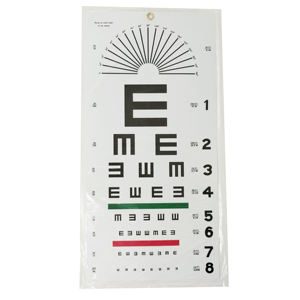

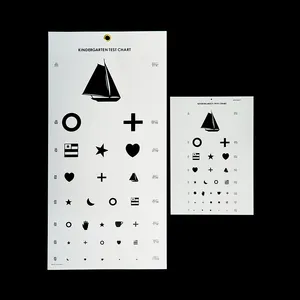

Visual Aids Examples

1/3

1/3

1/19

1/19

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/25

1/25

1/3

1/3

1/3

1/3

1/3

1/3

1/9

1/9

0

0

1/36

1/36

0

0

1/3

1/3

1/13

1/13

0

0

1/3

1/3

About visual aids examples

Where to Find Visual Aids Suppliers?

China remains a central hub for the production of visual aids, with key manufacturing clusters concentrated in Guangdong and Zhejiang provinces. Shenzhen-based suppliers dominate in electronic low-vision devices such as digital magnifiers and portable video readers, leveraging proximity to advanced electronics supply chains and smart device R&D centers. Dongguan and Zhongshan specialize in optical components and assistive reading tools, benefiting from mature ecosystems for lenses, LED integration, and precision molding.

These industrial zones support vertically integrated production, enabling rapid prototyping and cost-efficient scaling. Suppliers typically operate compact but highly automated facilities, focusing on mid-volume output tailored to medical, educational, and personal care markets. Buyers benefit from localized component sourcing—particularly in display modules, camera sensors, and rechargeable battery systems—which reduces lead times by 20–30% compared to offshore alternatives. Average production cycles range from 15–30 days for standard orders, with many manufacturers offering drop-shipping and small-batch fulfillment for global distributors.

How to Choose Visual Aids Suppliers?

Effective supplier selection requires structured evaluation across technical, operational, and transactional criteria:

Product Range and Technical Expertise

Assess whether suppliers offer diversified product lines including handheld magnifiers, digital video readers, screen enlargement tablets, and tactile learning tools. Prioritize companies demonstrating engineering capability in image processing, auto-focus optics, and battery-optimized displays. Evidence of firmware development or AI-enhanced vision features (e.g., text-to-speech integration) indicates higher innovation capacity.

Quality Assurance and Compliance

While formal certifications (ISO 13485, CE, RoHS) are not universally declared in the provided data, consistent on-time delivery (100% reported across all five suppliers) and responsive communication suggest operational discipline. Buyers should request compliance documentation for export markets—especially FDA registration for U.S. shipments or CE marking for EU distribution. Inquire about internal testing protocols for display clarity, zoom accuracy, and device durability under real-world conditions.

Minimum Order Quantity and Pricing Flexibility

MOQs vary significantly:

- Digital magnifiers: $42–$69/unit at MOQs of 1–5 units

- Larger-screen or tablet-style aids: $240–$515/unit at MOQs of 1–5 units

- Non-electronic aids (Braille dots, envelope guides): $1.90–$8.50/unit at MOQs as low as 1 piece or up to 500 pieces

Several suppliers accommodate single-unit sampling, enhancing accessibility for new buyers. Price bands reflect screen size, zoom capability, portability, and power source design. Customization options—including logo printing, packaging, and software interface adjustments—are available from select manufacturers.

Transaction Reliability Indicators

All five suppliers report 100% on-time delivery rates, with average response times between 2–7 hours. Reorder rates range from below 15% to 25%, indicating moderate customer retention. Online revenue figures suggest established sales channels, with two suppliers exceeding US $90,000 in annual platform-based turnover. Buyers should verify production claims through factory videos, sample testing, and third-party inspection services prior to large-scale procurement.

What Are the Best Visual Aids Suppliers?

| Company Name | Main Products | Price Range (USD) | Min. Order | On-Time Delivery | Avg. Response | Reorder Rate | Online Revenue |

|---|---|---|---|---|---|---|---|

| Shenzhen Yishd Industrial Co., Ltd. | Digital Magnifiers, Low-Vision Tablets | $330–$68 | 1–5 pieces | 100% | ≤4h | 25% | $30,000+ |

| Srate Optical Instrument Manufactory | Electronic Reading Aids, LCD Vision Devices | $360–$49.50 | 1–10 pieces | 100% | ≤7h | <15% | $110,000+ |

| Shenzhen Keshengda Technology Co., Limited | HDIM Low-Vision Aids, USB Mouse Readers | $515–$35 | 2–500 pieces | 100% | ≤4h | <15% | $40,000+ |

| Dongguan Wufan Optical-Electronic Technology Co., Ltd. | Digital Magnifiers, Collapsible Lenses | $28.79–$6.20 | 5–50 pieces | 100% | ≤2h | 15% | $90,000+ |

| TORCHIT ELECTRONICS PRIVATE LIMITED | Smart Glasses, Tactile Training Tools | $199–$1.90 | 1 piece | 100% | ≤3h | - | $500+ |

Performance Analysis

Shenzhen Yishd stands out with the highest reorder rate (25%) and competitive pricing across mid-range electronic aids. Srate Optical and Dongguan Wufan demonstrate strong commercial activity with online revenues exceeding $90,000, suggesting robust export experience and market penetration. Dongguan Wufan offers the lowest per-unit pricing for bulk digital magnifiers ($28.79 at 50-piece MOQ), making it suitable for budget-sensitive or high-volume buyers. TORCHIT distinguishes itself with ultra-low MOQs and innovative products like AI-powered smart glasses, ideal for niche or pilot-market deployments. However, its minimal online revenue suggests limited scale.

FAQs

How to verify visual aids supplier reliability?

Cross-check self-reported metrics with transaction history, customer reviews, and verifiable shipment records. Request product specifications, user manuals, and test reports for critical parameters such as magnification accuracy, screen resolution, and battery life. Conduct video audits to confirm facility operations and quality control processes.

What is the typical sampling timeline?

Standard samples are typically shipped within 7–14 days. Electronic models may require additional time for firmware configuration or custom branding. Allow 3–7 days for international express delivery.

Can suppliers customize visual aid products?

Yes, several suppliers offer customization including color variation, logo imprinting, packaging redesign, and software interface modifications. Confirm minimum volumes and setup fees before initiating customization projects.

Do suppliers provide after-sales support?

Support levels vary. Buyers should clarify warranty terms (typically 6–12 months), availability of spare parts, and technical assistance channels. Proactive suppliers provide multilingual user guides and remote troubleshooting options.

Are non-electronic visual aids available?

Yes, tactile tools such as Braille dots, bump markers, envelope guides, and collapsible magnifiers are offered by multiple suppliers. These items often have lower MOQs and faster fulfillment cycles, suitable for institutional or educational procurement.