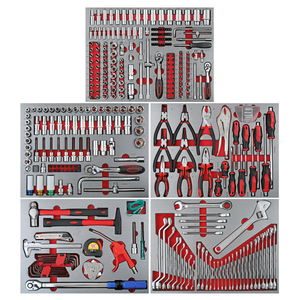

Tool Box With Tool Set

0

0

0

0

1/3

1/3

1/15

1/15

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/1

1/1

1/3

1/3

0

0

1/3

1/3

1/2

1/2

About tool box with tool set

Where to Find Tool Box with Tool Set Suppliers?

China leads global production of tool boxes with integrated tool sets, with concentrated manufacturing hubs in Zhejiang, Jiangsu, and Guangdong provinces. These regions host vertically integrated supply chains combining metal fabrication, injection molding, and assembly operations within compact industrial zones. Zhejiang’s Yongkang district, known as China’s hardware capital, produces over 70% of the nation’s hand tools and storage solutions, supported by localized access to cold-rolled steel, ABS plastic, and powder coating materials.

Suppliers in these clusters benefit from economies of scale and proximity to component manufacturers, reducing material procurement lead times by 25–40% compared to offshore alternatives. Integrated facilities enable rapid prototyping and batch production, with standard order fulfillment averaging 25–35 days. Buyers gain access to diverse product tiers—from economy-grade tool kits for retail distribution to professional-duty sets compliant with international ergonomics and durability standards. Export-oriented suppliers typically maintain stock-to-order flexibility, accommodating MOQs from 100 units for customized configurations to 1,000+ units for container-load efficiency.

How to Choose Tool Box with Tool Set Suppliers?

Implement structured evaluation criteria to ensure supplier reliability and product consistency:

Quality Management Systems

Verify ISO 9001 certification as a baseline for process control. For markets requiring regulatory compliance, confirm CE marking (EU), RoHS adherence (electronics components in multi-tool sets), or ANSI/ASME alignment for tool specifications. Request test reports on critical performance metrics: tool hardness (HRC 50–60 for chrome vanadium steel), corrosion resistance (48–96hr salt spray testing for coated surfaces), and structural integrity of tool box hinges and latches (tested to 10,000+ open/close cycles).

Production Infrastructure Assessment

Evaluate operational capacity through key indicators:

- Minimum 3,000m² factory area to support stamping, CNC machining, and automated assembly lines

- In-house tooling capabilities for mold development and die-casting processes

- On-site quality labs equipped for material spectrometry, torque testing, and drop impact validation

Cross-reference facility size with monthly output capacity—leading suppliers report 20,000+ units per month—with delivery reliability exceeding 97%.

Procurement Risk Mitigation

Utilize third-party inspection services (e.g., SGS, BV) for pre-shipment audits covering packaging integrity, labeling accuracy, and tool dimensional conformity. Prioritize suppliers offering sample validation under real-world usage conditions. Negotiate payment terms using milestone-based structures, releasing balances only after successful quality verification at destination. Confirm export experience with documentation proficiency in HS code classification (e.g., 8205.40 for tool sets) and customs compliance for target markets.

What Are the Best Tool Box with Tool Set Suppliers?

No supplier data is currently available for detailed comparison. Buyers are advised to initiate sourcing inquiries with verified manufacturers in core industrial zones, focusing on those demonstrating documented production capabilities, quality certifications, and responsive communication channels. Due diligence should include video audits of assembly lines, material sourcing traceability, and historical performance metrics such as on-time delivery rates and customer reorder frequency.

Performance Analysis

In absence of specific supplier profiles, procurement strategy should emphasize scalability and compliance readiness. Suppliers operating facilities above 5,000m² with dedicated R&D teams are better positioned to support customization, including ergonomic redesigns, branded packaging, and modular tray configurations. Responsiveness remains a critical differentiator—top-tier partners typically respond to technical inquiries within 2 hours and provide prototype samples within 10–14 days. Prioritize manufacturers with proven export logistics networks capable of managing FOB, CIF, or DDP shipments with accurate incoterm execution.

FAQs

How to verify tool box and tool set supplier reliability?

Validate certifications through issuing bodies and request audit trails covering raw material sourcing, heat treatment processes, and final inspection protocols. Analyze customer feedback focused on long-term tool wear, box durability under transport stress, and accuracy of included tool specifications. Third-party factory assessments provide objective insights into operational maturity.

What is the average sampling timeline?

Standard sample production takes 7–14 days. Customized versions with engraved branding, unique tray layouts, or specialized tool assortments require 15–21 days. Air freight adds 5–10 days depending on destination region.

Can suppliers ship tool sets worldwide?

Yes, established manufacturers support global distribution via sea and air freight. Confirm compliance with import regulations related to metal content, packaging materials (ISPM 15 for wooden pallets), and labeling requirements (language-specific user manuals, safety warnings). Most suppliers offer door-to-door logistics coordination under major incoterms.

Do manufacturers provide free samples?

Sample policies vary. Some suppliers waive fees for qualified buyers committing to minimum order volumes (typically 500+ units). Otherwise, expect to cover 30–60% of unit cost plus shipping, refundable against first production order.

How to initiate customization requests?

Submit detailed specifications including box dimensions, preferred steel grade (e.g., Cr-V or S2 alloy), tray configuration (EVA, PE, or molded foam), and packaging design files. Reputable suppliers respond with CAD drawings within 72 hours and deliver functional prototypes within three weeks.