Vendor Managed Inventory System

CN

CN

CN

CN

About vendor managed inventory system

Where to Find Vendor Managed Inventory System Suppliers?

Global supplier concentration for vendor managed inventory (VMI) systems is centered in China and Southeast Asia, with key players emerging from Guangdong, Jiangsu, and Malaysia. These regions host integrated technology ecosystems combining software development, IoT hardware manufacturing, and cloud infrastructure support. Chinese suppliers benefit from mature industrial clusters that enable rapid prototyping and deployment of scalable VMI solutions, particularly in smart warehousing and retail automation sectors.

The supply chain advantage stems from co-location of software developers, electronic component manufacturers, and logistics integrators within 100km radii, reducing integration lead times by up to 40%. Buyers gain access to modular systems incorporating barcode scanning, RFID tracking, POS integration, and real-time analytics dashboards. Pricing models vary significantly—from entry-level SaaS platforms at $10–$20 per unit to enterprise-grade automated storage systems exceeding $10,000 per installation—enabling flexibility across SMEs and large-scale operations.

How to Choose Vendor Managed Inventory System Suppliers?

Evaluate suppliers using the following technical and operational criteria:

System Integration & Technical Compliance

Confirm compatibility with existing ERP or POS environments. Prioritize suppliers offering API documentation and middleware support for seamless data synchronization. For international deployments, ensure compliance with regional data protection standards such as GDPR or CCPA where applicable. Verify uptime guarantees (target ≥99.5%) and cybersecurity protocols including encryption and role-based access control.

Production and Development Capability

Assess technical infrastructure through documented evidence:

- Minimum 2-year track record in inventory management software or hardware systems

- Dedicated R&D teams focused on IoT, cloud computing, or supply chain automation

- In-house coding, testing, and deployment pipelines for software iterations

Cross-reference online revenue metrics (>US $60,000 annual platform sales) and reorder rates (<15% indicates low customer churn) as indicators of product reliability and market acceptance.

Customization and Transaction Safeguards

Require clear specifications on customization scope—including UI branding, reporting modules, and hardware configuration (e.g., cabinet size, material, labeling). Use secure payment mechanisms such as escrow services until system validation is completed. Conduct pilot testing with a single-unit deployment before scaling procurement, evaluating performance across order accuracy, stock replenishment speed, and user interface responsiveness.

What Are the Best Vendor Managed Inventory System Suppliers?

| Company Name | Location | Main Products | Price Range (Min. Order) | On-Time Delivery | Avg. Response | Online Revenue | Reorder Rate |

|---|---|---|---|---|---|---|---|

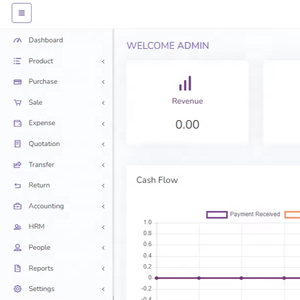

| KAEM SOFTWARES PRIVATE LIMITED | India | Inventory Management Software, POS Systems | $95 (1–2 units) | Not specified | ≤2h | US $8,000+ | Not specified |

| SERVEDECK INNOVATION SDN. BHD. | Malaysia | Cloud-Based Inventory & Contract Management | $10–20 (5 units) | Not specified | ≤2h | Not specified | Not specified |

| Monolith Electric (Changzhou) Co., Ltd. | Jiangsu, CN | IoT-Enabled Automated Warehousing Systems | $3,000–16,000 (1 set) | 90% | ≤5h | US $100,000+ | <15% |

| Global Health Technology & Services Co., Ltd. | Guangdong, CN | Smart Warehouse & Industrial Vending Systems | $1,799–4,599 (1 piece) | 100% | ≤1h | US $60,000+ | <15% |

| Guangzhou Mohang Times Info Tech Limited | Guangdong, CN | POS + Inventory Software, Warehouse Management | $30–65 (1–2 sets) | 100% | ≤11h | US $10,000+ | 37% |

Performance Analysis

Chinese suppliers dominate high-value, hardware-integrated VMI systems, with Monolith Electric and Global Health Technology offering fully automated solutions backed by strong delivery performance (90–100%) and significant online revenue ($60K–$100K+). Their systems are optimized for industrial environments requiring precision inventory tracking and minimal manual intervention. In contrast, Indian and Malaysian suppliers like KAEM and SERVEDECK focus on affordable software-centric models ideal for small retailers and service providers seeking cloud-based contract and billing management. Guangzhou Mohang stands out for mid-tier POS-integrated systems but shows a higher reorder rate (37%), suggesting potential gaps in long-term customer satisfaction or system scalability. Buyers prioritizing responsiveness should consider Global Health Technology (≤1h response) or KAEM/SERVEDECK (≤2h).

FAQs

How to verify vendor managed inventory system reliability?

Cross-check functional claims with demonstrable case studies or video demonstrations of live installations. Request trial access to software interfaces and validate update frequency, error logging, and alerting mechanisms. For hardware systems, inspect build quality through HD imagery or third-party inspection reports covering materials, safety ratings, and power consumption.

What is the typical implementation timeline?

Software-only deployments can be operational within 3–7 days post-purchase. Integrated hardware-software systems require 15–30 days for manufacturing, configuration, and shipping. Complex customizations involving AI-driven forecasting or multi-node warehouse networks may extend timelines to 45 days.

Can suppliers support global deployments?

Yes, established suppliers offer multilingual interfaces and multi-currency/multi-tax zone support. Confirm server hosting locations for latency optimization and regulatory compliance. Most vendors support air or sea freight shipping with FOB terms; buyers must arrange last-mile delivery and local technical setup unless otherwise contracted.

Do suppliers offer free trials or samples?

Many software providers allow time-limited demo accounts (7–14 days). Hardware sampling is less common due to cost but available upon request—typically at 30–50% of unit price, redeemable against bulk orders. Some suppliers waive fees for qualified buyers committing to minimum purchase volumes.

How extensive is customization support?

Top-tier suppliers support full customization: color, material, logo imprinting, packaging, and UI/UX branding. Software modifications include report templates, integration APIs, and permission hierarchies. Submit detailed technical requirements early in negotiations to assess feasibility and avoid scope creep during implementation.