Investing in the stock market can feel overwhelming for beginners. The jargon, volatility, and sheer number of choices often create hesitation. But with the right approach, anyone can begin building wealth through stocks—regardless of income level or financial background. Confidence doesn’t come from knowing everything; it comes from taking informed, structured steps. This guide walks you through each phase of starting your investment journey with clarity and purpose.

1. Build Your Financial Foundation First

Before buying a single share, ensure your personal finances are stable. Jumping into the market without preparation increases risk and emotional decision-making. Focus on these three pillars:

- Emergency Fund: Save 3–6 months’ worth of living expenses in a high-yield savings account. This buffer protects you from selling investments during downturns due to unexpected costs.

- High-Interest Debt: Pay off credit cards or loans with interest rates above 7%. Earning 7% annually in the market while paying 18% in interest is a losing proposition.

- Budgeting: Track income and expenses. Know how much you can consistently invest each month without compromising essentials.

2. Understand the Basics of How the Stock Market Works

The stock market isn't a casino—it's a mechanism for ownership. When you buy a stock, you own a small piece of a company. As that company grows, profits increase, and its value typically rises. Over time, the broad market has delivered average annual returns of about 7–10% after inflation.

Key concepts to grasp:

- Stocks vs. Bonds: Stocks represent ownership; bonds are loans to companies or governments. Stocks are riskier but offer higher long-term growth potential.

- Index Funds & ETFs: These are baskets of hundreds or thousands of stocks. They provide instant diversification and are ideal for beginners.

- Compound Growth: Reinvesting dividends and capital gains accelerates wealth over time. Starting early—even with small amounts—makes a dramatic difference.

“Do not save what is left after spending, but spend what is left after saving.” — Warren Buffett

