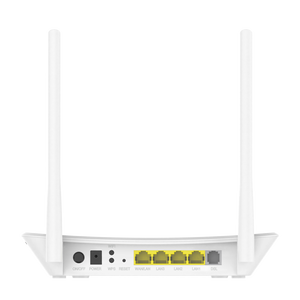

Wifi Router And Modem

0

0

1/18

1/18

1/3

1/3

1/3

1/3

1/3

1/3

1/15

1/15

1/3

1/3

1/3

1/3

1/3

1/3

0

0

0

0

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/3

1/17

1/17

About wifi router and modem

Where to Find WiFi Router and Modem Suppliers?

China remains the central hub for global telecommunications hardware manufacturing, with key production clusters in Guangdong, Jiangsu, and Zhejiang provinces. These regions host vertically integrated supply chains specializing in networking equipment, supported by mature ecosystems of PCB fabrication, RF component sourcing, and firmware development. Dongguan and Shenzhen in Guangdong alone account for over 50% of China’s consumer and enterprise-grade router and modem output, leveraging proximity to semiconductor distributors and automated SMT assembly lines.

The industrial clusters enable rapid prototyping and scalable production, with many facilities operating under ISO 14001 and ISO 9001 standards. Localized access to critical components—such as Qualcomm or MediaTek chipsets, Wi-Fi 6/6E modules, and DOCSIS 3.1 modems—reduces material lead times by 20–35% compared to offshore alternatives. Buyers benefit from consolidated logistics networks, with Shenzhen Port and Ningbo-Zhoushan facilitating efficient containerized or air freight shipments. Standard order fulfillment cycles range from 25 to 40 days, depending on customization level and testing requirements.

How to Choose WiFi Router and Modem Suppliers?

Procurement decisions should be guided by structured evaluation criteria to ensure technical compliance, production reliability, and post-delivery support.

Technical Compliance

Confirm adherence to international regulatory standards including CE (Europe), FCC Part 15 (USA), ICES-003 (Canada), and RoHS for hazardous substance control. For dual-band and tri-band wireless systems, verify IEEE 802.11ax/ac/abgn compliance through certified test reports. Suppliers must provide documentation for conducted/radiated emissions, SAR levels, and ESD protection (IEC 61000-4-2). DOCSIS 3.1 certification is mandatory for cable modem suppliers targeting North American markets.

Production Capability Audits

Assess operational infrastructure using the following benchmarks:

- Minimum 3,000m² factory space with dedicated SMT and DIP production lines

- In-house testing labs equipped for RF performance, thermal cycling, and burn-in validation (72-hour minimum)

- Automated optical inspection (AOI) and X-ray BGA inspection systems

- R&D teams comprising at least 12% of total staff to support firmware updates and feature customization

Validate on-time delivery performance (target ≥97%) and traceability systems via ERP/MES integration.

Transaction Safeguards

Utilize secure payment mechanisms such as irrevocable LC at sight or third-party escrow arrangements until product acceptance. Prioritize suppliers with documented export experience to target markets, including pre-shipped customs clearance dossiers. Conduct pre-shipment inspections (PSI) through independent agencies to audit packaging integrity, labeling accuracy, and functional performance across a statistically valid sample size (AQL 1.0).

What Are the Best WiFi Router and Modem Suppliers?

No supplier data is currently available for analysis. Buyers are advised to initiate due diligence by requesting facility audits, product certifications, and reference client lists from potential manufacturers. Emphasis should be placed on firms demonstrating compliance with global telecom standards, proven export logistics, and investment in R&D for next-generation wireless technologies (Wi-Fi 7, multi-gig WAN support).

Performance Analysis

In the absence of verified supplier profiles, procurement focus should shift toward capability-based screening. Manufacturers with in-house firmware development, DOCSIS or GPON module integration, and modular design architectures offer greater flexibility for ISP-branded or enterprise-specific deployments. Video-conducted factory tours and live production line demonstrations can serve as proxies for assessing scalability and quality discipline prior to sample evaluation.

FAQs

How to verify WiFi router and modem supplier reliability?

Cross-validate all certifications with issuing bodies and request full test reports from accredited labs (e.g., TÜV, SGS, Intertek). Evaluate supplier track record through verifiable customer references, particularly those in regulated markets. Review after-sales service agreements, warranty terms (minimum 24 months), and spare parts availability.

What is the average sampling timeline?

Standard samples take 10–18 days to produce, including programming, RF tuning, and environmental stress screening. Custom firmware integration or enclosure modifications extend timelines to 25–35 days. Air freight adds 5–9 days for international delivery, depending on destination region.

Can suppliers ship WiFi routers and modems worldwide?

Yes, most established manufacturers support global distribution under FOB, CIF, or DDP terms. Ensure compliance with local spectrum regulations and import tariffs for telecommunications equipment. Suppliers should provide detailed packing lists, HS codes (typically 8517.62), and country-specific user documentation.

Do manufacturers provide free samples?

Sample policies vary. Reputable suppliers may waive fees for qualified buyers committing to MOQs exceeding 500 units. Otherwise, expect to cover 40–60% of unit cost plus shipping. Refundable sample charges apply upon order confirmation in select cases.

How to initiate customization requests?

Submit detailed specifications covering wireless standards (e.g., Wi-Fi 6E, MU-MIMO), port configuration (LAN/WAN/PoE), modem type (DSL, cable, fiber), and software features (OpenWRT compatibility, VLAN support). Leading suppliers respond with engineering feasibility assessments within 72 hours and deliver functional prototypes within 4 weeks.