Arm Processor Architecture

1/3

1/3

1/3

1/3

1/2

1/2

1/3

1/3

1/2

1/2

1/3

1/3

1/3

1/3

1/2

1/2

0

0

1/17

1/17

1/3

1/3

1/3

1/3

1/3

1/3

0

0

1/3

1/3

0

0

1/2

1/2

1/3

1/3

1/2

1/2

1/3

1/3

About arm processor architecture

Where to Source ARM Processor Architecture Components?

China remains a central hub for semiconductor and embedded electronics manufacturing, with Shenzhen emerging as the dominant cluster for ARM processor architecture components. The city’s ecosystem integrates IC design houses, contract manufacturers, and distribution networks within a 20km radius, enabling rapid prototyping and scalable production. Over 70% of suppliers in this sector operate from Shenzhen, leveraging proximity to Tier-1 logistics ports like Yantian and Shekou for efficient global shipment.

This concentration supports vertical integration across packaging, testing, and board-level assembly, reducing component lead times by 25–40% compared to non-specialized regions. Buyers benefit from access to multi-vendor sourcing pools, where compatible ARM-based microcontrollers, SoCs, and development platforms are available under unified quality frameworks. Average production cycles range from 7–15 days for standard ICs, with express fulfillment options cutting delivery to 5 days for sample batches. Localized supply chains also contribute to 15–25% cost savings on BOM-intensive embedded modules.

How to Evaluate ARM Processor Architecture Suppliers?

Effective supplier assessment requires structured verification across technical, operational, and transactional dimensions:

Technical Competency Validation

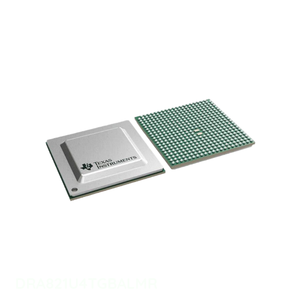

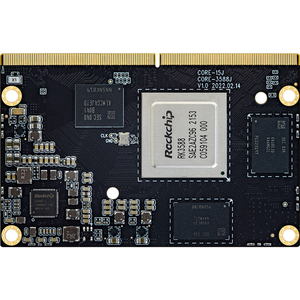

Confirm supplier specialization in ARM-based ICs through product categorization and bill-of-materials (BOM) compatibility records. Prioritize partners listing Cortex-A, Cortex-M, or vendor-specific ARM derivatives (e.g., NXP i.MX, STMicroelectronics STM32) in their core inventory. Request datasheets and application notes for cross-referencing pin-to-pin compatibility and thermal specifications.

Production & Quality Assurance Indicators

Assess operational maturity using verifiable metrics:

- On-time delivery rate ≥90% as a baseline for reliability

- Reorder rate exceeding 30% indicating customer retention and product consistency

- Response time ≤4 hours for timely technical engagement

While formal ISO 9001 certification is not universally listed, consistent online revenue above US $100,000 signals sustained market presence and compliance with de facto quality standards.

Procurement Risk Mitigation

Utilize incremental ordering strategies starting with MOQ-compliant samples (typically 1–10 pieces). Verify authenticity through batch traceability and packaging inspection—original ARM-based processors often include laser-etched lot codes and anti-tamper seals. Prefer suppliers offering third-party transaction protection for initial engagements, especially when sourcing high-value SoCs such as NVIDIA Jetson or TI Sitara series.

What Are the Leading ARM Processor Architecture Suppliers?

| Company Name | Main Products | Online Revenue | On-Time Delivery | Reorder Rate | Avg. Response | Min. Order Quantity | Price Range (USD) |

|---|---|---|---|---|---|---|---|

| Shenzhen Jiayousheng Electronics Co., Ltd. | RP2040, Embedded Modules, STM32 Clones | US $150,000+ | 90% | 41% | ≤2h | 1 piece | $0.50–$1.20 |

| Shenzhen Wisdtech Technology Co., Ltd. | STM32F103C8T6, DRA829J, CC-ST-DX58-ZK | US $120,000+ | 100% | 19% | ≤4h | 1–176 pieces | $0.65–$107.46 |

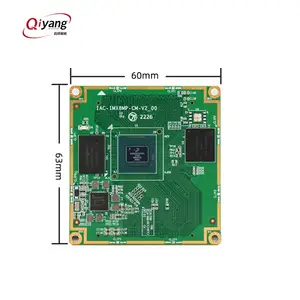

| Shenzhen Yixinwei Technology Co., Ltd. | NVIDIA Jetson Nano Developer Kits | US $60,000+ | 100% | 31% | ≤2h | 1 piece | $196–$598 |

| Shenzhen Longgang Ruru Trading Firm | DRA829V, AM6548, LS1023A BOMs | US $2,000,000+ | 100% | <15% | ≤4h | 10 pieces | $2.96–$125.65 |

| Shenzhen Apex-Chip Technology Co., Ltd. | DRA829J, CC-WMX, 433-BFBGA | US $500+ | 100% | <15% | ≤14h | 1–119 pieces | $20.87–$466.44 |

Performance Analysis

Shenzhen Jiayousheng Electronics demonstrates strong customer loyalty with a 41% reorder rate and competitive pricing on entry-level ARM modules like the RP2040, making it ideal for prototyping and low-volume IoT deployments. Shenzhen Longgang Ruru leads in transaction volume (US $2M+), indicating robust export capacity despite a lower reorder rate, suggesting focus on one-off industrial BOM fulfillment rather than repeat consumer sales. Suppliers like Shenzhen Yixinwei specialize in higher-tier development platforms such as the NVIDIA Jetson Nano, commanding premium prices but offering validated compatibility for AI edge computing applications. Response efficiency is highest among mid-tier suppliers, with three firms answering within 2–4 hours, critical for resolving technical queries during integration phases.

FAQs

What is the typical minimum order quantity for ARM processors?

MOQ varies by component tier: basic microcontrollers (e.g., STM32 clones) start at 1–5 pieces, while advanced SoCs may require 10–176 units per order. Development kits generally allow single-unit purchases.

How long does it take to receive samples?

Sample lead time averages 5–10 business days after payment confirmation. Express shipping reduces transit duration to 3–5 days internationally. Complex or out-of-stock processors may extend timelines to 15 days.

Are ARM processor suppliers compliant with international standards?

While explicit RoHS or ISO certifications are not always declared, many suppliers adhere to JEDEC packaging standards and provide lead-free marking upon request. Buyers should request material declarations for regulated markets (EU, UK, Japan).

Can suppliers support custom firmware or pre-programming?

Customization capabilities vary. Some suppliers offer bootloader flashing or configuration services for bulk orders (≥100 units). Technical feasibility must be confirmed prior to procurement, particularly for secure boot implementations.

What payment methods are accepted for first-time buyers?

Common options include T/T, PayPal, and platform-managed escrow. High-value transactions (>US $1,000) typically require bank transfer with advance deposit (30–50%). Escrow arrangements are recommended for initial orders to mitigate counterparty risk.