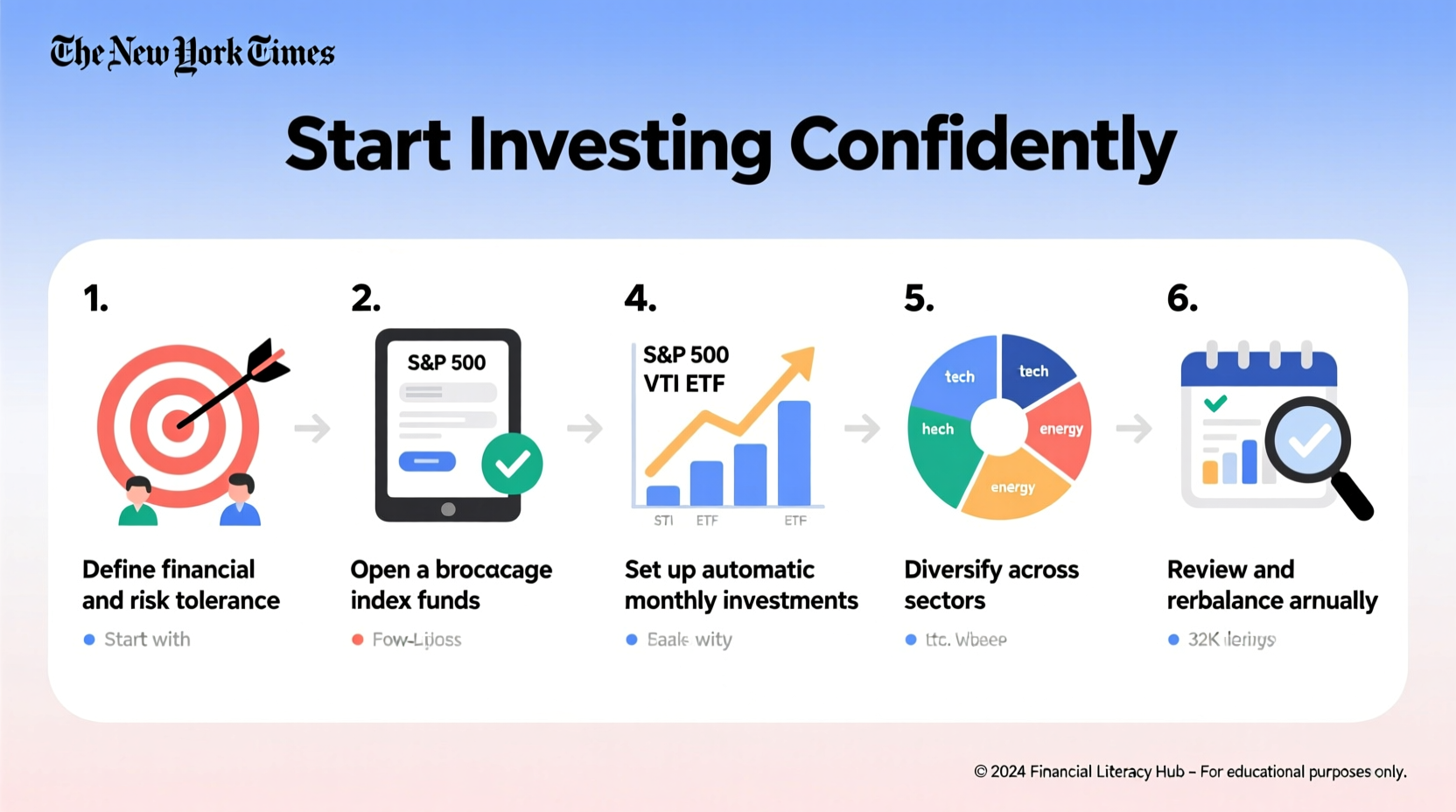

3. Define Your Investment Goals and Risk Tolerance

Your investment strategy should reflect your life goals. Are you saving for retirement in 30 years? A home in 5? Each goal requires a different approach.

Risk tolerance depends on both psychology and timeline. If a 20% market drop would cause you to panic-sell, you may prefer conservative allocations—even if your timeline is long.

| Goal Timeline | Suggested Strategy | Acceptable Risk Level |

|---|---|---|

| Less than 3 years | High-yield savings, CDs, short-term bonds | Low – avoid stocks |

| 3–10 years | Mix of stocks and bonds (e.g., 60/40) | Moderate |

| 10+ years | Majority in diversified stock funds | Higher – volatility evens out over time |

4. Choose the Right Brokerage and Account Type

Not all brokerages are created equal. For beginners, prioritize low fees, educational resources, and ease of use.

Common account types:

- Taxable Brokerage Account: Flexible, no contribution limits, but gains are taxed annually.

- Roth IRA: Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free. Ideal for young investors in lower tax brackets.

- 401(k) or Employer Plan: If your employer offers a match, contribute enough to get the full match—it’s free money.

Top beginner-friendly platforms include:

- Vanguard – excellent low-cost index funds

- Fidelity – strong customer support and research tools

- Charles Schwab – no-fee trades and robust educational content

Mini Case Study: Sarah’s First Investment

Sarah, 28, earns $55,000 annually. She pays off her credit card debt, builds a $6,000 emergency fund, and decides to invest $200 per month. She opens a Roth IRA with Fidelity, selects a target-date fund (Fidelity Freedom Index 2060), and sets up automatic contributions. The fund automatically adjusts its stock/bond mix as she ages. She reviews her portfolio once a year and stays invested through market swings. In 30 years, assuming a 7% return, her investment could grow to over $250,000—without ever picking a single stock.

5. Create and Execute Your Investment Plan

Confidence comes from having a plan and sticking to it. Follow this checklist to get started:

Investing Startup Checklist

- ✅ Assess current financial health (debt, savings, budget)

- ✅ Define clear investment goals (timeline, amount needed)

- ✅ Determine risk tolerance using a questionnaire

- ✅ Open a brokerage or retirement account

- ✅ Choose low-cost, diversified funds (e.g., S&P 500 index fund)

- ✅ Set up automatic monthly investments

- ✅ Schedule annual review dates

Start simple. Most new investors benefit from a “set it and forget it” approach using one or two broad-market index funds. Avoid chasing hot stocks or trying to time the market—a habit that consistently underperforms passive investing.

“The stock market is a device for transferring money from the impatient to the patient.” — Warren Buffett

6. Monitor, Review, and Stay Disciplined

Once you’re invested, resist the urge to check your portfolio daily. Short-term fluctuations are normal. Instead, adopt a long-term mindset.

Review your investments annually. Ask:

- Have my goals changed?

- Is my asset allocation still appropriate?

- Are fees still low?

- Am I contributing consistently?

If everything aligns, stay the course. Market downturns are not emergencies—they are opportunities to buy more at lower prices.

Frequently Asked Questions

How much money do I need to start investing?

You can start with as little as $10 on platforms like Fidelity or Charles Schwab. Many index funds have no minimums if purchased through these brokers. Focus on consistency, not size.

Should I invest in individual stocks or funds?

For most beginners, low-cost index funds or ETFs are better. They reduce risk through diversification. Individual stocks require research, time, and emotional resilience. You can explore them later as your knowledge grows.

What happens if the market crashes after I invest?

If you’re investing for the long term (10+ years), a crash is not a disaster—it’s a chance to buy more shares at lower prices. Historically, markets have always recovered and reached new highs. Staying invested through downturns is key to long-term success.

Final Thoughts: Take Action Today

Starting to invest isn’t about being perfect—it’s about beginning. The most powerful force in investing is time. Every month delayed reduces your future wealth. You don’t need to predict the market; you just need to participate in it consistently.

Open your account this week. Set up your first automatic transfer. Choose a simple, diversified fund. Then let compounding work in silence while you focus on your life. Confidence isn’t the absence of fear—it’s acting despite it.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?