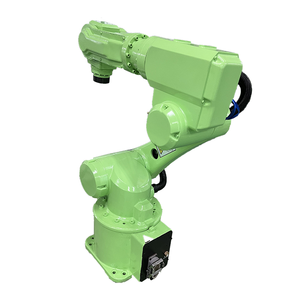

Advanced Robotics For Manufacturing Hub

About advanced robotics for manufacturing hub

Where to Find Advanced Robotics for Manufacturing Hub Suppliers?

China leads the global supply of advanced robotics for manufacturing hubs, with key production clusters in Hubei, Guangdong, and Zhejiang provinces. Wuhan and Shenzhen serve as primary innovation centers, combining robust industrial ecosystems with specialized R&D infrastructure. These regions host vertically integrated supply chains—spanning precision machining, servo systems, and robotic control software—enabling rapid prototyping and scalable deployment.

The concentration of technical talent and component suppliers within 50km radii reduces logistics overhead and accelerates production cycles. Buyers benefit from lead times averaging 30–45 days for standard configurations, with cost advantages of 20–35% over Western manufacturers due to localized sourcing of harmonic drives, controllers, and end-effectors. The ecosystem supports both high-volume procurement and engineered-to-order solutions, particularly for collaborative robots (cobots), 6-axis articulated arms, and automation peripherals.

How to Choose Advanced Robotics for Manufacturing Hub Suppliers?

Selecting reliable suppliers requires structured evaluation across technical, operational, and transactional dimensions:

Technical Capability Verification

Confirm expertise in core robotic technologies: motion control algorithms, torque precision, repeatability (±0.02mm typical), and integration compatibility with CNC machines or conveyor systems. Prioritize suppliers offering CE or ISO 9001 certification as baseline compliance. For deployment in regulated environments (e.g., automotive, medical device manufacturing), validate adherence to functional safety standards such as ISO 10218 or IEC 62061.

Production & Engineering Capacity

Assess supplier infrastructure through verifiable metrics:

- Minimum 10,000m² production area for sustained output

- In-house design teams comprising >10% of workforce

- Integrated testing facilities for cycle life, payload accuracy, and thermal stability

Cross-reference online revenue data and reorder rates as indicators of market validation. On-time delivery performance exceeding 97% reflects logistical reliability.

Customization and Integration Support

Evaluate flexibility in modifying reach (1,000–2,300mm), payload capacity (10–12kg), and mounting options. Confirm availability of SDKs, ROS compatibility, and PLC interface documentation. Suppliers should support branding customization (logo, color, packaging) and provide 3D models or simulation files upon request.

Transaction Security Protocols

Utilize secure payment mechanisms such as escrow services until post-delivery acceptance testing is completed. Review historical dispute resolution records and prioritize vendors with transparent quality assurance processes. Pre-shipment inspection reports and sample testing against ISO 9283 (robot performance criteria) are recommended before full-scale orders.

What Are the Best Advanced Robotics for Manufacturing Hub Suppliers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Avg. Response | Reorder Rate | Customization | Product Range |

|---|---|---|---|---|---|---|---|

| Wuhan Shengtongli Technology Co., Ltd. | Articulated Robots, Laser Equipment | US $7,000+ | 100% | ≤1h | - | Limited | 5 |

| Shenzhen Era Automation Co., Ltd. | Collaborative Robots (161) | US $350,000+ | 100% | ≤2h | 25% | Standard | 5 |

| Wuhan Baike Intelligent Technology Co., Ltd. | Programmable Industrial Arms | US $200,000+ | 100% | ≤2h | 21% | Yes | 4 |

| Zhejiang Qiyue Mechanical Technology Co., Ltd. | Harmonic Drives, Reducers | US $10,000+ | 100% | ≤3h | 40% | Yes | 5 |

| Changingtek Robotics Technology (Suzhou) Co., Ltd. | Cobots, Electric Grippers | US $6,000+ | 100% | ≤2h | <15% | Yes | 5 |

Performance Analysis

Shenzhen Era Automation stands out with the highest online revenue and extensive cobot listings, indicating strong market penetration and product diversification. Zhejiang Qiyue achieves a leading 40% reorder rate by focusing on critical subcomponents like harmonic reducers—essential for high-precision robotic joints—demonstrating niche specialization success. Wuhan-based suppliers exhibit superior responsiveness, with Shengtongli achieving sub-one-hour average reply times, advantageous for urgent sourcing cycles. All listed vendors maintain perfect on-time delivery records, suggesting disciplined production planning. However, lower reorder rates among newer entrants signal potential gaps in after-sales service or long-term reliability. Buyers seeking turnkey robotic cells should prioritize suppliers with documented integration experience and comprehensive technical documentation.

FAQs

What is the typical MOQ and pricing range for advanced manufacturing robots?

Minimum order quantity is generally 1 set, with prices ranging from $1,899 for compact desktop arms to $17,900 for high-reach, high-payload 6-axis cobots. Component-level items (e.g., harmonic drives, electric grippers) are available per piece at $195–$500.

How long does it take to receive a sample unit?

Sample production typically takes 15–25 days, depending on configuration complexity. Units with custom programming or non-standard accessories may require up to 40 days. Air freight adds 7–10 days for international delivery.

Can suppliers integrate robots with existing factory systems?

Yes, most suppliers support communication protocols such as Modbus TCP, EtherNet/IP, and PROFINET. They provide API access and HMI interfaces for seamless integration with MES/SCADA platforms. Confirmation of protocol compatibility is required during technical scoping.

Do suppliers offer warranty and technical support?

Standard warranties range from 12 to 24 months, covering core components like motors and controllers. Remote troubleshooting is commonly provided; on-site support may incur additional fees unless contracted separately.

Are there export controls on advanced robotics shipments?

While general-purpose industrial robots face minimal restrictions, dual-use systems with AI-driven autonomy or military-grade precision may be subject to export licensing under national regulations. Buyers should verify classification codes (HS 8479.50) and destination-country import requirements prior to ordering.