Different Types Of Manufacturing Systems In Operations Management

CN

CN

1/2

1/2

CN

CN

1/5

1/5

1/7

1/7

1/25

1/25

About different types of manufacturing systems in operations management

Supplier Landscape for Manufacturing Systems in Operations Management

The global market for manufacturing systems in operations management is increasingly concentrated among specialized engineering firms offering integrated hardware and software solutions. Key suppliers are primarily based in China, where industrial clusters in Jiangsu, Beijing, and Henan provinces enable vertically integrated production of automation equipment, material handling systems, and digital control platforms. These regions host mature ecosystems combining mechanical engineering expertise with advanced software development capabilities, supporting rapid deployment of turnkey manufacturing systems.

Suppliers leverage localized supply chains to reduce component procurement lead times by 25–40% compared to non-specialized manufacturers. Facilities typically operate within compact industrial zones—often under 50km radius networks—where CNC machining centers, electrical subsystem integrators, and software R&D teams coexist. This proximity enables faster prototyping (average 10–18 days for custom configurations) and shorter delivery cycles (30–60 days for full system installation). Buyers benefit from scalable options ranging from modular production lines to enterprise-level MES and ERP integration platforms.

How to Evaluate Suppliers of Manufacturing Systems?

Selecting reliable partners requires structured assessment across technical, operational, and transactional dimensions:

Technical Capability Verification

Confirm that suppliers offer documented experience in deploying systems aligned with specific production needs—such as discrete, continuous, or batch manufacturing models. For software-driven systems (e.g., MES, WMS), verify compatibility with existing infrastructure through API documentation and data synchronization protocols. Hardware-focused suppliers should provide CAD layouts, power consumption specs, and throughput benchmarks per hour/shift.

Production Infrastructure Assessment

Evaluate the following indicators of scalability and reliability:

- Facility size exceeding 3,000m² indicating capacity for large-scale assembly

- In-house design and engineering teams (minimum 8–10% of total staff)

- Integrated testing bays for end-to-end system validation prior to shipment

Cross-reference on-time delivery performance (target ≥95%) with response time metrics (ideally ≤4 hours) to assess operational responsiveness.

Quality & Transaction Assurance

While formal certifications like ISO 9001 are not universally listed, prioritize suppliers demonstrating consistent quality via 100% on-time delivery records and verifiable post-installation support. Use third-party payment safeguards where available, especially when procuring high-value systems ($20,000+). Request live demos or video walkthroughs of installed systems to validate functionality before commitment.

Leading Manufacturing System Suppliers: Performance Overview

| Company Name | Main Product Focus | Price Range (USD) | Min. Order | On-Time Delivery | Avg. Response | Reorder Rate | Core Technologies |

|---|---|---|---|---|---|---|---|

| Benlong Automation Technology Co., Ltd. | MES, Warehouse Management, Process Execution | $11,500–55,000 | 1 set | 100% | ≤4h | - | Intelligent MES, Real-Time Monitoring, Data Sync |

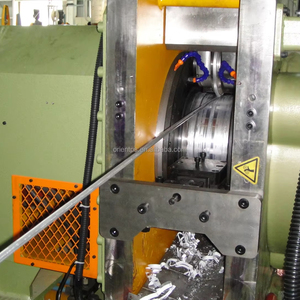

| Beijing Orient Pengsheng Tech. Co., Ltd. | Metal Extrusion, Continuous Processing Lines | $125,000–145,000 | 1 set | 100% | ≤8h | <15% | Copper/Aluminum Extrusion, Busbar Production |

| Changzhou Zhenglong Intelligent Equipment Technology Co., Ltd. | Plastic, Metal, Food & Packaging Lines | $1+ | 1 piece | 100% | ≤4h | - | Automated Feeding, Pneumatic Conveying, Granulation |

