Cassava Processing Factory

About cassava processing factory

Where to Find Cassava Processing Factory Equipment Suppliers?

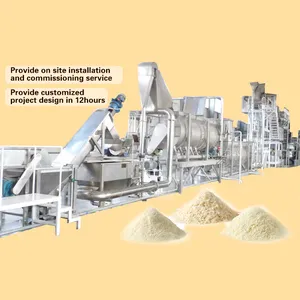

China is a dominant hub for cassava processing machinery manufacturing, with key supplier clusters concentrated in Henan and Nanyang regions. These areas host vertically integrated production ecosystems specializing in complete processing lines for cassava flour, starch, gari, and related by-products. Henan province, in particular, accounts for over 50% of listed suppliers, supported by mature supply chains for steel fabrication, motor components, and food-grade conveyor systems. Proximity to Zhengzhou’s multimodal logistics network enables efficient export operations across Africa, Southeast Asia, and Latin America—primary markets for cassava-based food processing infrastructure.

The industrial clusters offer economies of scale through consolidated R&D, machining, and assembly capabilities within compact geographic zones. This integration reduces component lead times and supports rapid deployment of customized or turnkey systems. Buyers benefit from competitive pricing structures, with standard full-line setups starting at $11,000 for small-scale gari production and exceeding $65,000 for high-capacity, automated flour lines. Lead times typically range from 20–45 days depending on customization scope, with most suppliers offering FOB terms and coordination of containerized sea freight.

How to Choose Cassava Processing Factory Suppliers?

Procurement decisions should be guided by structured evaluation criteria to ensure technical reliability and transaction security:

Technical Specifications & Production Capacity

Assess equipment output ratings (e.g., 300–1,000 kg/h) against operational needs. Confirm compatibility with regional cassava varieties, which vary in moisture content and cyanogenic glycoside levels. Prioritize suppliers offering modular line configurations—washing, peeling, grating, dewatering, drying, milling—for scalability. Verify heating methods (electric, diesel, or biomass), material contact surfaces (stainless steel vs. carbon steel), and automation level (manual feed vs. fully automatic).

Quality Assurance and Compliance

While formal certifications (ISO, CE) are not explicitly stated in available data, prioritize suppliers demonstrating quality control via on-time delivery records (target ≥97%) and response efficiency (≤3 hours). Evidence of online revenue exceeding $200,000 suggests established market presence and post-sale support capacity. For regulated markets, require documentation of food safety compliance, including surface finish standards and lubricant isolation in gearboxes.

Customization and After-Sales Support

Evaluate flexibility in design modifications such as logo branding, color coding, voltage adaptation (380V/50Hz vs. 220V/60Hz), and packaging integration. Multiple suppliers indicate customization options for grating size, conveying speed, and frying parameters—critical for product-specific texture and moisture targets. Confirm availability of technical manuals, installation guidance, and remote troubleshooting services before order placement.

What Are the Leading Cassava Processing Factory Suppliers?

| Company Name | Location | Main Products | Price Range (USD) | Min. Order | On-Time Delivery | Avg. Response | Online Revenue | Reorder Rate |

|---|---|---|---|---|---|---|---|---|

| Henan Baixin Machinery Equipment Co., Ltd. | Henan, CN | Cassava flour, full-line systems | $22,000–66,000 | 1 set | 100% | ≤3h | $850,000+ | 40% |

| Nanyang Goodway Machinery & Equipment Co., Ltd. | Nanyang, CN | Gari, starch, small-scale lines | $11,150–45,000 | 1 set | 100% | ≤9h | $210,000+ | <15% |

| Fangcheng Goodway Potato Machinery Factory | Nanyang, CN | Garri, attieke, flour | $11,500–45,000 | 1 set | 100% | ≤12h | - | - |

| Baixin Machinery INC | Henan, CN | Flour, potato-compatible lines | $22,000–38,000 | 1 set | - | ≤4h | - | - |

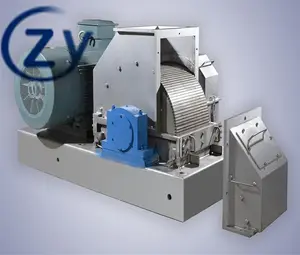

| Henan Zhiyuan Starch Engineering Machinery Co., Ltd. | Henan, CN | Starch extraction, rasper units | $4,500–50,000 | 1 set | 100% | ≤25h | - | - |

Performance Analysis

Henan Baixin Machinery stands out with the highest recorded online revenue ($850,000+) and a 40% reorder rate, indicating strong customer retention and service consistency. All five suppliers report 100% on-time delivery where data is available, underscoring reliable fulfillment performance within this niche. Response times vary significantly—from ≤3h for top-tier suppliers to over 24h for others—making communication efficiency a key differentiator in time-sensitive procurement cycles. The wide price dispersion reflects specialization: Henan Zhiyuan offers entry-level single machines (e.g., $4,500 rasping units), while complete 1,000kg/h flour lines reach $65,000, emphasizing the importance of aligning budget with throughput requirements.

FAQs

How to verify cassava processing equipment supplier reliability?

Cross-check declared delivery performance and response metrics against transaction history where available. Request reference projects or client testimonials, particularly from buyers in similar climatic or regulatory environments. Conduct virtual factory audits to assess production floor organization, welding quality, and testing procedures for critical components like motors and bearings.

What is the typical minimum order quantity (MOQ)?

The standard MOQ across all major suppliers is 1 set, enabling low-risk pilot procurement. This allows buyers to evaluate machine performance and after-sales support before scaling to multiple-line deployments.

Can suppliers customize cassava processing lines?

Yes, customization is widely offered. Modifications include capacity adjustments, voltage specifications, stainless steel upgrades, logo printing, and integration with existing plant layouts. Some suppliers also support tailored process parameters for regional products like gari, fufu, or cassava couscous.

What are common payment and transaction safeguards?

Buyers should utilize secure payment mechanisms such as irrevocable letters of credit or platform-backed escrow services. Advance payments typically range from 30–50%, with balance due prior to shipment. Ensure contracts specify inspection rights and dispute resolution protocols before final disbursement.

How long does it take to receive ordered equipment?

Lead times generally fall between 20 and 45 days post-deposit, depending on customization complexity and factory workload. Shipping via sea freight adds 15–35 days internationally. Expedited production may be negotiable for standardized models.