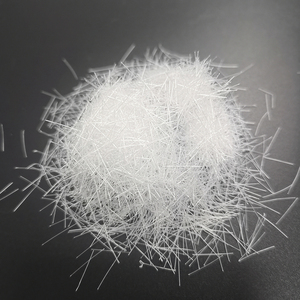

Synthetic Fibres Examples

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/13

1/13

0

0

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/1

1/1

1/17

1/17

1/3

1/3

1/3

1/3

0

0

1/3

1/3

1/3

1/3

About synthetic fibres examples

Where to Find Synthetic Fibres Examples Suppliers?

China leads global production of synthetic fibres, with key manufacturing clusters concentrated in Henan and Guangdong provinces. These regions specialize in differentiated fibre applications—from human hair alternatives to industrial reinforcement materials—leveraging localized supply chains and technical expertise. Xuchang in Henan has emerged as a dominant hub for synthetic hair products, hosting over 1,200 specialized manufacturers that benefit from vertically integrated dyeing, texturing, and braiding facilities. Meanwhile, Guangdong’s Pearl River Delta supports advanced polymer processing, enabling cost-efficient extrusion and spinning of polypropylene and other chemical fibres used in construction and cosmetics.

The clustering effect enables rapid prototyping and scalable output, with many suppliers operating end-to-end production lines capable of fulfilling both small trial orders and bulk contracts exceeding several tons monthly. Buyers access ecosystems where raw material sourcing, filament engineering, and finishing operations are co-located within 50km radii, reducing lead times by up to 30%. Key advantages include MOQ flexibility (from single pieces to multi-ton batches), competitive pricing driven by economies of scale, and growing customization capabilities across fibre texture, color, diameter, and performance additives.

How to Choose Synthetic Fibres Examples Suppliers?

Evaluate potential partners using the following verification criteria:

Material & Application Expertise

Confirm supplier specialization aligns with intended use. Hair-grade synthetic fibres require precise denier control, heat resistance, and UV stability, while construction-grade polypropylene fibres demand high tensile strength (>500 MPa) and alkali resistance for concrete integration. Request technical data sheets detailing polymer composition (e.g., PET, PAN, PP), filament linear density (measured in dtex), and durability testing results under relevant environmental conditions.

Production Capacity and Scalability

Assess infrastructure maturity through verifiable metrics:

- Minimum monthly output capacity of 10+ metric tons for industrial fibres

- In-house extrusion, drawing, crimping, and cutting capabilities for full process control

- Dedicated R&D teams focused on fibre modification (e.g., anti-static, flame-retardant variants)

Cross-reference online transaction volumes with on-time delivery rates (target ≥95%) to validate operational reliability.

Quality Assurance and Transaction Security

Prioritize suppliers with documented quality management systems. While ISO 9001 certification is not universally held among smaller exporters, consistent on-time delivery (100% reported by top-tier suppliers) and reorder rates above 20% indicate dependable performance. Utilize secure payment mechanisms such as trade assurance programs, and insist on pre-shipment inspection protocols—especially when procuring for regulated markets requiring compliance with REACH, RoHS, or ASTM standards.

What Are the Leading Synthetic Fibres Examples Suppliers?

| Company Name | Main Products | Price Range (USD) | Min. Order Quantity | On-Time Delivery | Avg. Response Time | Reorder Rate | Online Revenue | Customization Options |

|---|---|---|---|---|---|---|---|---|

| Xuchang Mingshow Industrial Co., Ltd. | Braiding Hair, Wigs, Training Heads | $0.61–19.90 | 1–10 pcs/packs | 100% | ≤5h | 22% | US $130,000+ | Color, style, packaging |

| Xuchang Yuanyao Hair Products Co., Ltd. | Braiding Hair, Ponytails | $0.65–3.00 | 3–10 packs | 100% | ≤7h | <15% | US $40,000+ | Pre-stretched, ombre, curl pattern |

| Henan Fuluorui New Materials Co., Ltd. | Polypropylene Fibres for Concrete | $0.45–0.60/kg | 1,000 kg | 75% | ≤5h | <15% | US $1,000+ | Fibre length, dosage form |

| Fully Cosmetic (GZ) Co., Limited | Synthetic Hair Building Fibers | $2.98/unit | 240 pcs | 100% | ≤4h | 50% | US $140,000+ | Color, bulk volume, labeling |

| Xuchang Morgan Hair Products Co., Ltd. | Synthetic Hair Extensions, Packs | $2.20–13.00 | 1–10 packs | 100% | ≤2h | 18% | US $590,000+ | Color, size, logo, packaging |

Performance Analysis

Suppliers like Xuchang Morgan and Fully Cosmetic demonstrate strong buyer retention, supported by high responsiveness (≤2h average) and flexible MOQs suitable for niche distributors. Fully Cosmetic stands out with a 50% reorder rate, indicating consistent product satisfaction in the cosmetic fibre segment. Industrial fibre suppliers such as Henan Fuluorui offer low per-kilogram pricing but exhibit lower on-time delivery performance (75%), suggesting logistical or production bottlenecks. Xuchang-based companies dominate the hair-fibre market with comprehensive customization, including pre-stretched braids and ombre coloring, while maintaining 100% on-time delivery records. For high-volume procurement, prioritize suppliers with verified revenue streams exceeding US $100,000 annually and response times under 5 hours to ensure post-order support efficiency.

FAQs

How to verify synthetic fibres supplier reliability?

Cross-check claimed production capabilities with available documentation such as facility photos, machinery lists, and export licenses. Analyze transaction history via verifiable revenue metrics and customer feedback focusing on product consistency and communication reliability. For industrial applications, request test reports validating mechanical properties (e.g., elongation at break, modulus of elasticity).

What is the typical sampling timeline for synthetic fibres?

Standard samples are typically dispatched within 5–7 days after confirmation. Complex customizations (e.g., specific denier profiles or additive formulations) may require 10–14 days. Air freight adds 3–7 days for international delivery. Some suppliers offer free samples contingent upon subsequent order placement.

Can synthetic fibre suppliers accommodate OEM/ODM requests?

Yes, multiple suppliers listed provide full customization services, including private labeling, bespoke packaging, and tailored physical properties. Minimum thresholds vary: hair fibre suppliers often accept branding changes from 1-pack orders, whereas industrial fibre producers may require minimum runs of 500–1,000 kg for formulation adjustments.

What are common MOQs for different synthetic fibre types?

Consumer-grade hair fibres and wigs are available from 1 piece or pack, facilitating low-risk entry for resellers. Industrial polypropylene fibres typically require 1,000 kg minimums due to batch processing constraints. Cosmetic building fibres often have higher MOQs (e.g., 240 units) to optimize packaging efficiency.

Are there certifications relevant to synthetic fibre exports?

While not all suppliers hold formal ISO certifications, compliance with destination-market regulations is critical. Textile fibres should meet REACH and OEKO-TEX® standards for restricted substances. Construction-grade fibres must demonstrate compatibility with ASTM C1116 or EN 14889-1 for use in reinforced concrete. Always request test certificates prior to shipment.