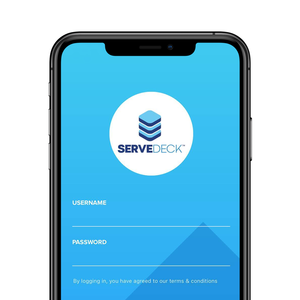

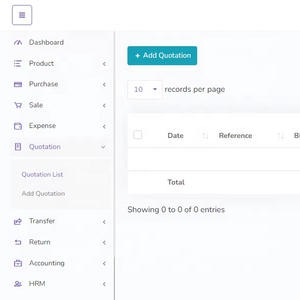

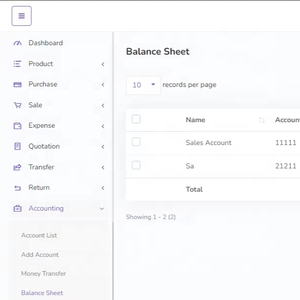

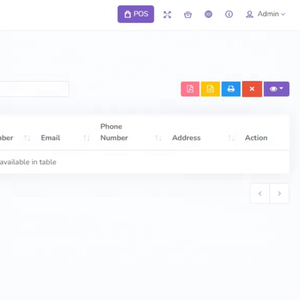

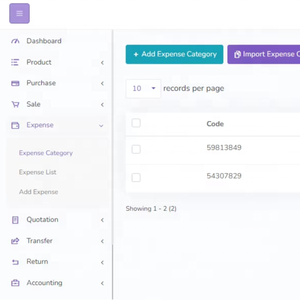

| STEPMEDIA SOFTWARE VIET NAM COMPANY LIMITED | ERP, WMS, Inventory & Manufacturing Software | $5,000–50,000 | 1 unit | - | ≤2h | - | Cloud ERP, Inventory Control, Open-Source Integration |

| Zhengzhou Yugong Construction Machinery Co., Ltd. | Paper, Liquid Packaging, Cutting & Sync Systems | $6,000–19,741 | 1 set/unit | 95% | ≤3h | 30% | Multi-Function Packaging, Data Synchronization, Cutting Control |

Performance Analysis

Benlong Automation and Beijing Orient Pengsheng represent capital-intensive solution providers focused on heavy industrial applications, with average system prices exceeding $100,000. Their 100% on-time delivery rates reflect strong project management discipline, though limited reorder rate visibility suggests lower customer turnover tracking. In contrast, Changzhou Zhenglong offers highly flexible procurement terms (from $1/unit), enabling low-risk sampling and phased implementation—ideal for SMEs testing automation feasibility.

Software-centric suppliers like STEPMEDIA emphasize rapid response times (≤2h) and mid-range pricing, catering to enterprises seeking agile ERP/WMS deployment without hardware dependency. Zhengzhou Yugong stands out with a 30% reorder rate, indicating strong customer satisfaction in packaging and paper processing niches. Buyers requiring hybrid systems—combining physical machinery with real-time data control—should prioritize vendors listing both hardware and software capabilities in their product portfolios.

FAQs

What are common types of manufacturing systems available from these suppliers?

Suppliers offer solutions across four primary categories: (1) Discrete manufacturing systems (e.g., automated plastic/metal lines), (2) Continuous process systems (e.g., copper rod extrusion), (3) Batch production systems (e.g., liquid packaging), and (4) Digital execution systems (MES/ERP/WMS). Hybrid configurations integrating multiple types are increasingly common.

What is the typical minimum order quantity (MOQ)?

MOQs vary significantly: hardware-based systems generally require 1 set, while some suppliers (notably Changzhou Zhenglong) list MOQs as low as 1 piece at symbolic $1 pricing—indicating willingness to accommodate pilot projects or component-level sales.

Are customization options available?

Yes, most suppliers support tailored configurations. Engineering teams can modify conveyor speeds, integrate IoT sensors, adjust software dashboards, or redesign feed mechanisms based on client specifications. Lead time increases by 15–30% for customized builds.

How long do manufacturing systems typically take to deliver?

Standard system deliveries range from 30 to 60 days after order confirmation. Software-only deployments may be completed within 10–15 days. Complex mechanical systems involving precision machining or multi-stage assembly often require up to 75 days, especially if site-specific adaptations are needed.

Do suppliers provide installation and training support?

While not explicitly stated in all profiles, leading suppliers commonly offer remote commissioning, user manuals, and video-based training. For high-value contracts, on-site technician dispatch may be negotiated as part of the service package, particularly for systems priced above $50,000.