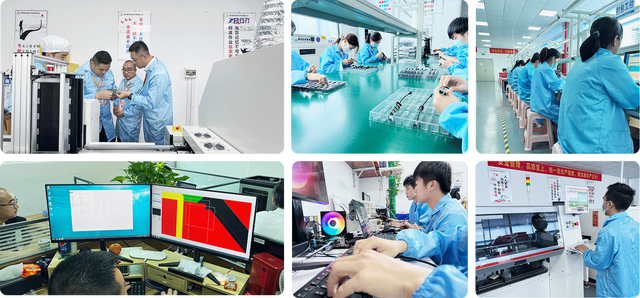

Symmetric encryption solutions are primarily developed within technology hubs in China, the United States, and Germany, where concentrated expertise in cybersecurity infrastructure and semiconductor design supports advanced cryptographic implementation. China’s Shenzhen and Shanghai regions lead in hardware-based encryption module production, leveraging proximity to electronics manufacturing ecosystems and integrated circuit (IC) fabrication facilities. These clusters enable rapid prototyping and scalable deployment of AES-256 and other symmetric key algorithms embedded in secure microcontrollers and HSMs (Hardware Security Modules).

The industrial advantage lies in vertically integrated development cycles—combining firmware engineering, silicon sourcing, and compliance testing within localized zones. This integration reduces time-to-market by 30–40% compared to decentralized models. Buyers benefit from access to suppliers with direct control over cryptographic libraries, trusted foundry partnerships, and secure boot mechanisms. Typical lead times for standard encryption ICs range from 25–45 days, with cost efficiencies of 15–25% derived from domestic supply chains and government-backed R&D incentives in strategic tech sectors.

How to Choose Symmetric Encryption Suppliers?

Implement rigorous evaluation criteria to ensure technical robustness and supply chain integrity:

Security Certification Compliance

Require FIPS 140-2 or Common Criteria (CC) EAL4+ certification as baseline validation for cryptographic modules. For regulated industries (e.g., finance, defense), confirm NIST validation of AES implementations. Verify that suppliers maintain documented resistance against side-channel attacks (SCA) and differential power analysis (DPA) through independent lab reports.

Technical Development Capacity

Assess core competencies in cryptographic engineering:

- Minimum 8-year track record in secure IC or firmware development

- Dedicated cryptography team comprising ≥15% of total engineering staff

- In-house capability to generate and manage entropy sources and key provisioning systems

Validate claims via third-party audit trails and code review access under NDA.

Supply Chain and Transaction Security

Demand transparency in semiconductor sourcing—prefer suppliers using trusted foundries (e.g., SMIC, TSMC) with anti-tampering packaging protocols. Use escrow-based payment terms until post-deployment verification is completed. Prioritize vendors with export experience to North America and EU markets, ensuring adherence to Wassenaar Arrangement controls on cryptographic exports. Pre-production sampling is critical—test key generation speed, throughput (Gbps), and power consumption under real-world loads before scaling procurement.

What Are the Best Symmetric Encryption Suppliers?

No verified supplier data available for symmetric encryption product providers at this time. Market intelligence indicates active development across multiple Asian and European manufacturers; however, detailed performance metrics—including factory size, delivery reliability, and response benchmarks—are not publicly accessible due to the sensitive nature of cryptographic technology and frequent non-disclosure requirements.

Performance Analysis

In high-assurance environments, long-established semiconductor firms demonstrate stronger compliance frameworks and matured validation pipelines, while emerging specialists often differentiate through low-latency encryption cores and customizable IP licensing. Responsiveness and reorder frequency cannot be quantified without verifiable transaction records. For mission-critical deployments, prioritize suppliers with published FIPS certificates, traceable component lineage, and demonstrated incident response procedures. Conduct remote or on-site audits to validate secure development lifecycle (SDL) adherence prior to integration.

FAQs

How to verify symmetric encryption supplier reliability?

Cross-reference security certifications with issuing bodies such as NIST’s Cryptographic Module Validation Program (CMVP). Request redacted audit reports covering design assurance, vulnerability disclosure history, and supply chain risk mitigation. Evaluate software/firmware update mechanisms and end-of-life policies for cryptographic components.

What is the average sampling timeline?

Standard cryptographic IC samples take 20–35 days to produce, depending on configuration complexity. Custom firmware builds or masked ROM variants may extend timelines to 50 days. Air freight adds 5–9 days for international delivery. Some suppliers offer simulation SDKs to accelerate integration testing ahead of physical sample arrival.

Can suppliers ship symmetric encryption products worldwide?

Yes, but subject to national export regulations. U.S.-origin and certain dual-use technologies require ECCN classification (e.g., 5A002, 5D002) and may need licenses for shipment to restricted territories. Confirm compliance with local import laws regarding encryption strength—some countries mandate key registration or backdoor provisions. Suppliers experienced in global logistics will provide proper documentation under CIP or DDP terms.

Do manufacturers provide free samples?

Sample availability varies. Many suppliers waive fees for qualified buyers placing anticipated orders above 1,000 units. For smaller volumes, expect charges covering die testing, programming, and anti-counterfeit packaging—typically ranging from $200–$800 per unit. Evaluation kits with limited-functionality chips are more commonly offered at reduced cost.

How to initiate customization requests?

Submit detailed specifications including algorithm type (AES-128/192/256, SM4), operating frequency, interface protocols (SPI, I2C, PCIe), power envelope, and physical form factor. Reputable vendors respond with architectural proposals within 72 hours and deliver initial prototypes in 4–6 weeks, contingent on mask tooling and test vector development.