Active Learn Primary

1/3

1/3

0

0

1/3

1/3

1/3

1/3

1/6

1/6

1/3

1/3

0

0

1/3

1/3

1/1

1/1

1/3

1/3

1/3

1/3

1/3

1/3

1/14

1/14

1/3

1/3

1/21

1/21

1/1

1/1

0

0

About active learn primary

Where to Find Active Learn Primary Suppliers?

No verified suppliers currently operate within concentrated manufacturing hubs for educational technology products specifically designated under the "Active Learn Primary" category. The absence of supplier data indicates limited industrial clustering or formalized production networks dedicated exclusively to this product line. As a result, buyers may need to explore adjacent sectors—such as interactive learning devices, digital classroom tools, or early childhood education hardware—where similar technical capabilities and compliance frameworks apply.

In markets like China, regions including Guangdong, Zhejiang, and Jiangsu host robust ecosystems for educational electronics manufacturing, supported by integrated supply chains for PCB assembly, touchscreen fabrication, and firmware integration. These zones offer scalable production infrastructure suitable for tech-enabled learning solutions, with average lead times ranging from 45–60 days for customized orders. However, without active suppliers in the specified category, procurement strategies must prioritize cross-sector sourcing and adapt existing quality evaluation models accordingly.

How to Choose Active Learn Primary Suppliers?

Given the lack of direct supplier availability, due diligence protocols should be proactively established to assess potential partners once they emerge:

Technical Compliance

Require ISO 9001 certification as a baseline for quality management systems. For international deployments, verify adherence to regional standards such as CE (Europe), FCC Part 15 (North America), and RoHS for hazardous substance restrictions. Ensure software components comply with child safety regulations including COPPA or GDPR-K where applicable.

Production Capability Audits

Evaluate minimum operational thresholds:

- Facility size exceeding 3,000m² to support batch production

- Dedicated R&D teams focused on educational technology interfaces

- In-house capabilities for SMT assembly, firmware programming, and UI/UX testing

Confirm scalability through documented order fulfillment rates (target >95%) and inventory turnover metrics.

Transaction Safeguards

Implement secure payment structures using third-party escrow services until product validation is complete. Review transaction histories via trusted B2B platforms, focusing on dispute resolution records and post-delivery support performance. Prototype evaluation is critical—test user interface responsiveness, battery endurance (if applicable), and content delivery stability prior to volume ordering.

What Are the Best Active Learn Primary Suppliers?

No suppliers are currently listed for the "Active Learn Primary" product category. The absence of verifiable entities prevents comparative analysis based on factory size, delivery performance, response time, or customer retention metrics. Buyers should monitor industry registries and trade databases for new entrants positioning within digital primary education hardware.

Performance Analysis

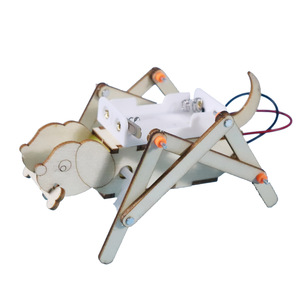

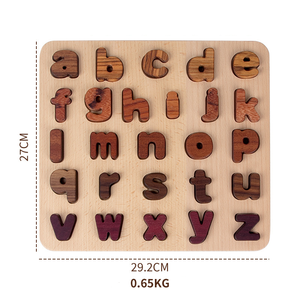

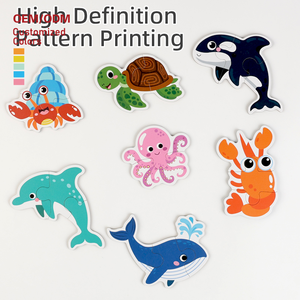

In the absence of active market participants, sourcing professionals are advised to engage manufacturers specializing in K–12 edtech devices, tablet-based learning systems, or STEM education kits. These suppliers often possess transferable competencies in curriculum-aligned content integration, durable design for classroom use, and multi-language support. Prioritize companies with demonstrated export experience to OECD countries and participation in education-focused tenders or institutional contracts.

FAQs

How to verify Active Learn Primary supplier reliability?

Once suppliers enter the market, validate certifications through official accreditation bodies. Request independent audit reports covering design validation, software security, and hardware durability testing. Analyze client references from school districts or educational NGOs to assess real-world deployment performance.

What is the average sampling timeline?

For comparable edtech devices, sample development typically takes 20–35 days, depending on software customization requirements. Add 7–14 days for air freight delivery. Complex integrations involving cloud platforms or AI-driven adaptive learning may extend prototyping to 50 days.

Can suppliers ship Active Learn Primary products worldwide?

Manufacturers with export licenses can facilitate global shipments. Confirm Incoterms (FOB, CIF, DDP) during negotiation and ensure compliance with destination-specific regulations on electronic equipment, data privacy, and import tariffs. Sea freight remains optimal for full-container loads, reducing per-unit logistics costs by up to 40%.

Do manufacturers provide free samples?

Free samples are uncommon for high-tech educational products. Most suppliers charge 30–60% of unit cost to cover materials and programming setup. Fee waivers may apply upon confirmation of bulk orders exceeding 100 units.

How to initiate customization requests?

Submit detailed specifications including device compatibility (iOS, Android, web), curriculum alignment (e.g., national standards), language support, and content management system requirements. Leading suppliers respond with functional prototypes and API documentation within 4–5 weeks.